Year-End Equity Flows, Oil's Setup and STIR Pricing

Buybacks in November & December. The wealth effect and why it means the stock market is the economy. Large money manager short positions in oil. Fewer cuts in the U.S. and more cuts in Europe.

Dear readers,

I hope you had a nice weekend. It is a quiet Sunday and I am looking at my macro dashboard and models, trying to figure out where to invest my money.

Most of my net worth sits in equities, held through tax-efficient vehicles that make long-term compounding a no-brainer. Beyond that, I keep a separate trading account - the one I often write about here.

I allocate to my trading account because it is uncorrelated to equity markets. It guarantees I remain flexible when opportunities arise. If equity markets crash, I will be able to take advantage.

But let’s dive into macro views, analysis and charts. As always, if you find these write-ups helpful, please leave a like, subscribe or share the article with others. Let’s jump in.

Equities - Constructive Flows Into Year-End

As I mentioned above, I am structurally long equities. Especially in today’s world - one that’s improving at an accelerating pace - it seems unwise not to maintain a long-term equity allocation.

Macro investors often dwell on valuations, inflation, and rising debt burdens. While those risks matter, I believe it pays to be an optimist. Consider the secular trends likely to drive global growth over the next decade:

Artificial intelligence is accelerating innovation and democratising knowledge. Anyone with a phone can access AI tools. And the AI boom will require a massive energy build-out.

Robotics is poised to be the next great technological wave. By 2040, it’s not far-fetched to imagine many U.S. households owning a personal robot.

Biotech and healthcare innovation are approaching major breakthroughs, many powered by AI. Longevity itself could become a secular theme, reshaping consumption and savings behaviour.

India is now the world’s most populous nation and is projected to grow 6–7% annually - a powerful engine for global demand.

Emerging markets still contain billions striving for better lives. As long as capitalism and innovation persist, global living standards - and equity markets - will continue to rise.

That’s my structural view: over time, human progress drives equity appreciation. But in the short term, markets swing around that trend. Active allocation - overweighting or underweighting equities when the macro backdrop calls for it - still matters.

With that in mind, let’s look at some charts to see where we stand today.

