STIR Outlook, US Dollar Strength and Rising Equity Risks

In this article, we discuss this week's FOMC and its implication for short-term interest rates. We also take a look at the US dollar and warning signals for equities.

Dear readers,

It’s Saturday morning - I went for a 10km run, watched the sun rise, and had a great breakfast. Now, I’m sitting at my desk with a coffee, writing this article. It’s a good day - and the fact that markets got more interesting this week makes it even better.

I like to think of global macro investing as the world’s largest, most complex, and most intellectually challenging strategy game. If you’re like me - curious about how the world works, opinionated, and long-term focused - then global macro is your playground without limits.

Having said that, let’s dive into this weekend’s article.

This Week’s FOMC - Main Takeaways

This week’s FOMC meeting delivered a hawkish cut. The real question is: how hawkish? The rate decision itself wasn’t the catalyst - it was this Powell line:

“A December cut is not to be seen as a foregone conclusion. In fact, far from it.”

Before the press conference, SOFR pricing implied one 25bps cut in December. Just a few weeks ago, the SOFR curve was pricing in more than two cuts across October & December. Powell also stressed that the committee has “strongly differing views” on the path ahead. Roughly half want to pause in December, the other half want another 25bps cut.

There are only two people on the Fed board - Bowman and Waller - that Trump is considering for Fed Chair. As you would expect, both voted for a 25bps cut. Perhaps some within the committee are now trying to assert independence from Trump’s influence.

The half that wants to pause in December has a solid case. The Atlanta Fed’s GDPNowcast forecasts 3.9% GDP growth in Q3-2025, core PCE rose from 2.6% in April to 2.9% in August and the unemployment rate is low at 4.3%. So why cut interest rates right now?

Breakeven NFP is around 30,000, which is very small relative to a labor force of roughly 170 million. In an economy that large, does it make a difference if NFPs print 25,000 or 40,000? And is it worth cutting interest rates multiple times to chase that? Danny Dayan made this point earlier this week.

We also got news on the Fed’s balance sheet policy. Quantitative tightening will end and mortgage-backed security (MBS) redemptions will be re-invested into bills starting December 1st. I do not think this policy change will have a major impact on financial markets.

Eventually - probably in 6 to 9 months - the Federal Reserve will start to grow reserves again. If they are serious about matching the weighted-average maturity of outstanding Treasuries, they will buy bills or sub 5-year coupons. Call it what you want - reserve management or quantitative easing.

Bottom line: uncertainty around the future path of interest rates has increased. With limited economic data, Fed speeches and private data sources are now the best tools to gauge whether the Federal Reserve will cut interest rates in December. So let’s take a look at that.

Fed Speakers and Retail Sales

Comments from Fed officials last week were revealing. Bostic - who currently has a vote on rate decisions - said:

BOSTIC: EVENTUALLY GOT BEHIND THIS WEEK’S RATE CUT

BOSTIC: GLAD POWELL SAID DEC. CUT IS “FAR FROM” FOREGONE MOVE

Hammack and Logan, who don’t currently vote but will rejoin the rotation after the December FOMC, leaned hawkish. On Friday, Hammack said:

HAMMACK: I WOULD’VE PREFERRED TO HOLD RATES STEADY THIS WEEK

HAMMACK: INFLATION BROADER THAN TARIFFS; CORE SERVICES STRONG

Logan agreed, saying: “I did not see a need to cut rates this week,” and added that she’d “find it difficult to cut rates again in December unless there is clear evidence (…)”.

Then there’s Waller - widely seen as a top contender for the next Fed Chair - who said on Friday: “I’m still advocating that we cut interest rates in December.” Of course he is. As Powell described, the committee is clearly divided.

