Too Blue to Buy: The Rally That Democrats Didn’t Believe In

This week, I learned that 65% of all equity fund managers voted for Biden. It made me wonder - did political bias shape institutional positioning during the equity rally? And much more.

Hi everyone,

Today’s piece will focus on:

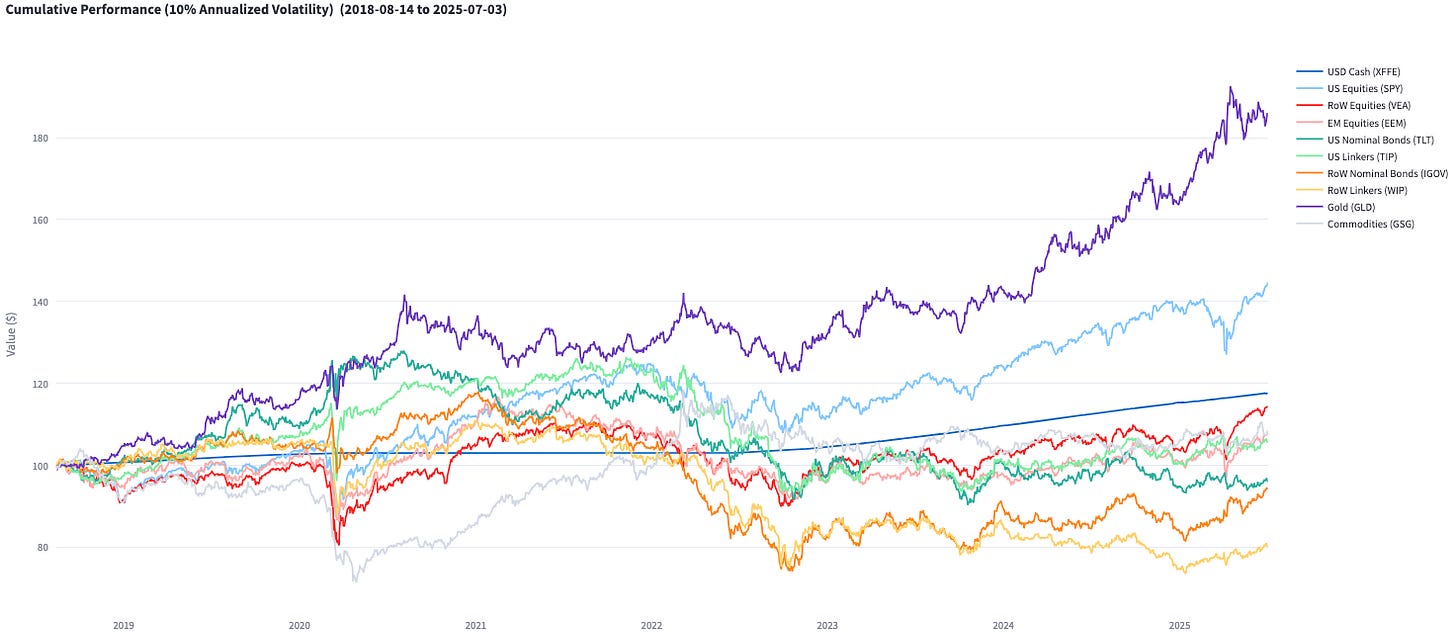

Chart of the Week: Gold Has Outperformed Every Major Risk Asset

Macro Pulse: Softening Labor Data vs. Rebound in H2 GDP Growth

Risk Assets Rundown: SOFR Curve, Equity Positioning, and Stablecoins

New ideas

As always, if you find these write-ups helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these out regularly. Let’s jump in!

1. Chart of the Week: Gold Has Outperformed Every Major Risk Asset

Since August 2018, gold has delivered the strongest risk-adjusted returns of any major asset class. Assuming 10% annualised volatility, it has outperformed U.S. equities, cash, and other risk assets. Gold is often viewed as a hedge against monetary debasement, but it also plays a valuable role as a portfolio diversifier. Its performance speaks to both qualities.

Ray Dalio recently summarised the investment case succinctly:

“When countries have too much debt, lowering interest rates and devaluing the currency that the debt is denominated in is the preferred path government policymakers are most likely to take, so it pays to bet on it happening.”

2. Macro Pulse: Softening Labor Data vs. Rebound in H2 GDP Growth

The macro picture hasn’t changed much overall, but recent data shows a growing divergence between labor market weakness and expectations for stronger GDP growth in the second half of the year.