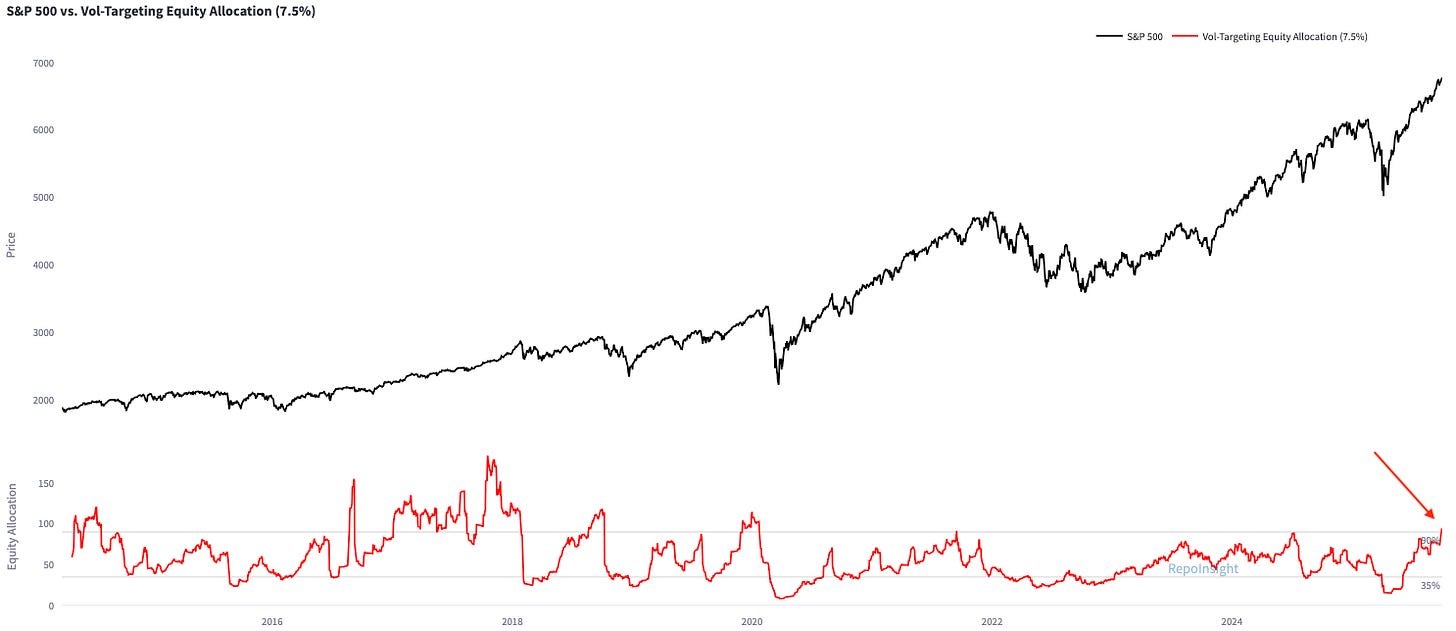

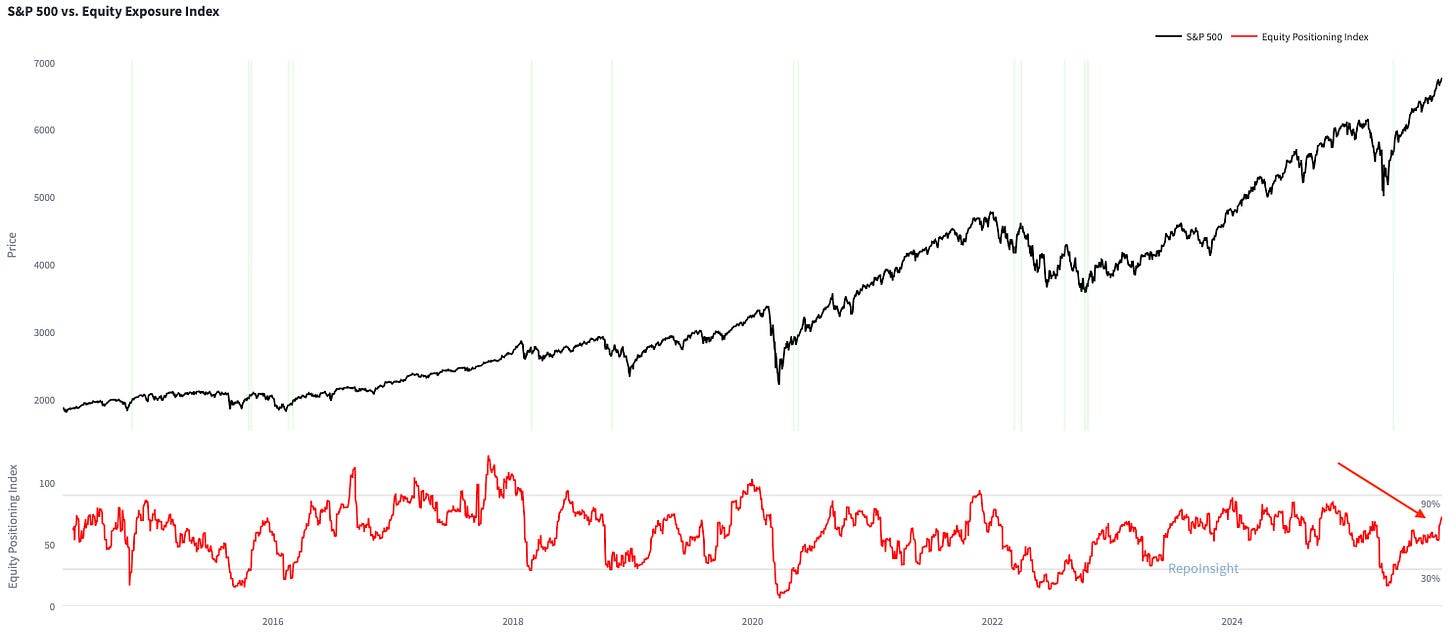

CTAs, vol-targeting funds, and many active investors have jumped back into the market. Vol-targeting funds have increased allocations as realised volatility has come down.

Combining vol-targeting allocations with futures positioning and the NAAIM Exposure Index suggests that while there’s still room for positioning to expand, exposure has risen over the past two weeks.

