Top-down macro trade ideas and are US equities ready to bounce?

Will the S&P500 bounce from here? And three more macro trade ideas that I am currently monitoring.

Each weekend, I take time to write down my thoughts and formulate macro trade ideas. This process has been invaluable in 2025, helping me stay organised and keep up with what is happening in the world. I hope you enjoy the articles, and I welcome any comments or feedback. Let’s dive in!

The bearish “tariff” and “DOGE” macro backdrop

We came into the year 2025 with high valuations and elevated earnings expectations. Now it is all about tariffs. The market expects the Trump administration to slow down the US economy. And the Trump administration is ignoring the market and tells everyone to brace for an “adjustment period”.

When Trump was elected, every entrepreneur on this planet was optimistic - almost euphoric - about the United States. De-regulation, lower taxes, a consumer in great financial shape, lower energy prices, the most developed financial markets in the world, and more. The United States has a lot of things going for it.

But the sentiment has flipped. The tariff uncertainty makes it much more difficult for business leaders to make informed decisions. For example, in the car industry, managers make investment decision with 10+ year horizons. In the aluminum industry, managers plan 20 to 30 years in advance.

There might be certainty about taxes and de-regulation, but tariff uncertainty means business investment remains low(er). Trump provoked a trade war. So far, Canada retaliated, China retaliated, and the EU retaliated. Companies that sell their products internationally do not know whether they will be hit with tariffs.

Not even tech companies are safe. The EU is talking about tariffs on “digital goods”. I think if Trump would have announced reciprocal tariffs to “level the playing field” without all the fuss, the outrage would have been smaller. Trump’s approach is too impulsive and aggressive.

Now add DOGE job cuts to the cocktail. Tariffs hit business sentiment. Job cuts and the drawdown in equities hit consumer sentiment. US GDP is 70% consumption, which means consumer sentiment is one of the main factors that determines whether the US economy slows down or not.

With household allocations to equities close to all-time highs, the 10% drawdown in the S&P500 is equivalent to a wealth shock of 12% of GDP according to Warren Pies. That is significant and has historically preceded recessions. A replay of Q4-2018, when the S&P500 declined by 20%, would likely impact consumption quite a bit.

Inflation came in weaker, but are pressures building?

On Wednesday, headline CPI came in weaker, 2.8% vs 2.9% expected. Core CPI also printed weaker, 3.1% vs 3.2% expected. The move down in core CPI was driven by airfares, which came in significantly weaker. Without the decline in airfares, core CPI m/m would have come in at 0.4% instead of 0.2%.

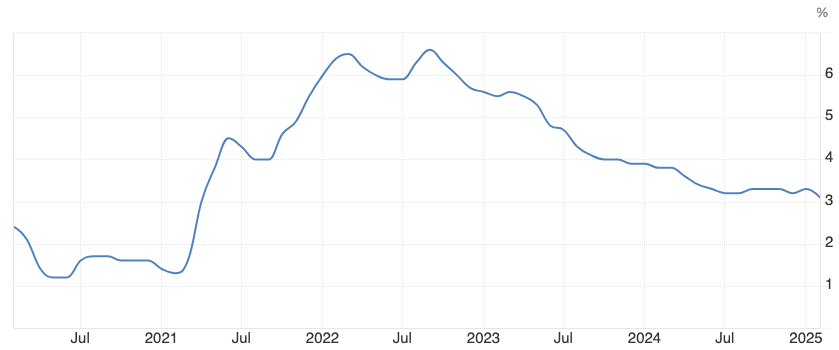

Shelter inflation is driving core CPI. In this week’s report, 55% of the rise in core CPI was driven by shelter inflation. Over the next couple of months, shelter inflation will likely decline, dragging core CPI lower. The below chart shows core CPI has stabilised around 3% in the past six months.