Labor market data continues to soften. The ISM employment and new orders components came in below expectations, while "prices paid" remained elevated - not the mix you want to see. The headline Non-Farm Payrolls (NFP) print surprised to the upside at +147k (vs. 106k expected), but beneath the surface, it was a weaker report:

Private payrolls came in at +74k (vs. 100k expected) and

Wednesday’s ADP showed -33k jobs, pointing to private-sector contraction

While the ADP report is often dismissed in favour of NFPs, both are now pointing in the same direction: slowing private-sector job growth.

Bloomberg economist Anna Wong highlighted on X that the Birth-Death model adjustment may be overstating NFPs by 80–100k, and with 70k of the 147k jobs coming from the public sector, adjusted private payrolls may have actually declined - which aligns with the ADP report.

The drivers of labor market weakness aren’t entirely clear. It could be a mix of:

Rising adoption of AI, putting white-collar jobs at risk

Tariff uncertainty, weighing on hiring plans

Higher real interest rates, tightening financial conditions

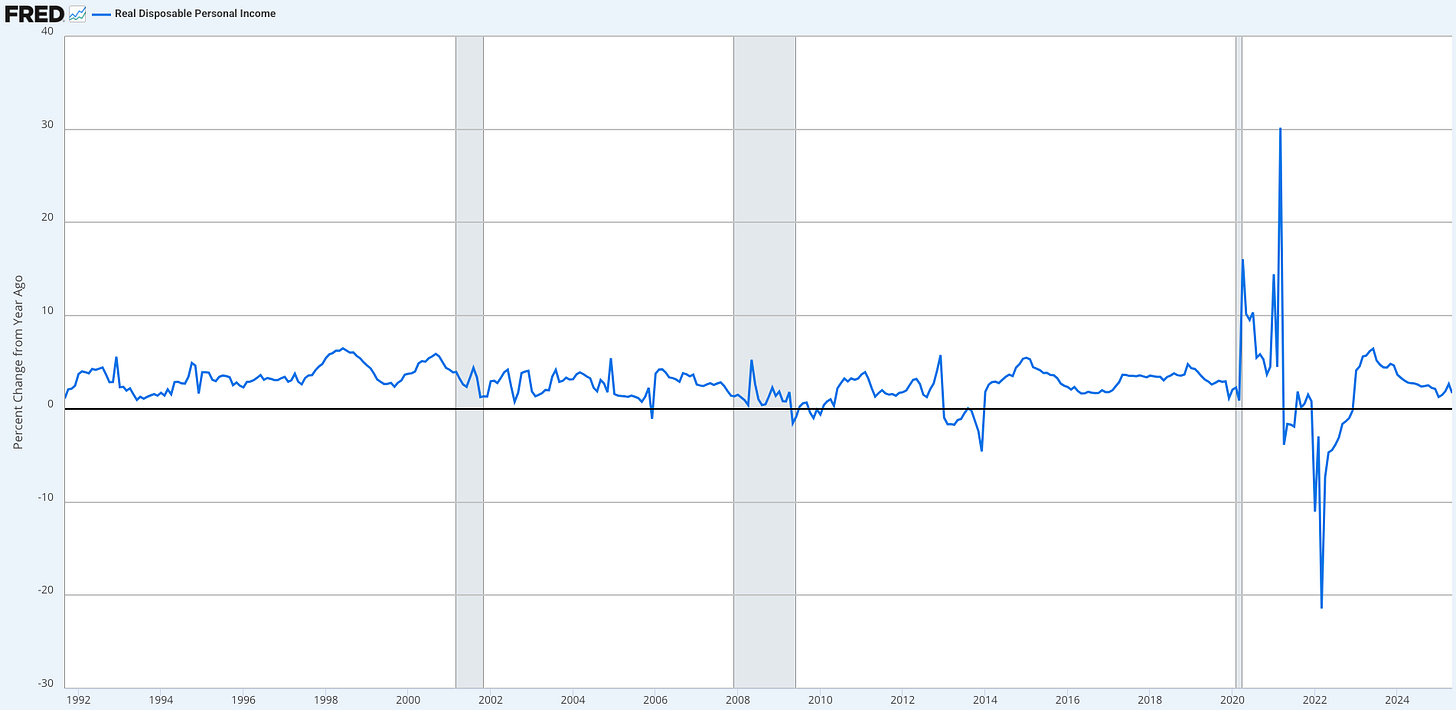

As job growth slows, wages tend to follow. And real disposable income is only growing at 1.7% year-on-year - among the weakest rates in recent memory.