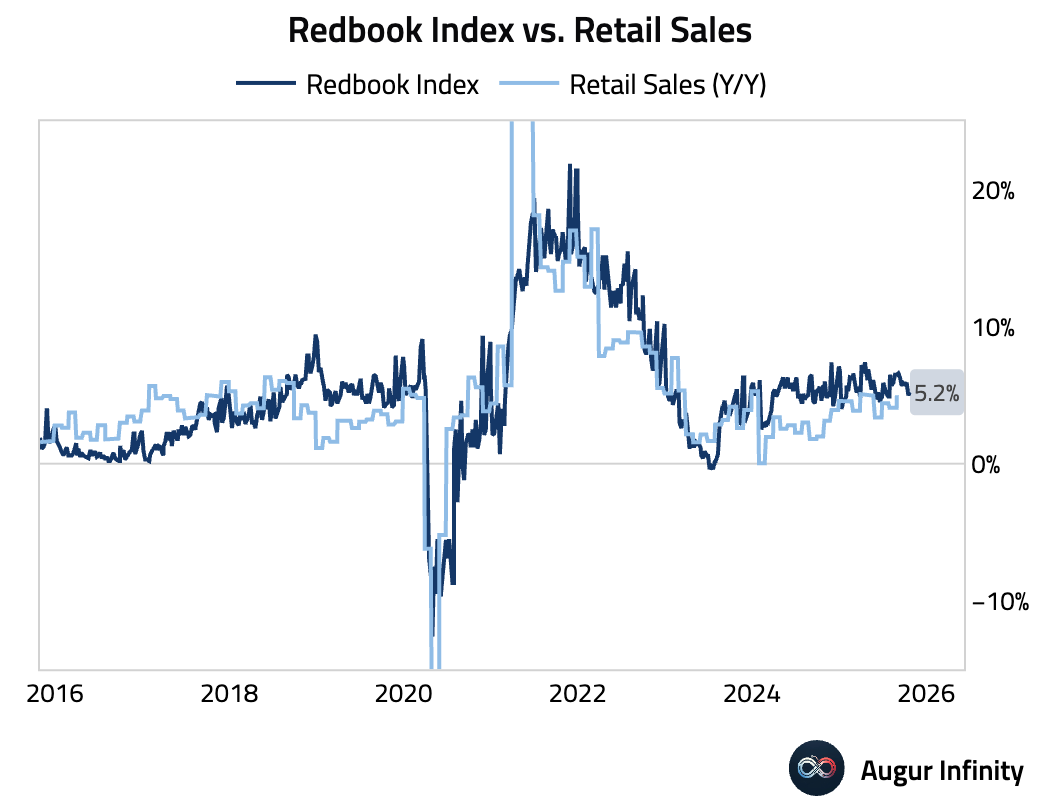

Beyond the Fed chatter, one alternative data point stood out: the Redbook Index, a useful proxy for retail sales. It suggests annualised sales growth of around 5%, consistent with my view of a still-strong U.S. consumer - supported by solid private sector balance sheets and the wealth effect.

STIR - What is Priced Into SOFR, Euribor & Corra?