Source: Trading Economics

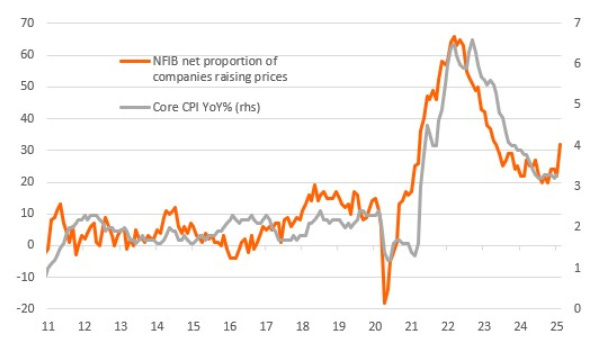

Despite the optimistic outlook on shelter inflation, there are some signs that inflation is re-accelerating. For example the NFIB survey among small and medium-sized businesses points towards higher core CPI. Inflation expectations have also risen. The question is whether the survey data will translate into the hard data. In the post-covid period, survey data was often misleading.

Source: Bob Elliott on X

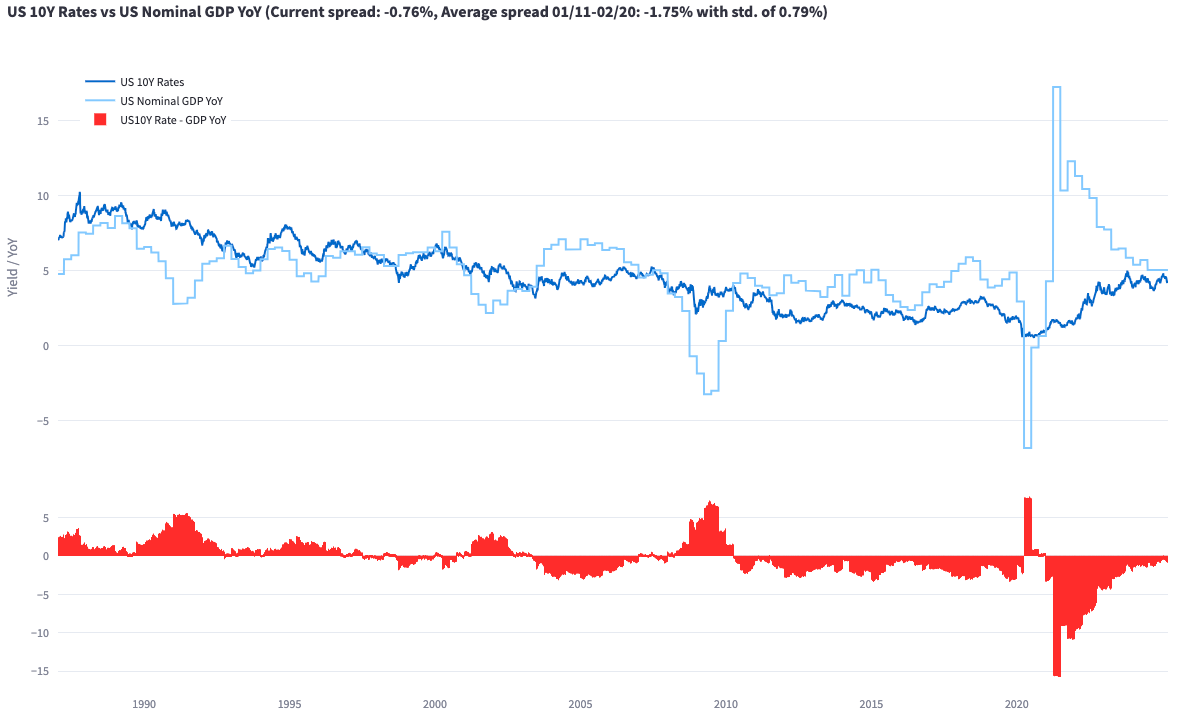

At the moment, my base case is that inflation will continue to slow towards the 2% target. If US nominal GDP growth slows to 3-4% and inflation slows to 2%, the historical spread of GDP growth to 10y yield suggests a lower 10y yield. From January 2011 to February 2020, the average 10y yield minus GDP growth spread was -1.75%.

