The US Dollar Comeback

Are economists wrong about the impact of tariffs on the US economy? Will inflation re-accelerate? And is it time for a US dollar comeback?

Hi everyone,

This article is structured in three parts: first, I discuss tariffs and inflation, then I discuss my views on interest rates and FX, and finally, I share how I currently navigate markets in my trading account.

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

A Tug of War: Recession vs. Moderate Growth

Macro strategists are currently split into two camps. One believes the U.S. economy will stabilize, while the other - which seems to be the consensus - expects a recession. That view assumes earnings expectations and equity valuations are too optimistic.

This sentiment reminds me of 2022, when nearly every economist predicted a recession. It never came - and equities rallied for the next two years. For context, this Bloomberg headline was published in June 2022:

We’ve never seen the U.S. raise tariffs to roughly 15% across the board in a globalized, hyper-financialized economy. I'm not convinced economists have an edge in forecasting the effects of such a shift.

Take GDP multipliers, for example - which multiplier do you use to estimate by how much tariffs will impact GDP? In 2020–2021, supply chains adjusted far faster than expected. If that happens again, many traditional models could be wrong.

That said, if the models are right, Bob Elliott’s estimate might be a useful guide:

„It increasingly looks like the best case scenario on tariffs will be roughly the 60% China and 10% all others, amounting to a roughly 15% hike in overall tariff rates. (…) Even if the tariff rates settle at those levels they would likely create a substantial drag on economic conditions, effectively raising taxes on US HH and/or biz amounting to 1.5% of GDP depending on elasticities.“

These downside scenarios - recession, lower earnings, and falling equities - are well known. But markets have continued to rally, and long-end yields have stabilized at elevated levels, suggesting the market is pricing in stronger growth. Maybe investors are already looking through the tariff shock.

The worst (tariff) news are likely behind us. Negotiations have started and tariff rates will fall from here. In my experience, if the market is doing the opposite of what you expect to happen based on the news, it is typically best not to fight it.

The S&P 500 is not back above its 200-day moving average yet. I am still long the S&P 500, but I would likely get out of the trade if the May 7th low is broken.

Inflation Re-Acceleration: Is it Happening?

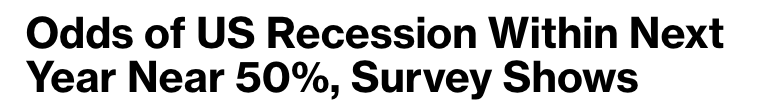

A lot of soft data currently points to a re-acceleration in inflation, with some investors citing the University of Michigan’s 1-year inflation expectations as a key signal.