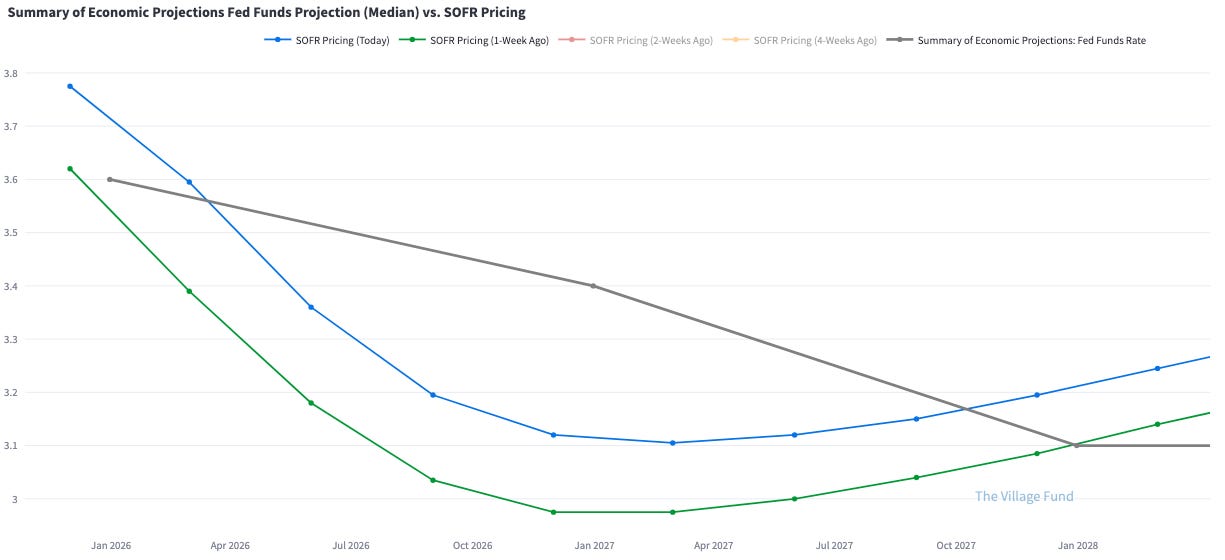

Whenever SOFR pricing deviates meaningfully from the Fed’s Summary of Economic Projections (SEP), it’s worth paying attention. Just a week ago (green line), the SOFR curve was pricing roughly 40bps more cuts than the Fed projected in its latest SEP.

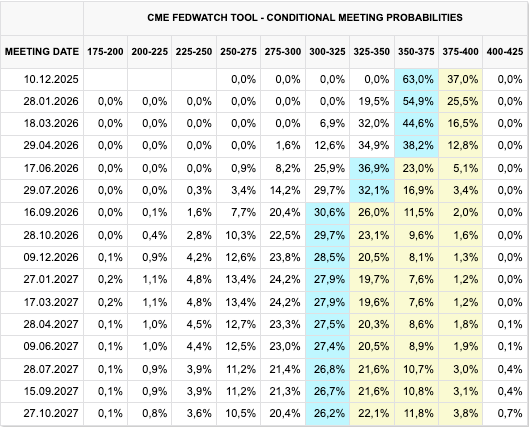

Following this week’s FOMC, the SOFR curve now implies a 63% chance of a December cut - still the market’s base case. After that, however, it expects the Fed to pause until April 2026.

I’m currently long SOFR June 2027 and short SOFR June 2026. The rationale:

Fewer cuts under Powell, and more under the next Fed Chair.

A stronger-than-expected U.S. economy and risk of inflation re-acceleration - meaning fewer cuts in the near term.

The trade is working so far: the spread now prices 24bps of cuts (entry: 19bps, stop: 16bps). I’d probably take profits if it moves another 5bps in my favour and stop out if it goes back to breakeven.