Equities - Bearish macro backdrop, but bullish short-term

The macro backdrop is bearish. Valuations are still high and earnings expectations are still elevated. There is no “Trump put” and there is no “Fed put”. There is no catalyst that can motivate investors to buy US equities and rotate back out of Europe or China. At least, so it seems.

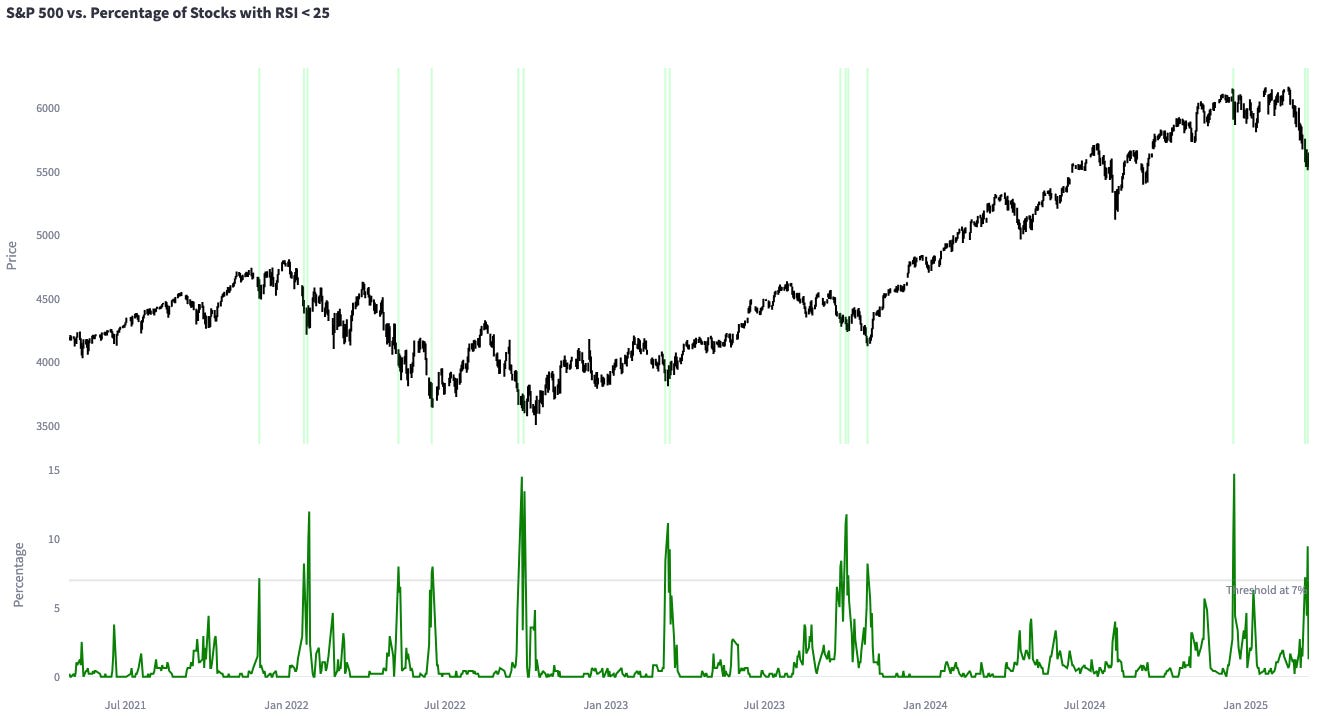

BUT, everyone knows this. If you trade tactically, it could be the time to play for a bounce. S&P500 stocks with RSI < 25 spiked at the end of the week.