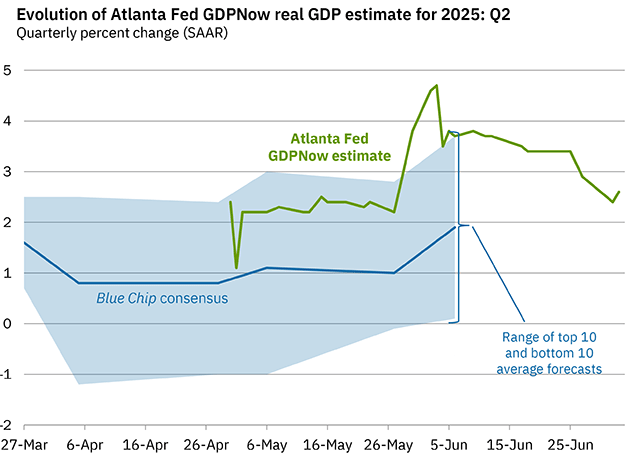

Meanwhile, the economy continues to grow - for now. The Atlanta Fed’s GDPNow model forecasts 2.6% Q2 growth, supported in part by a drop in imports, which mechanically boosts GDP. A similar rebound in H2 looks plausible, but the ongoing softness in labor and consumer data is a growing risk to that outlook.

Fiscal policy is also in focus. The “One Big Beautiful Bill” passed on Friday should help support growth in 2025–2026 through wider deficits, though markets may have already priced in much of that stimulus.