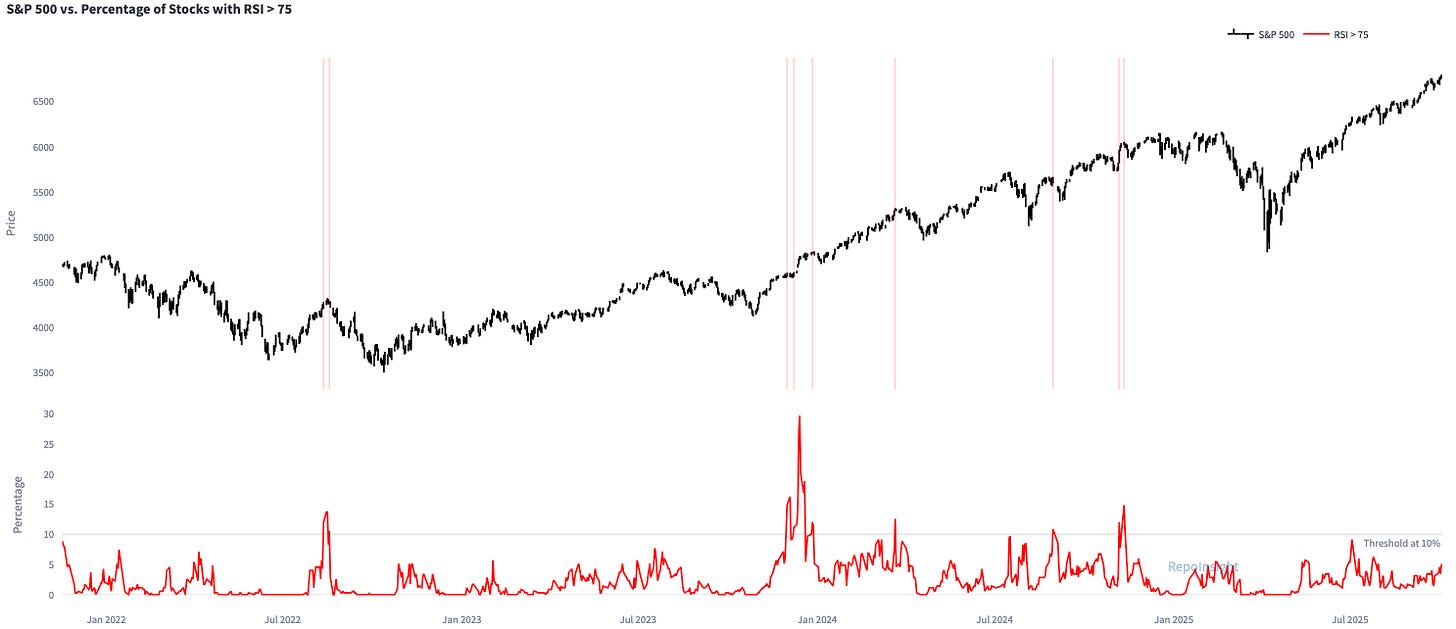

Market breadth is not a problem. The cumulative AD line (NYSE) is rising to new highs in line with the S&P500.

S&P500 stocks with RSIs above 75 stand at 5% - not a warning sign yet either.

The setup into year-end is constructive. In terms of seasonality, October 26th marks the Q4 low for the S&P500. And historically, November and December are the strongest buyback execution months for U.S. corporates.

With the S&P500 up 14.4% year-to-date, consumption is likely to pick up again as households feel wealthier. The wealth effect is real - U.S. household equity exposure is up +542% since 2020 (!). To some extent, the stock market is the economy these days.

I am not long equities in my trading account, but I will leave my long-term allocations unchanged. I do not see strong enough evidence to reduce long-term allocations.

Oil - Are the pieces falling together?

OPEC+ agreed to a modest 137k b/d output increase for November, smaller than the two- to threefold hike reportedly discussed earlier in the week. It will be interesting to see how crude oil reacts on Monday.

The limited increase may signal constraints in available spare capacity. Of the 2.2m b/d of planned output hikes between May and September, only about 60% materialized. This suggests some OPEC+ members may already be reaching the limits of what they can produce.