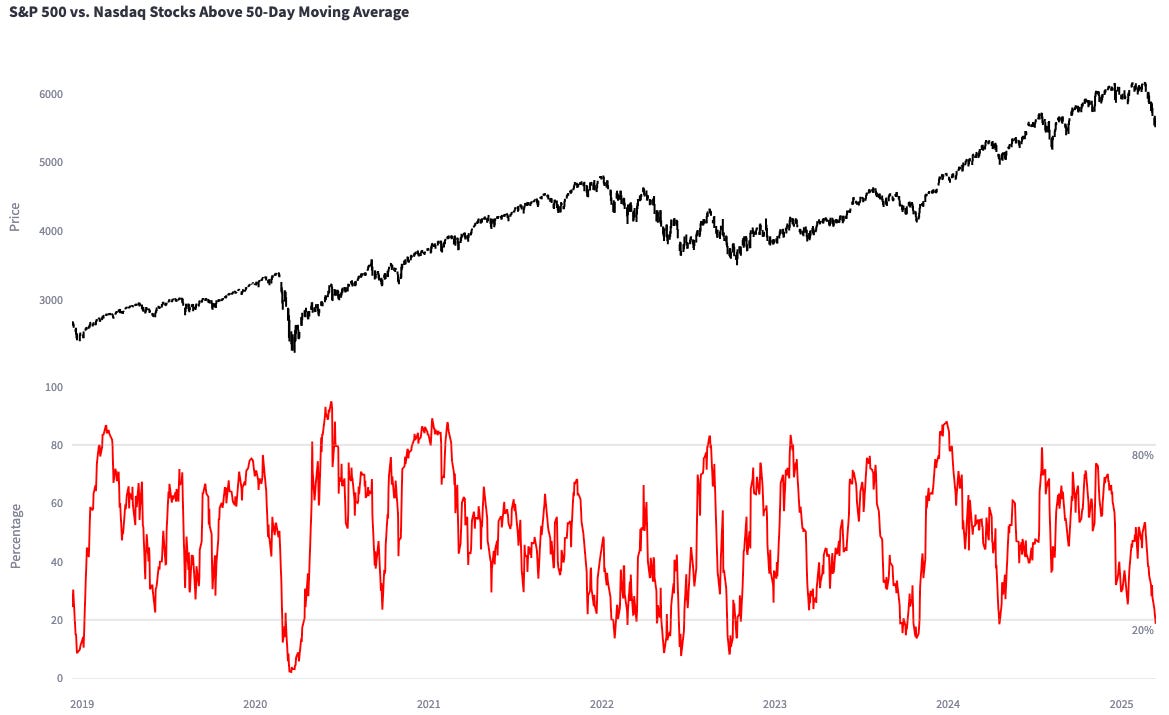

S&P500 stocks below their 50-day moving average are at similar extremes. That does not mean we cannot get even more oversold, it simply means the risk-to-reward to be short is not great anymore.