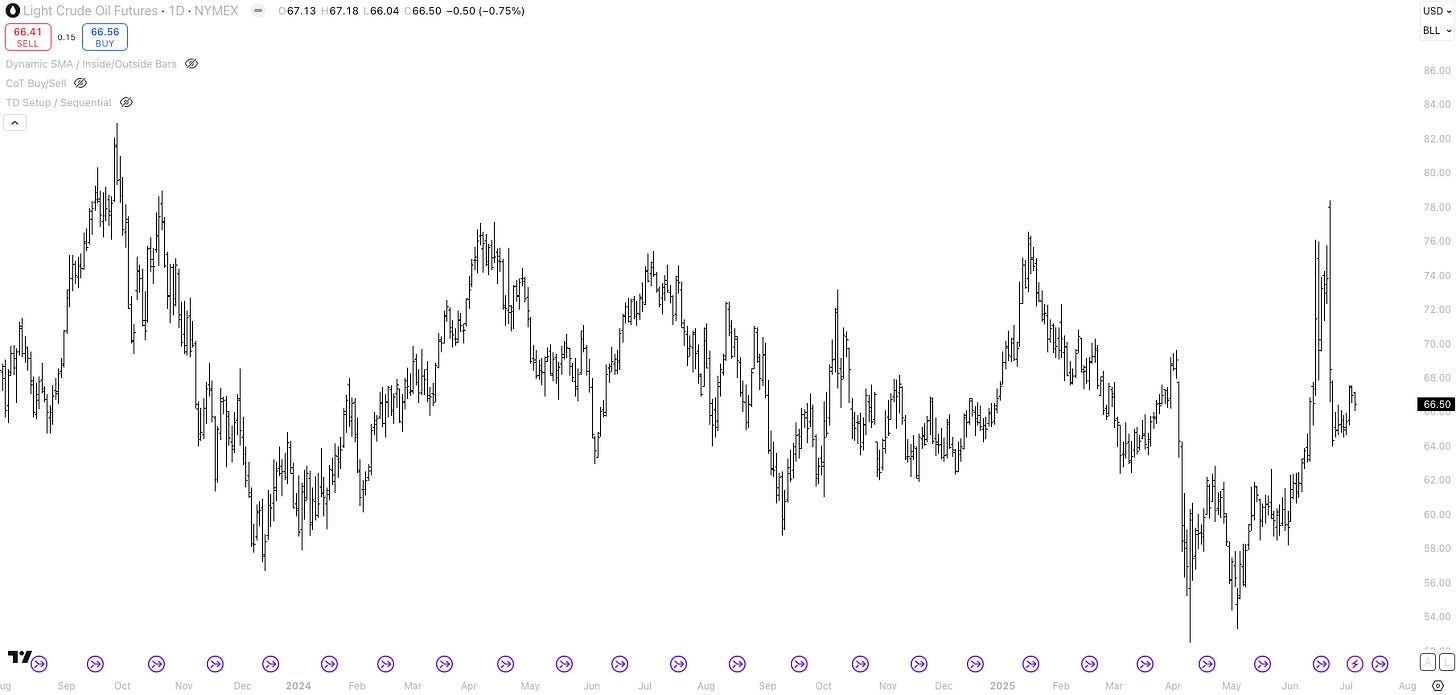

One final tailwind: rising oil output. OPEC+ is increasing production by 550k bpd, which exceeded expectations and could keep downward pressure on energy prices - helping soften inflation and support consumer spending.

3. Risk Assets Rundown: SOFR Curve, Equity Positioning, and Stablecoins

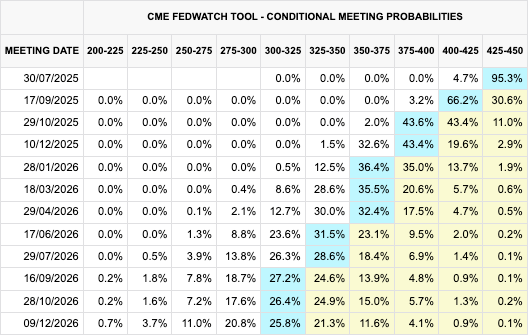

Let’s start with the front-end. Two key questions on my mind when looking at the SOFR curve:

Why is the market pricing multiple cuts under Powell - but none after?

Is terminal rate pricing too low… or too high?

On X this week, I summed up a simple thesis: Trump is scary, and no one on the Fed wants to be called “stupid” in public. But if you’re sitting on the FOMC, is that the legacy you want - caving to political pressure and risking an inflation resurgence?

In reality, Fed officials will likely try to walk a tightrope:

Don’t provoke Trump

Appear in control of the Fed

Avoid letting inflation re-accelerate to 3–5%

With Trump increasing pressure, we’ll likely see a few cuts in the coming months. But will the Fed really cut by as much as is currently priced in - especially if tariffs spark a re-acceleration in inflation?

After Friday’s jobs report, the front-end sold off. Markets now price 2 cuts in 2025 and 3 in 2026.

But let’s be clear: Core PCE is still running at 2.7%, and the U.S. dollar is down 11% YTD, implying a major easing of financial conditions. If tariffs are reintroduced, inflation could easily re-accelerate from here.

If that happens, 125bps of cuts over 18 months becomes a stretch. Yes, the ECB managed to cut by 200bps between May 2024 and June 2025 - but Eurozone inflation was at 2.6% (now: 2.0%) and growth much weaker. The U.S. macro backdrop is fundamentally stronger.