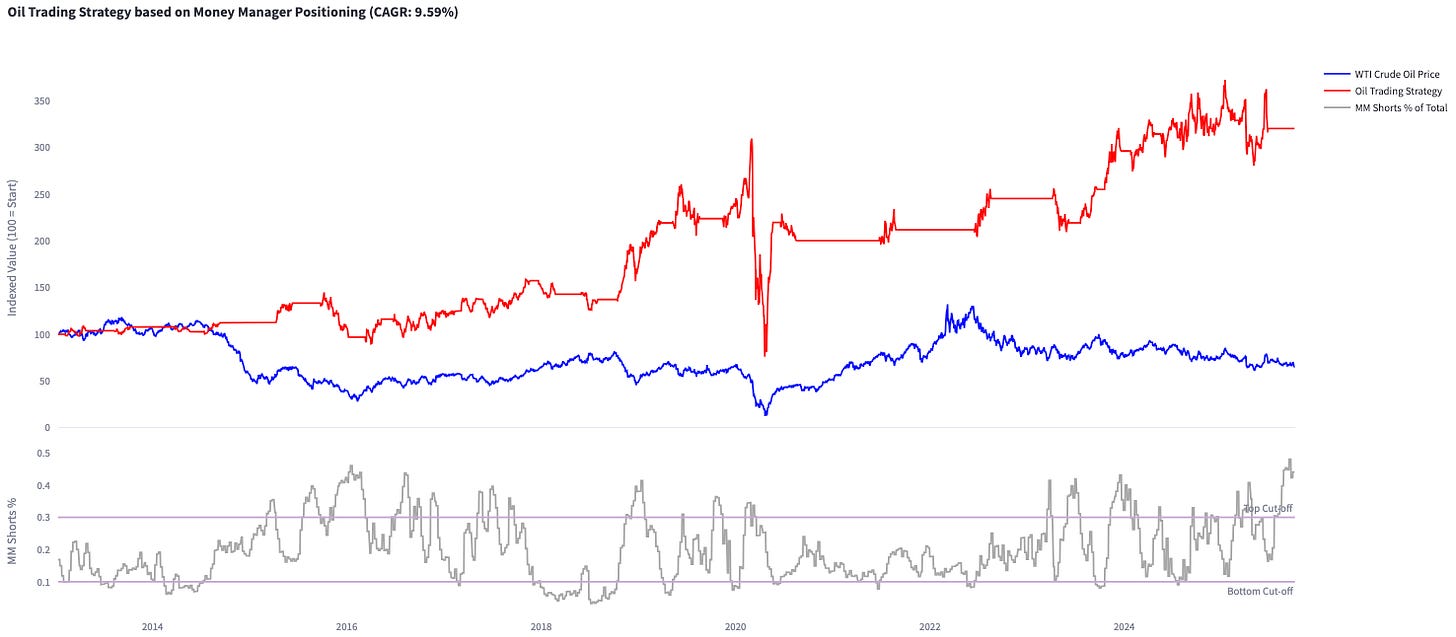

I am tracking three crude oil signals. COT positioning shows that money managers are very short crude oil futures (bottom line in the chart). If money managers unwind the shorts, the oil price should increase. Currently, the strategy is flat.

I am also tracking technical signals. This strategy buys pullbacks in short-term uptrends, but it is currently flat. The oil price sold off too aggressively in the past few days.

And lastly, I am tracking inventories data. When inventory draws are high relative to history, it pays off to get long oil. The strategy is currently long crude oil.

Eventually, I will combine all three strategies. Especially the money manager positioning looks very stretched. I hope it comes to an unwind in the coming weeks, and I will be able to trade it. I am still on the sidelines.