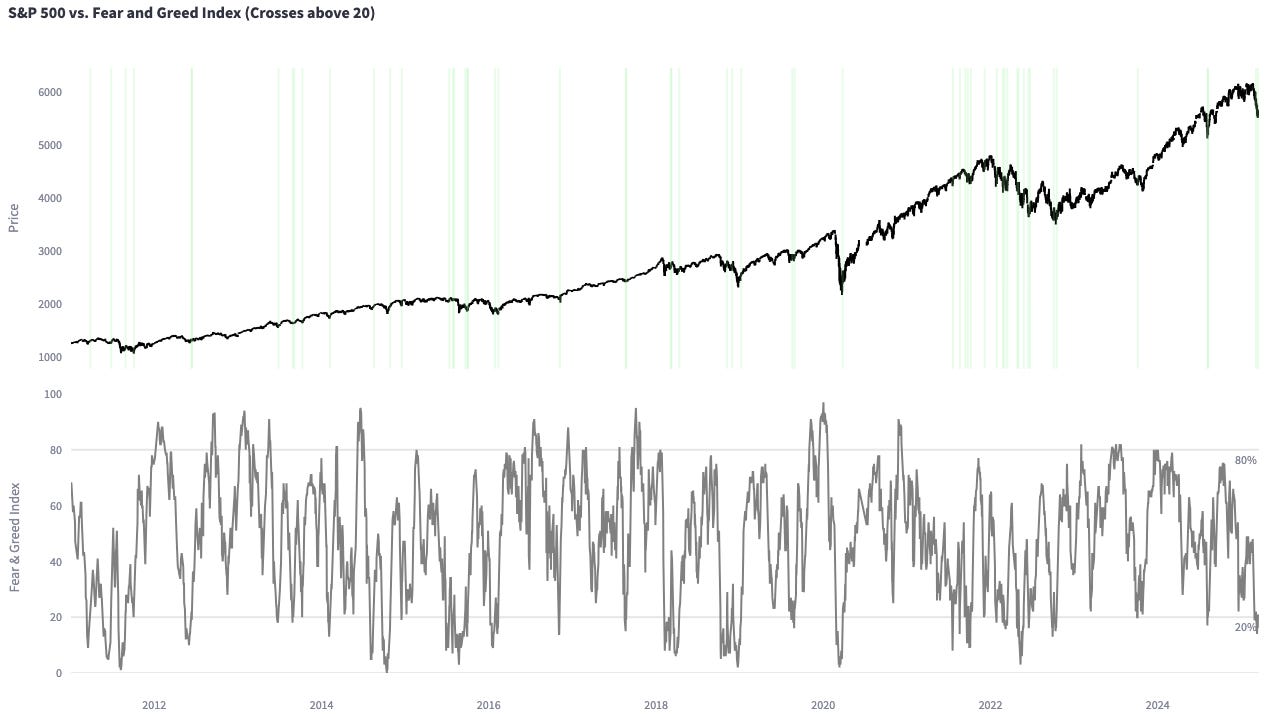

The CNN Fear & Greed index displays extreme fear and is now moving back up above 20. If the bull market continues, this correction could be one of the best buying opportunities in 2025. If this correction develops into a full-blown bear market, you have to be quick if you are trading a bounce.