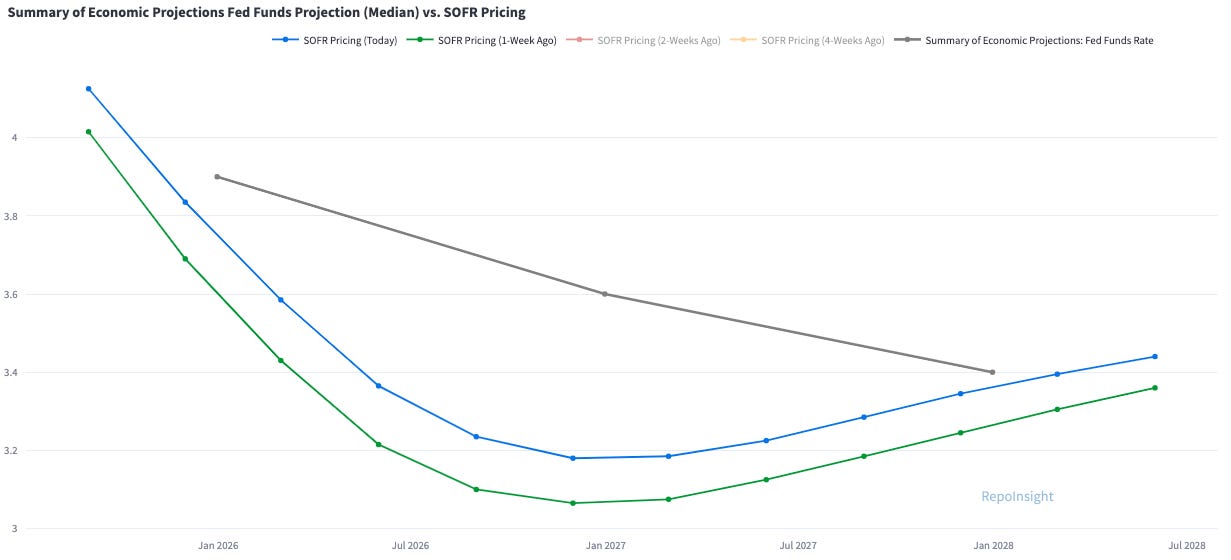

If growth surprises to the upside in H2 (thanks to easier FCIs), short-term rates (STIR) could reprice higher. For example, SOFR June 2026 is pricing in 4 of 6 total cuts during Powell’s remaining term (3.36%). If Powell simply stays on hold for a bit longer, those contracts need to reprice lower.

On the other hand, SOFR December 2028 still implies a terminal rate of 3.53%, well above the Fed’s long-run estimate of 3.0%. That’s a potential disconnect.

Even after the SOFR curve selling off last week (blue = today, green = one week ago), the trade could be to sell June 2026, and buy December 2028.

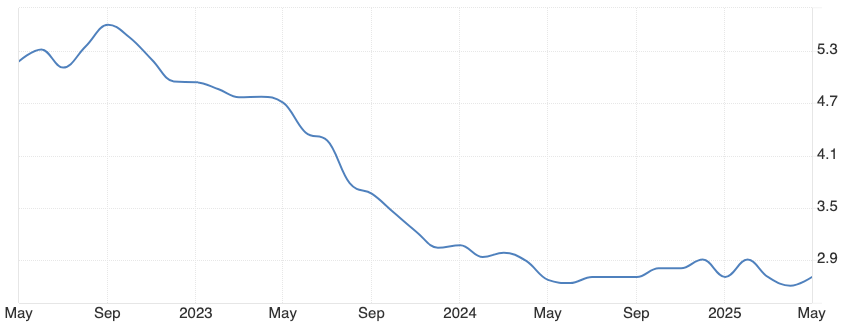

The below chart shows the spread (currently -16.5bps) of buying SOFR December 2028 and selling SOFR June 2026.

The main risk to this trade is Trump. If Trump pressures Powell into cutting rates aggressively, then we could see 125bps of cuts materialise within 18 months. That is what makes this trade difficult - we have to assign subjective probabilities to this outcome.

On 10Y–30Y Yields: I don’t have a strong conviction here. With inflation and growth likely re-accelerating in H2, you’d need a convincing slowdown in consumer spending to be bullish duration. That said, term premium and real yields remain elevated, so if we do get a disinflationary downturn, there’s asymmetric upside.

US 10-year yields remain in a trading range - I don’t feel like I have any edge here.

Let’s focus on equities. Equities have several tailwinds, including:

1) Impending interest rate cuts

2) A weaker USD, which contributes to easing FCIs

3) Continued strength in the AI boom

4) Positioning that is not yet stretched

Overall, I remain optimistic about equities over the next 12 months. However, in the near term, a pullback is possible - especially if Trump jacks up tariffs again (July 9th!). If that pullback materialises and macro sentiment turns bearish (again), with positioning data reflecting that shift, it could present a good buying opportunity.