FX & Rates - Hikes in Europe and Cuts in the United States

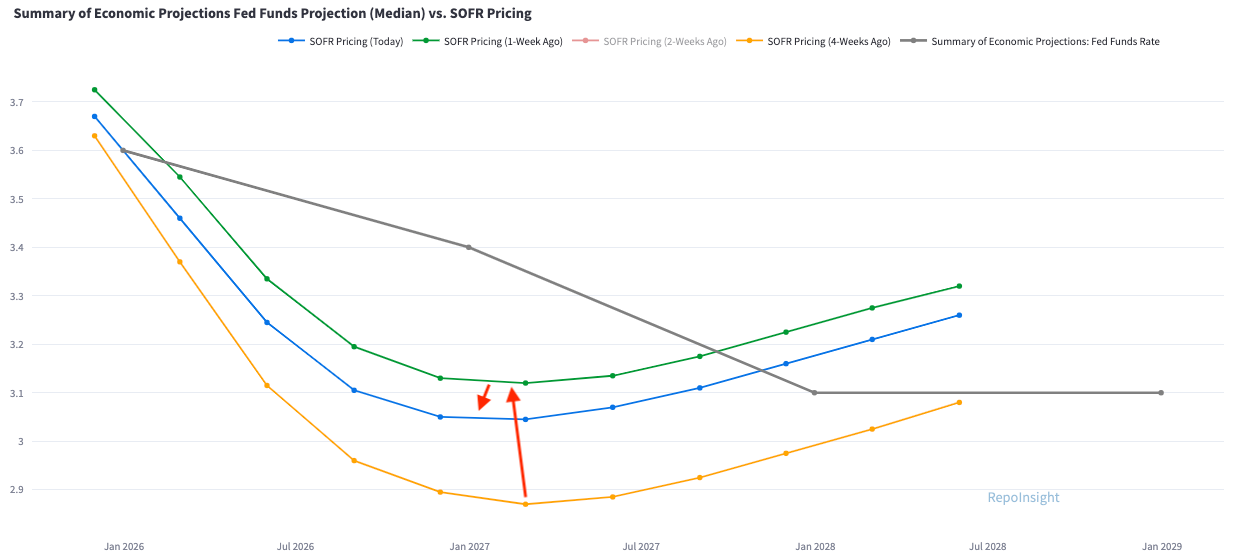

SOFR futures continue to price in significantly more rate cuts than indicated in the Fed’s SEP. Four weeks ago - amid concerns over labor market softness and slower growth - STIR pricing was notably dovish (yellow).

Since then, stronger-than-expected economic data, particularly on consumption, pushed the SOFR curve higher (green, one week ago). More recently, it has edged lower again (blue, today) as markets reassessed the near-term outlook.

The terminal rate has repriced lower too (see below). As I’ve noted many times in the past few months, the Fed’s projected long-term interest rate was (and still is) below the level the market is pricing as the long-term interest rate.

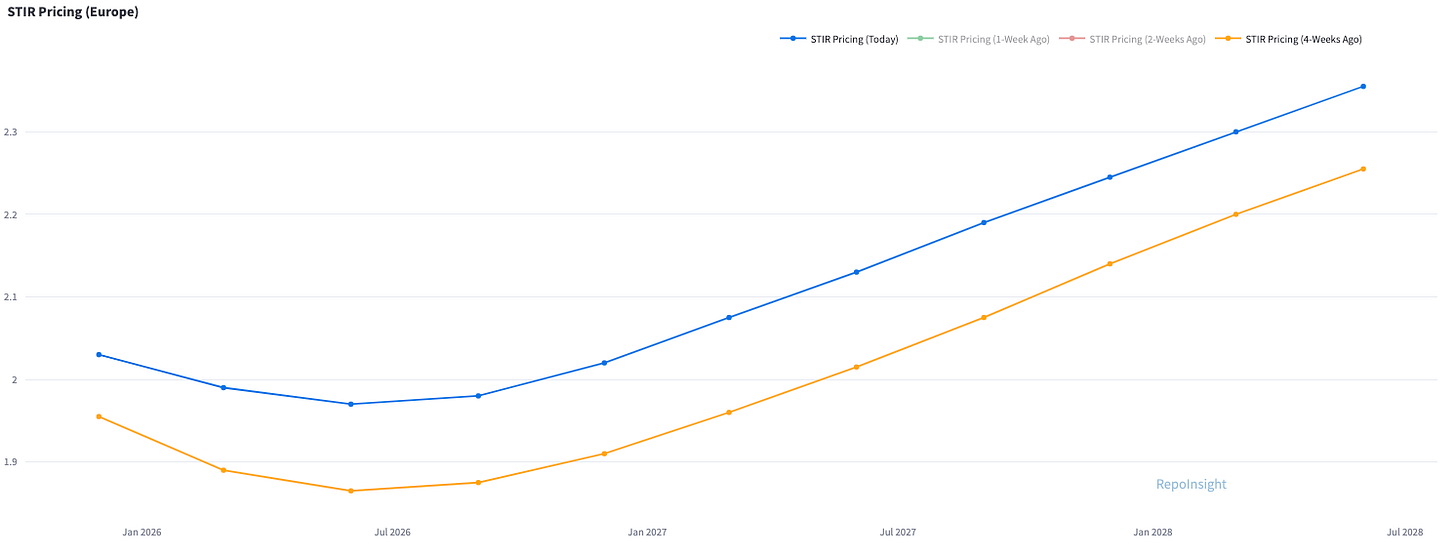

Now take a look at what 3-month Euribor futures are pricing for the ECB - hikes. Despite France’s political uncertainty and Germany’s stagnant economy, the market is not pricing more cuts.

I believe STIR markets will need to price in rate cuts in Europe and fewer cuts in the United States. That dynamic would support the U.S. dollar while pressuring the euro. At the last FOMC meeting (red arrow), Jerome Powell signalled multiple cuts - a theoretically bullish outcome for the euro - yet the currency reversed and closed lower.

I hope you enjoyed this update. I am still working on a few systematic strategies that I am looking to deploy in addition to my discretionary trading. But that will happen earliest in Q1-2026. My YTD trading performance is unchanged from my last article.

Don't you think there's still a chance the ECB could cut interest rates?