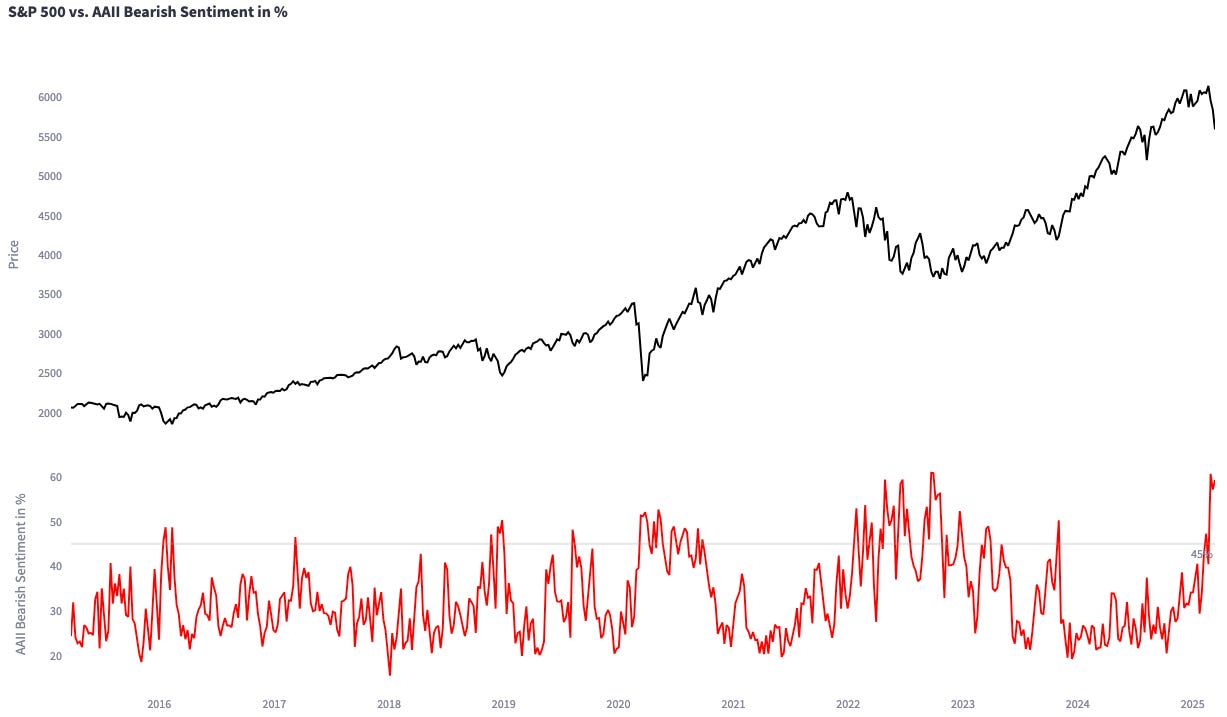

It is also worth pointing out that retail investor sentiment, as measured by the AAII investor sentiment survey, remains extremely bearish.

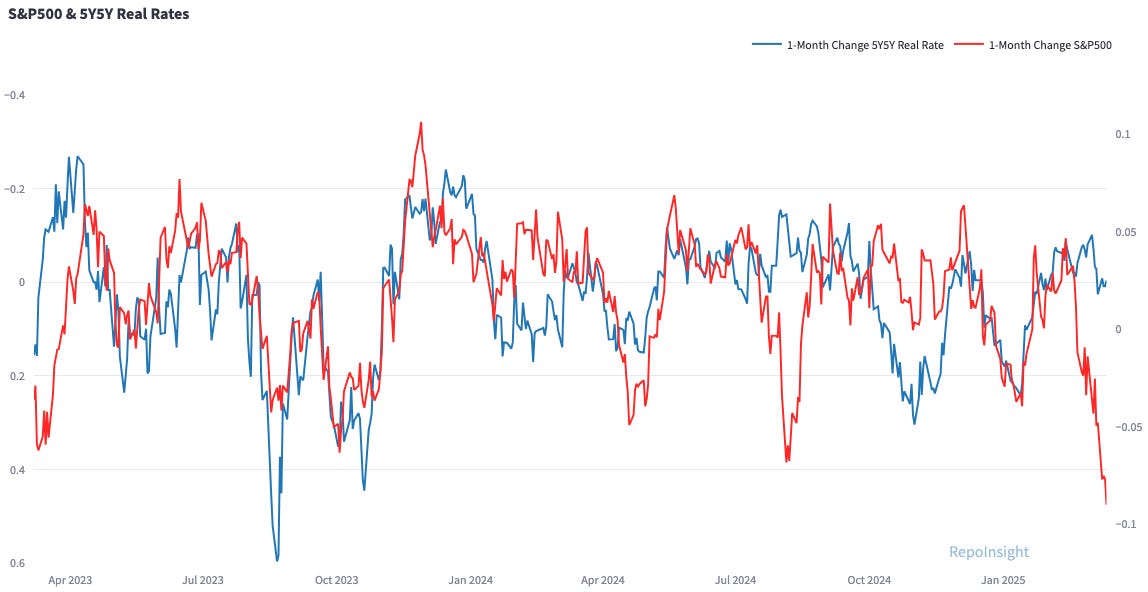

The move in equities is not supported by the bond market. Of course, if the bond market is pricing in a recession and a decline in earnings, this is negative for equities. But if a recession is not your base case, lower real rates allow for higher equity valuations.

One way to trade a bounce in the S&P500 is to enter a position on Monday - if we do not gap-up - and set the stop loss below Thursday’s low (on a closing basis). The risk-reward is probably worth taking that trade, but I also feel like everyone in the market is trying to buy the bounce…

Another way to trade a bounce is to buy SVIX, which is a short VIX futures ETF. If equities rally, the VIX will likely decline. Interestingly, SVIX bottomed on Tuesday and is already off the lows. Are volatility markets pointing towards a low in equities too?

Macro trade idea 1: Long Vietnamese equities

There are a few macro trade ideas I am thinking about. The first one is to go long Vietnamese equities. This idea depends on a recovery of the Chinese economy. If the Chinese economy recovers and simultaneously is hit with tariffs, Vietnam’s economy will benefit because exports and foreign direct investment will rise.