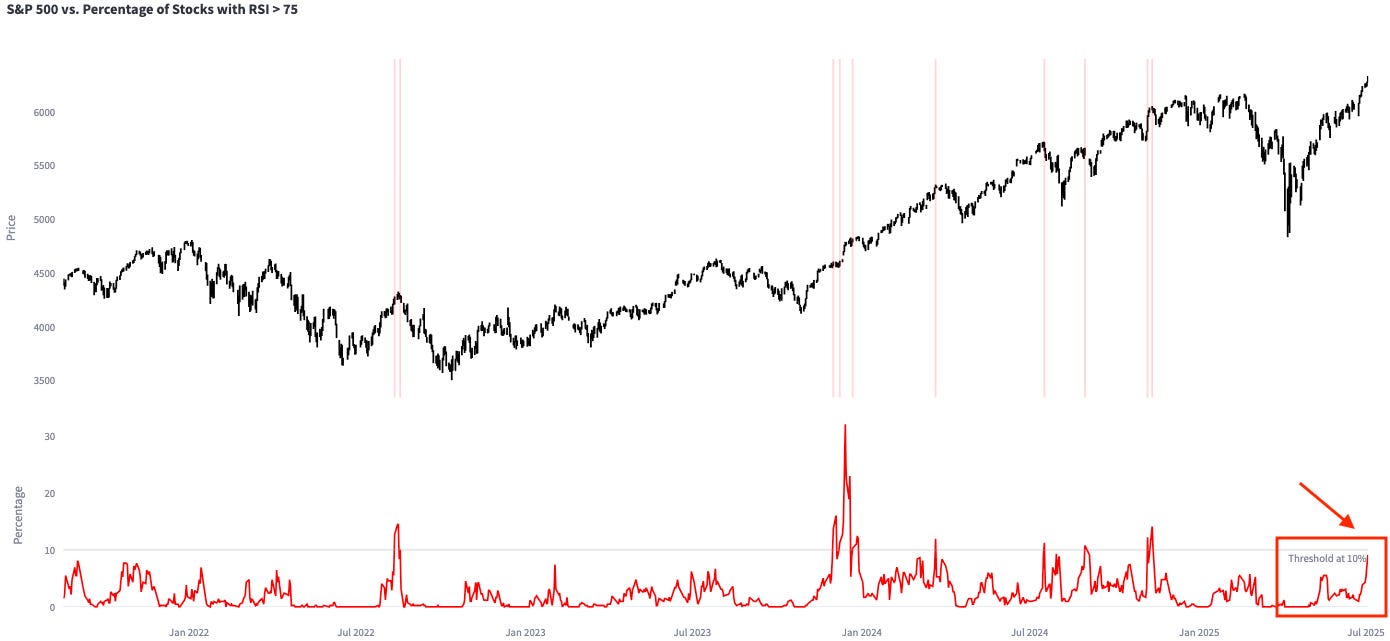

In the short-term, there are warnings signs. One development that is worrying me is the increasing number of S&P 500 stocks with RSIs above 75.

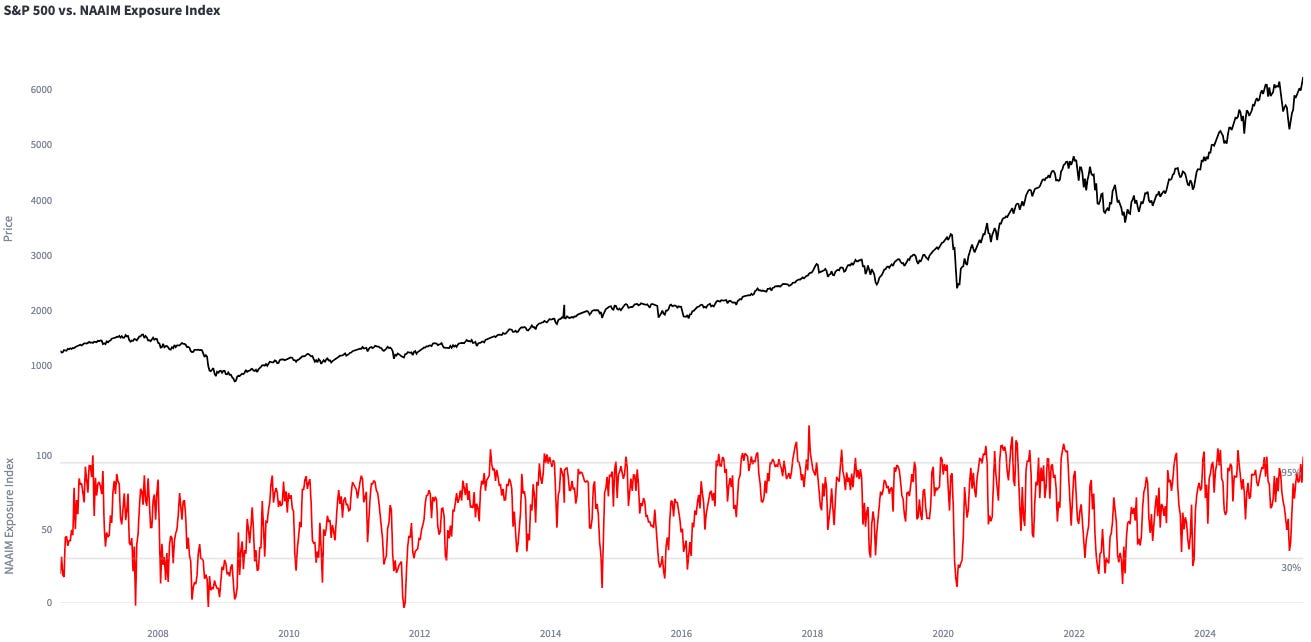

The NAAIM Exposure index printed the highest it has been in months too.