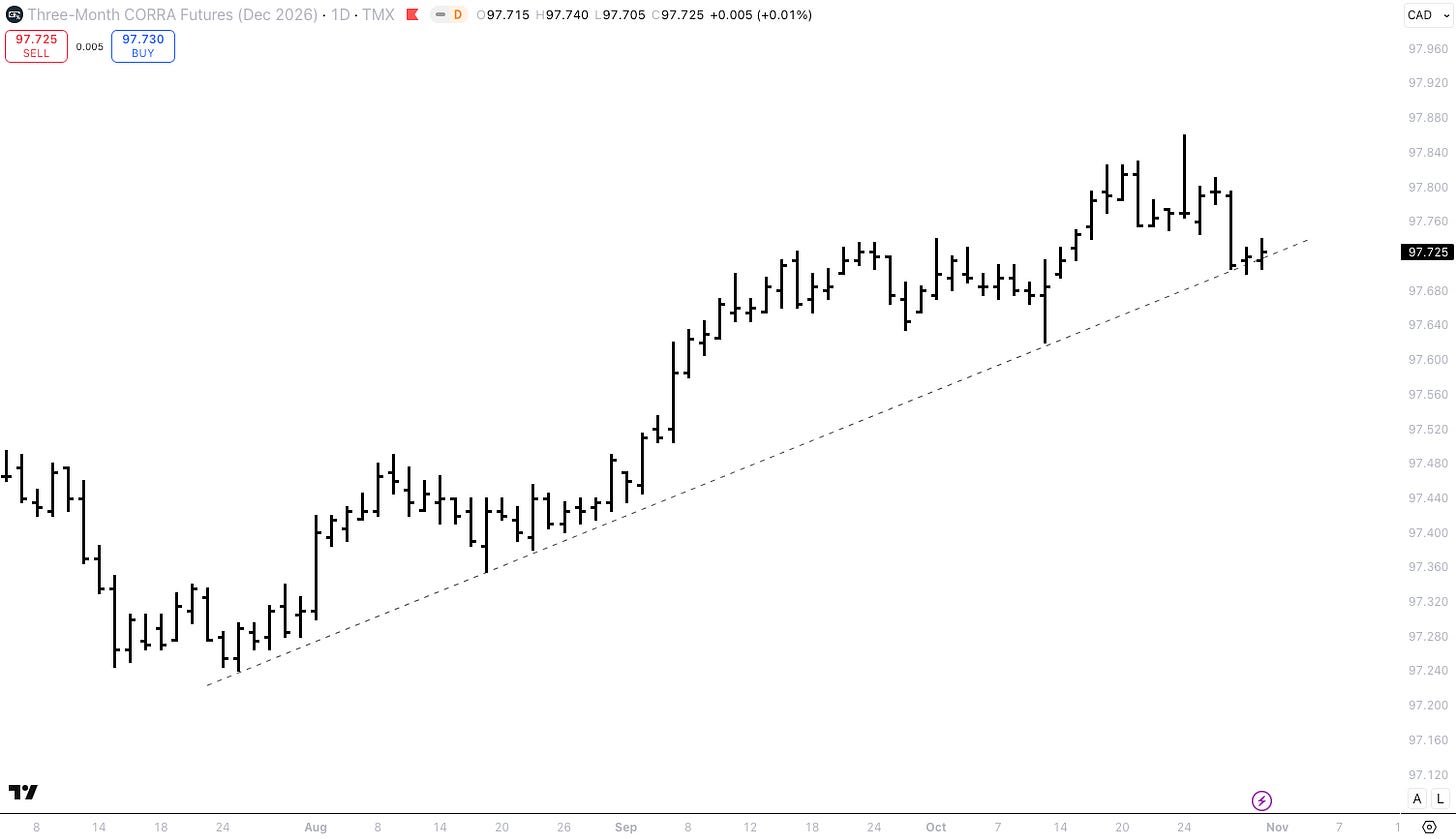

The Bank of Canada also cut rates by 25bps this week, but said that policy is now “about the right level.” As a result, CORRA futures flipped from pricing 5.5bps of cuts in 2026 to 5.5bps of hikes (Dec’25–Dec’26).

I’m long CORRA Dec’26, which has gone against me. It’s a half-sized position, so risk is small. Normally, I’m not a fan of averaging down - but in this case, I might add with a tight stop. If CORRA Dec’26 breaks below trend support, I’m out.

I still believe the Canadian economy warrants cuts, not hikes. The unemployment rate is up 2.3% since July 2022, the economy is stagnating, tariffs are growth-negative and disinflationary, and the latest Trump comment doesn’t help:

TRUMP: WILL NOT START RENEGOTIATIONS WITH CANADA

Across the Atlantic, Euribor futures are again pricing 7.5bps of cuts in 2026 (Dec ’25–Dec ’26). Further out, in 2027, the market expects 20.5bps of hikes (!) — down from 38.5bps on Liberation Day.

To me, Euribors pricing hikes in 2027 looks wrong, given France’s political instability, Germany’s structural economic problems, and weak demographics. I expect the market to continue pricing out hikes next year.

The main risk to this view is probably Germany’s fiscal package, which could start to support growth in 2026. But I doubt it will spark another economic wonder - Germany’s problems are structural, not cyclical.

Alternatively, an outright long in Euribor Dec ’26 looks attractive - a straightforward way to position for a weaker European economy and at least one to two cuts next year. Euribors are still only pricing in a quarter of a cut for 2026.