Vietnam's average wage is just one-third of China's. The country offers lower commercial income taxes than China. Over the past two decades, Vietnam has invested nearly 20% of its GDP in education, fostering a more skilled workforce. Looking ahead, the government has set a GDP growth target of 8.0% for 2025.

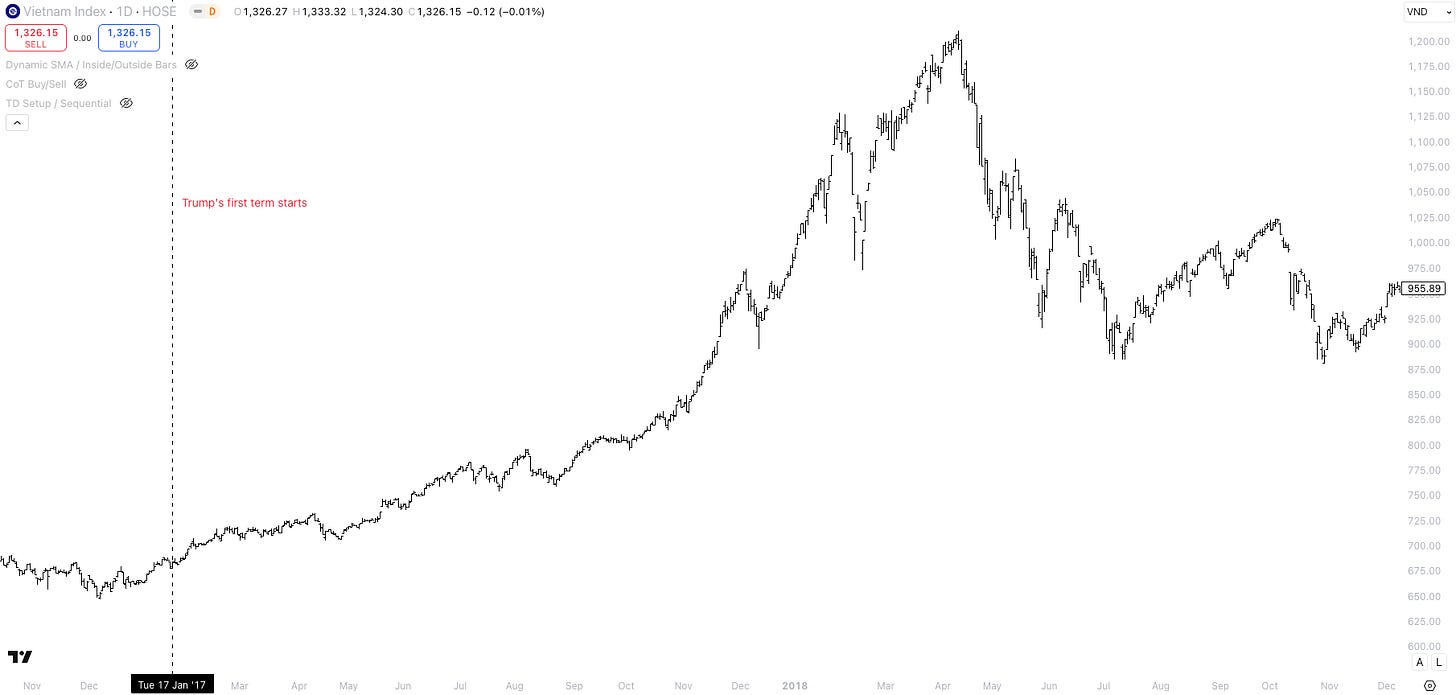

After Trump’s first term started in January 2017, Vietnamese equities rallied more than 60% in 12 months. A lot of foreign direct investment was re-directed from China to Vietnam.

The Regional Comprehensive Economic Partnership (RCEP) was signed in November 2020. RCEP is the largest free trade agreement in the world with 15 countries, including China, Australia, Japan, Vietnam and South Korea. The RCEP countries account for 28% of global economic output, 28% of global trade and 30% of the world's population. Since RCEP was signed, no custom duties have to be paid on 92% of all goods and two thirds of all services traded between member states.