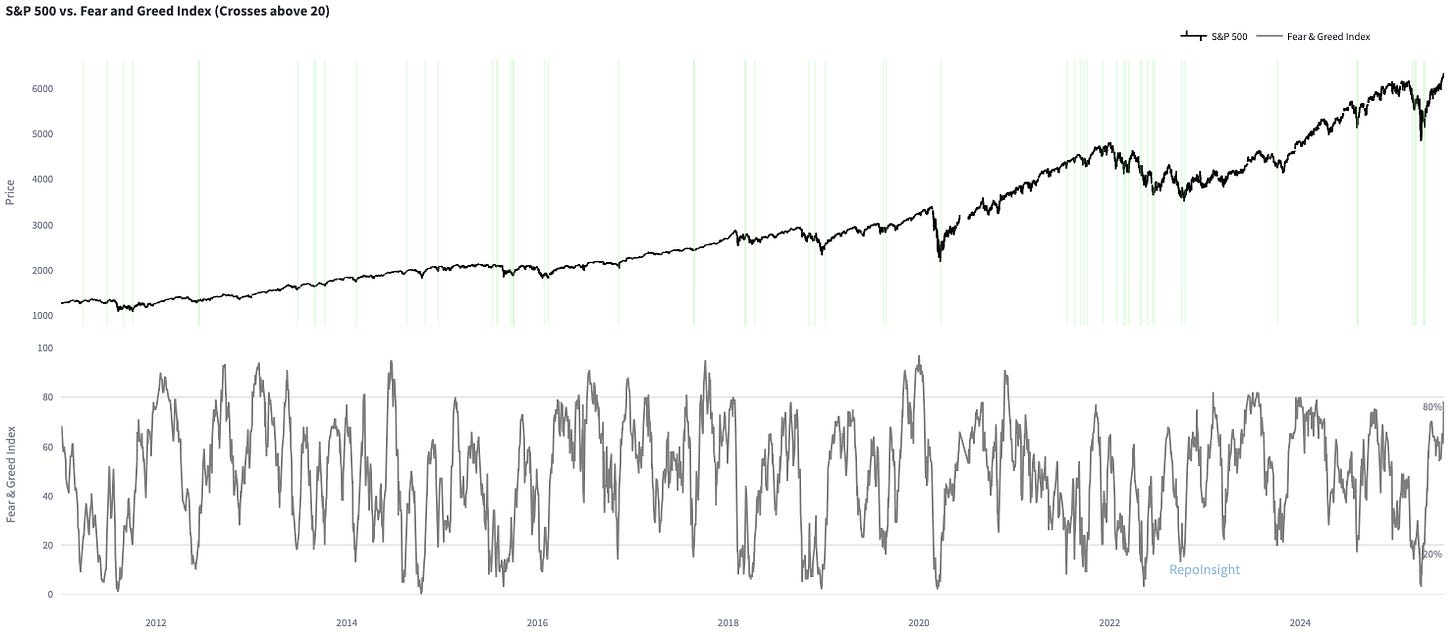

The Fear & Greed index is starting to look quite elevated.