FX - US Dollar Strength Post FOMC

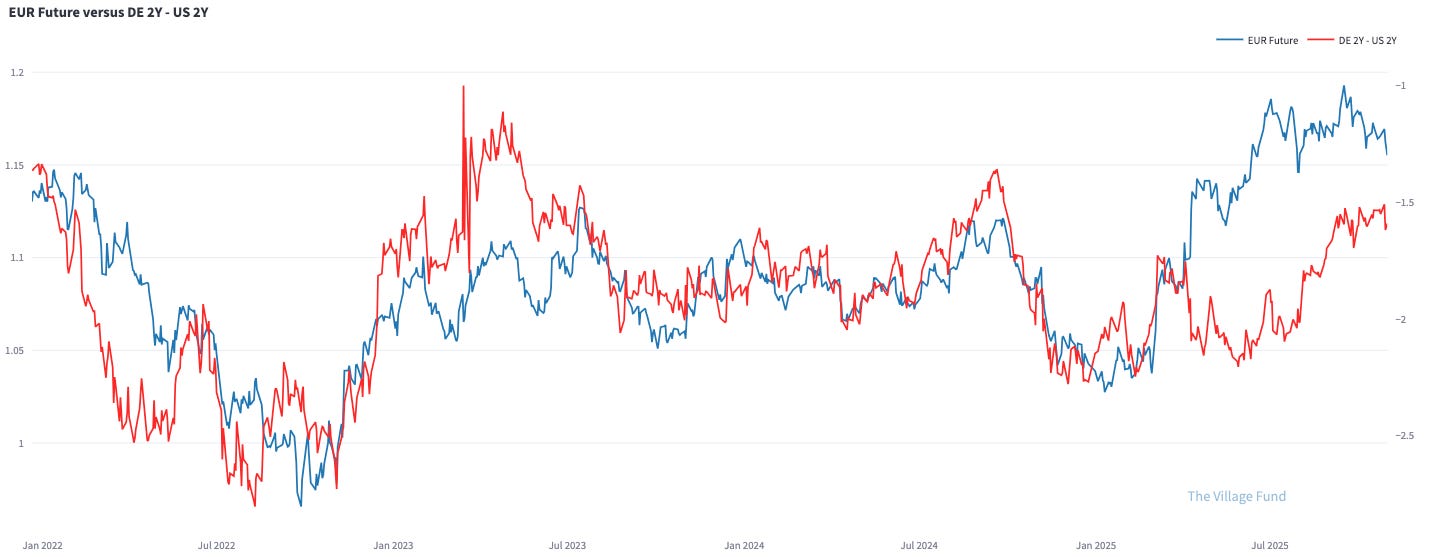

I am still long US dollars versus Euros. I think the Euro is too strong for the Europe’s export economy, yield differentials are starting to matter again, and the political narrative not to invest in the United States anymore post Liberation Day was always unrealistic. Take a look at the below chart, which shows 2-year yield differentials between Germany and the United States and the EURUSD exchange rate.

The Euro broke below the trend line I highlighted last week. The two red arrows mark the last two FOMC meetings. I expect more downside although positioning is likely not as crowded long Euros anymore.

Equities - AI Is Still Underestimated. But Are there First Cracks?

I believe the impact of AI on the economy remains underestimated by most. I am not talking about financial markets, I am talking about the real economy. Just a few developments that I find fascinating:

Qualcomm unveiled a new AI chip to challenge NVIDIA, while Substrate, a Peter Thiel–backed company, aims to compete with ASML. The race is no longer just about large language models - the hardware race is accelerating rapidly.

A Wharton study found that 75% of businesses using AI report positive returns on investment, and 46% of business leaders already use AI daily. Imagine life without ChatGPT, Grok, or Gemini - productivity would drop meaningfully.

Software engineers will soon face direct competition from AI agents. A human engineer costs at least $100,000 per year; a specialised AI agent that can do 80% of the same work will cost $300–1,000 per year.

Anthropic’s Claude is threatening jobs in Financial Services. OpenAI hired >100 former investment bankers to replace investment banking jobs. Who’s left? Only dealmakers. Banks are slow to adapt new technology, but it will happen.

Uber plans to launch a 100,000-vehicle robotaxi fleet with Nvidia’s help. The race for dominance in autonomous driving - between Tesla, Google, and others - is one of the biggest industrial shifts in motion.

You can now pre-order the humanoid robot “Neo” for $499 per month, with deliveries expected in 2026. Within a decade, it’s plausible that many households will own one. Robots threaten blue-collar jobs; AI agents threaten white-collar ones.

AI is a trend that will profoundly reshape the real economy and our daily lives. But that doesn’t necessarily mean it’s time to load up on tech stocks. In fact, several warning signals for equities are flashing.