The trade agreement has not shown its effects yet as China’s economic problems started in the beginning of 2021. With Trump in the office, Vietnam could be an attractive and largely uncorrelated investment for the next six to twelve months.

Macro trade idea 2: Long crude oil

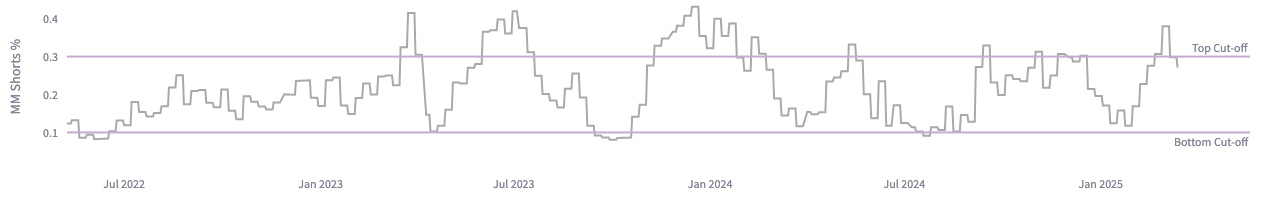

Another idea that I am currently monitoring is long oil. This idea is mainly based on positioning data. Money managers who are short as a percentage of total money manager positions are at extremes. If shorts are forced to unwind their positions, the resulting buying pressure could lead to higher oil prices.

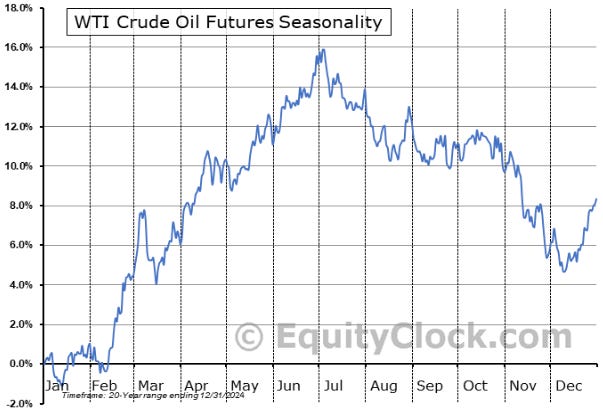

April is one of the best months for the oil price. In the past 20 years, oil has increased by on average 3.9% in April. 65% of all years were positive.

There are two major bearish developments right now. OPEC+ is going to raise the oil output by 138,000 bpd in April, marking the first increase since 2022, and the Trump administration is targeting lower oil prices. I am looking for bearish news, but the oil price shaking it off and closing up on the day.

Macro trade idea 3: Short JPY

And lastly, I am still monitoring a short JPY position. Higher rates, higher inflation and sustainably higher growth is the consensus for Japan. This is reflected in CoT positioning, which show speculators crowded long JPY. This does not mean the Yen rally cannot continue, but it indicates that the risk-reward of a long JPY position is poor and if JPY sells off, longs will get stopped out.

Summary

In my trading account, I am out of my long GBP position and 100% in cash. I am searching for the next opportunity. Short JPY and long crude oil look most interesting right now. I typically risk 1% of my capital per trade.

Long Vietnam is a longer-term idea that I might play via ETFs in one of my tax-incentivised accounts. I think a 5% allocation could be an attractive diversifier away from US equities. I will continue to dollar-cost average into US equities too.

I hope you enjoyed this article. I am writing about my views and trade ideas every weekend. Subscribe, so you do not miss the next article - it is 100% free.

Dear Mr. Repo,

Thank you once again for a great one!

Regarding Vietnam, I was thinking. Last time around during Trump1, it is said that some tariffs were avoided by first exporting from China to other Asian countries (such as Vietnam) so that then the latter could sell to the US tariff free or with reduced ones.

Two questions regarding this:

Do you reckon this was true? I might've read some misleading sources.

If true, do you think this could affect your Vietnam thesis, or it is not driven by US dynamics in any significant way?

Thank you!

Best,

Valentino