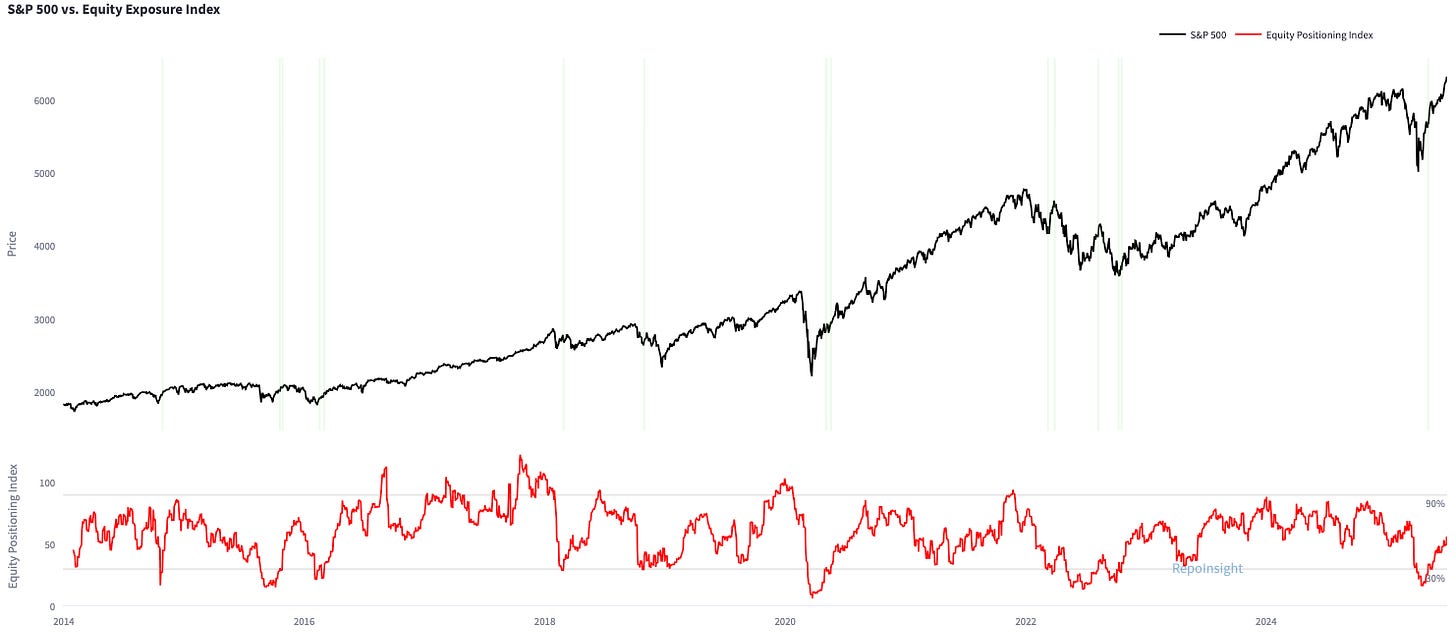

But zoom out, and my Equity Positioning Index - which aggregates futures positioning in equity indices, NAAIM, and vol-targeting fund allocations - still suggests positioning has room to expand. This stat support the bullish outlook over a 12-month time horizon.

Tom Lee noted in this interview on YouTube that 65% of all equity fund managers voted for Biden, i.e., are Democrats, whereas the majority of fixed income managers voted Republican. I think that could partially explain why institutional equity investors remain underinvested post Liberation Day crash.

Many survey shows that Democrats expect higher inflation and lower growth than Republicans. So was the majority of equity fund managers too cautious in April? And one more thing: isn’t it funny how markets are messing with both groups? Republican FI managers that expect yields to blow out also are not getting what they want.

If Trump reinstates tariffs on most countries, markets could sell off. I doubt it would match the magnitude of the April decline, but it could still trigger a 5% correction. I am still long S&P500 futures. I have not yet decided whether I will close them out before July 9th.

Two quick comments on the US dollar and precious metals. Positioning in the US dollar continues to be short. But positioning can get more extreme - it is not a timing instrument. After Friday’s NFP report, the US dollar traded weak. I remain patient and have not yet opened a long US dollar position.

I also have not been active in precious metals, e.g., silver or platinum. I continue to monitor positioning data and price action. Ideally, positioning becomes more crowded long, and then we see weaker price action, e.g., the US dollar selling off but metals sell off in lockstep.

With the S&P500 trading higher last week, the trading account is up 8% year-to-date.

I typically do not talk about crypto, but I wanted to share one thought on Ethereum. The U.S. government wants more foreign demand for Treasuries. Stablecoins are one way to do that, since ~80% of usage is outside the United States.

Private firms are also incentivised to launch stablecoins because holders don’t receive interest - meaning issuing stablecoins is a high-margin business model.

Most stablecoins still run on Ethereum, so if regulation is passed and usage increases, Ethereum might benefit via higher on-chain activity and gas fees. Was the latest underperformance just a massive shakeout?

4. New Ideas

I’m currently working on several side projects behind the scenes. I’ve been backtesting quantitative models for alpha generation and experimenting with different approaches to beta portfolio construction. The broader vision is to “build a multi-strat” - obviously on a much smaller scale, but the concept applies.

The goal is to construct a well-diversified portfolio that passively harvests beta - i.e., risk premia over cash - and overlay systematic and discretionary uncorrelated alpha strategies to improve risk-adjusted returns. I’ll keep you posted as things develop.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!