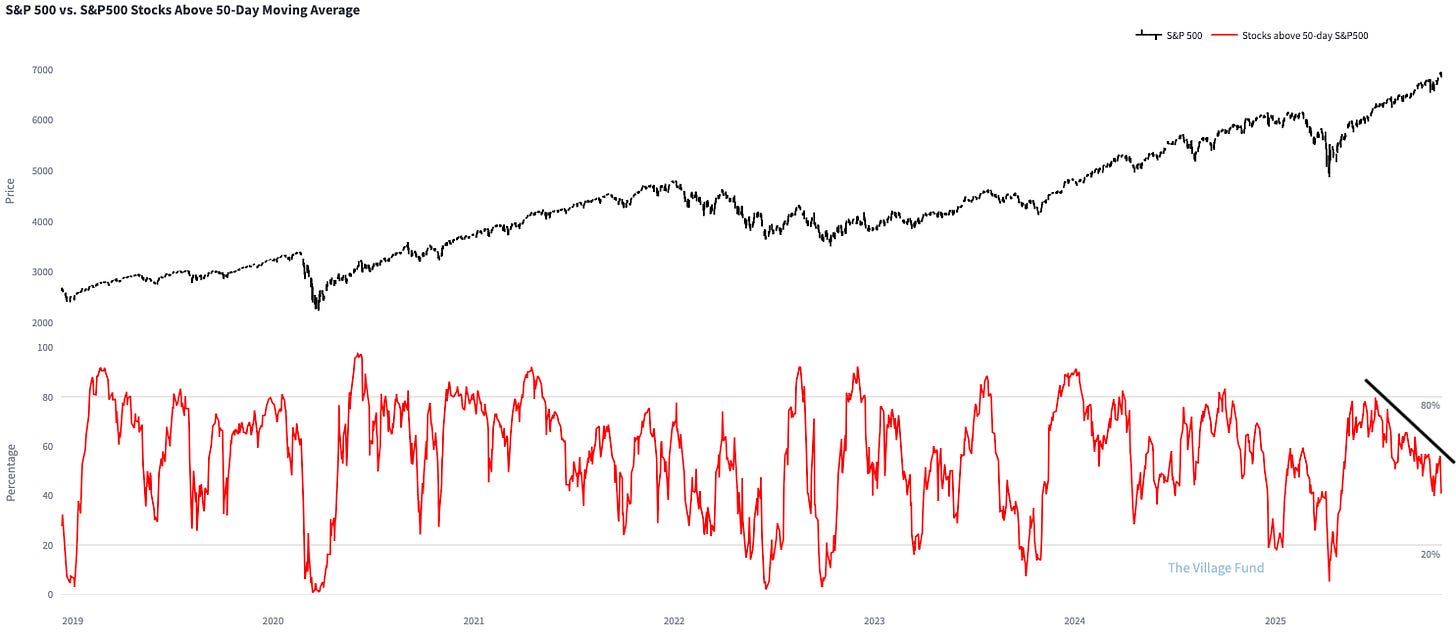

Market breadth is weakening - only 41% of S&P 500 stocks are above their 50-day moving average. While that doesn’t preclude further gains in indices, it points to underlying fragility.

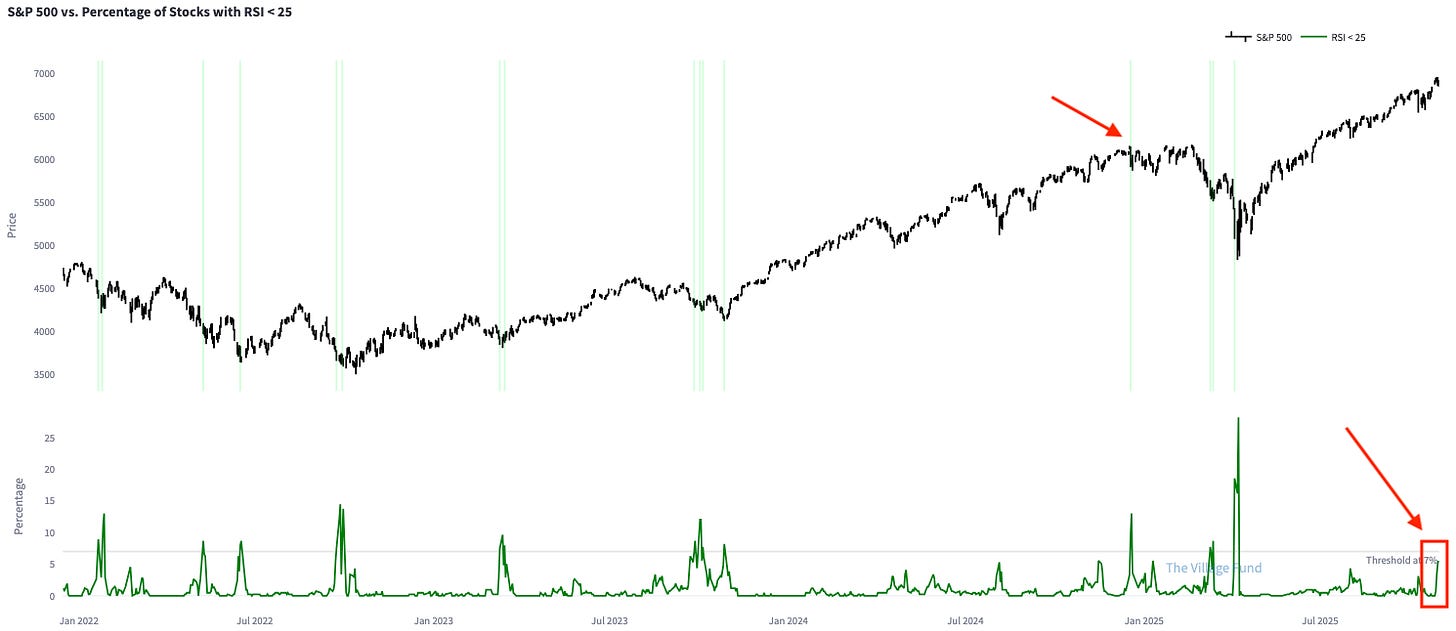

S&P 500 stocks with RSI values below 25 are spiking - typically a short-term buy signal, but also a potential sign of internal weakness. The same pattern appeared in December 2024, just before the Liberation Day correction.

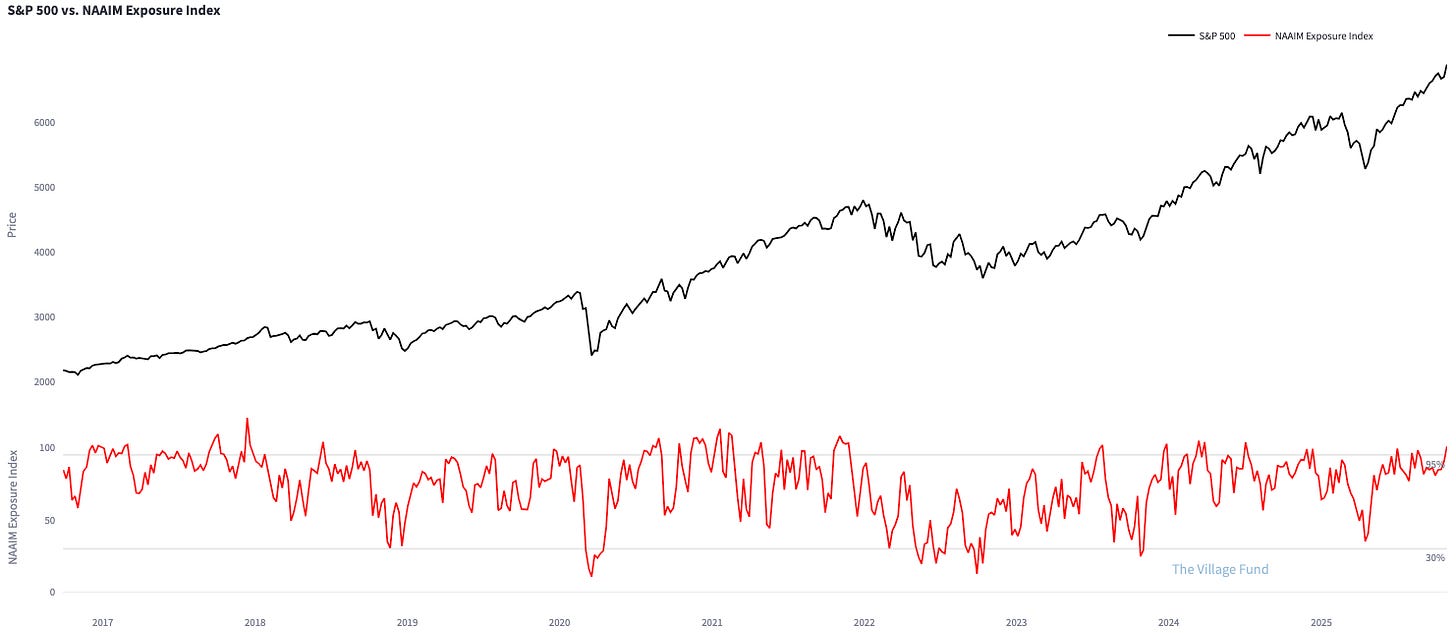

Similar to December 2024, the NAAIM Exposure Index indicates active investors are fully invested.

On the other hand, vol-targeting allocations are no longer stretched, the Fear & Greed Index is neutral, and AAII retail sentiment is not excessively bullish. Corporate buybacks in November and December should also provide support.

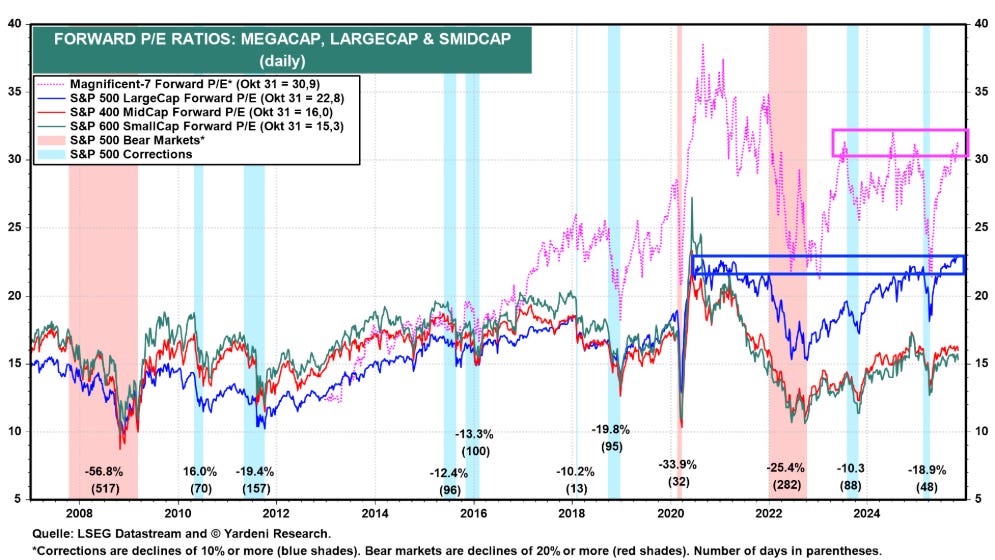

Valuations remain elevated. The Mag-7 forward P/E has reached levels that preceded prior corrections, while the S&P 500’s forward P/E is at a record high. With little room for multiple expansion, earnings will need to carry the rally from here.

I’m closely watching the U.S. 10-year yield, which broke above its trend line. A move higher - driven by a hawkish Fed, a re-acceleration in inflation, or stronger growth - could put pressure on stretched equity valuations. And what about November 5th? If the Supreme courts challenges the legality of tariffs, renewed fiscal concerns could push the 10-year yield higher again.

Crypto, the ultimate risk asset, hasn’t rebounded after the recent leverage wipe-out and has lagged equities in recent months. It’s rarely a good sign when high-beta assets roll over - remember, ARKK peaked in early 2021, long before the 2022 bear market.

Finally, the Hindenburg Omen flashed this week - a rare technical warning signal that often precedes market weakness. I’ll be watching to see if it clusters in the coming weeks. You can read more about this technical indicator here.

My game plan: in my long-term investment accounts, including my pension, I’m not making changes. In my tax-efficient investment account, I may trim some equity exposure. In my active trading account, I currently hold no equity positions - in fact, my long U.S. dollar exposure could serve as a hedge against equity weakness.

If U.S. equities correct, long Corra Dec’26 or Euribor Dec’26 positions could also benefit: lower equities → weaker consumption → slower growth → softer inflation → more comfortable conditions for central banks to cut rates. That could be a better trade than trying to time a correction in equity markets.

Those are my thoughts for this Saturday. I hope you enjoyed the article - see you next week!

Do you trade Euribor and Estr on Eurex instead of ICE? Margin req is insanely good in comparison. I only need 90 euro per contract for ESTR.

What do you think is the fair level of the 10y? I think Dec FOMC still cut,dont know why market will think Powell is hawkish