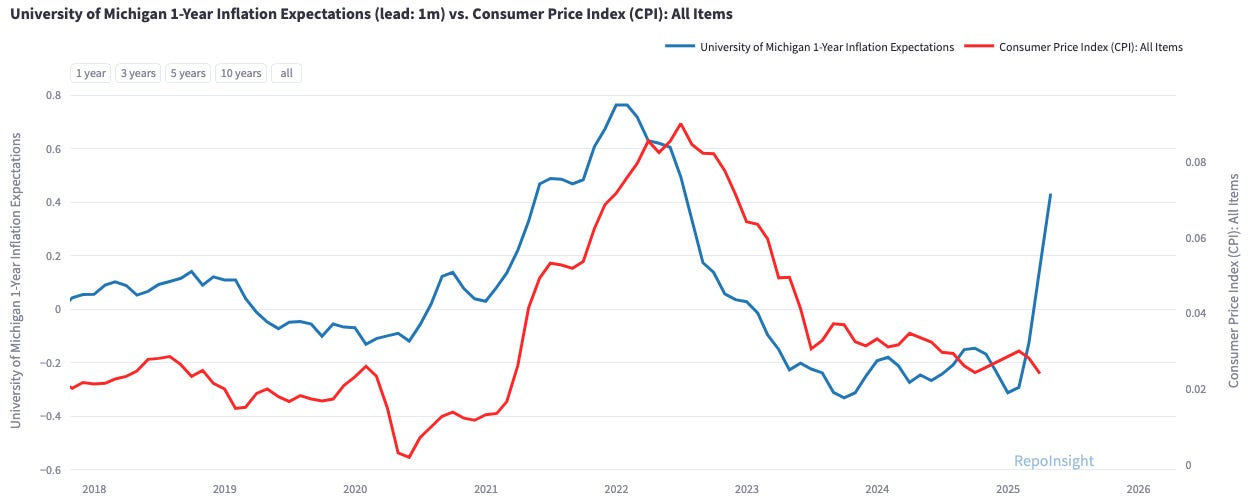

Or Empire State Prices Paid…

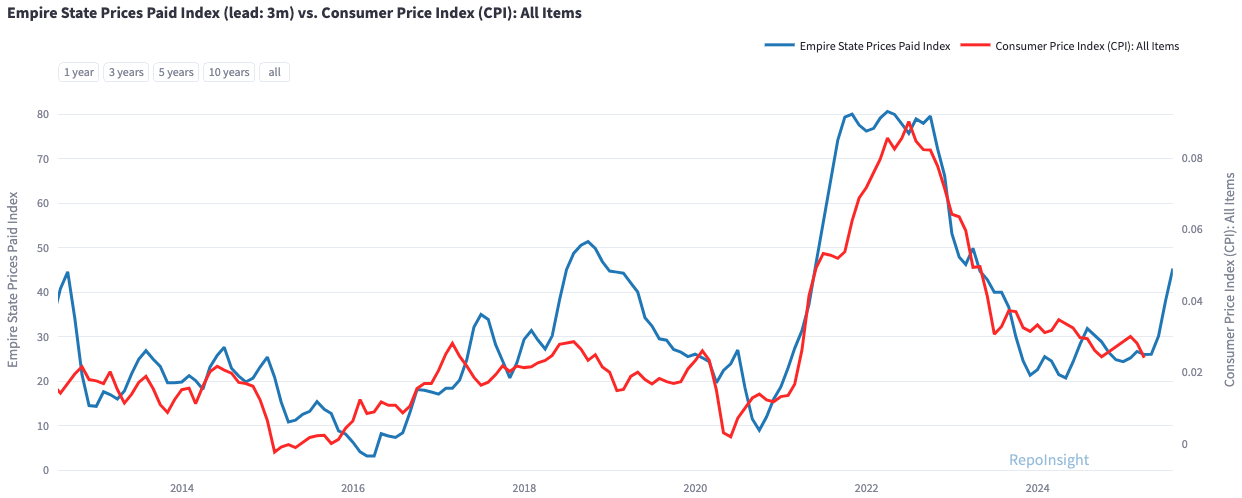

Or increasing delivery times due to supply chain disruptions..

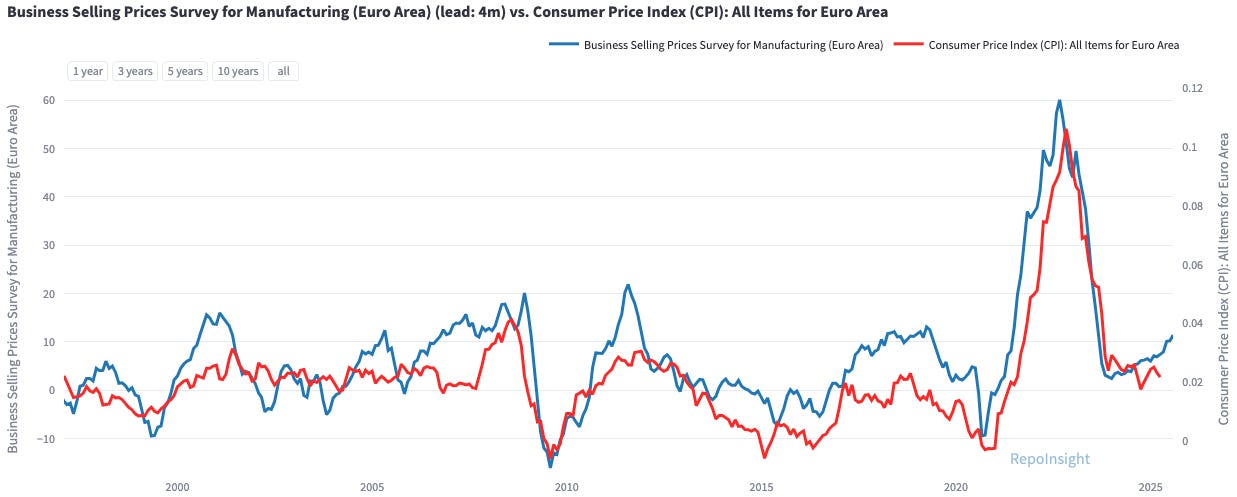

Even in the Euro Area, leading indicators such as business selling price surveys have been rising.

Plenty of charts, but not much signal - at least in my view. I don’t think anyone can reliably forecast inflation three to six months ahead. That’s why my approach is to wait for the data and adapt. Trying to front-run a re-acceleration that never comes can mean six months of losses. Hoping for higher inflation isn’t a strategy.

Interest Rates: Lack of Conviction

I prefer to fade extremes in fixed income. When only zero to one cut is priced in, but a weak data print can suddenly shift expectations to three or four cuts. That is the kind of scenario when I have a view on the short-end. But right now, I have little conviction on rates - we’re stuck in the middle of the range.

Markets are still pricing in three cuts for 2025 - a scenario that could materialize if the economy slows materially once tariffs kick in. That’s why I referred to STIR as “cheap recession insurance” last week. But if growth holds up and inflation stays sticky, we might only see one or two cuts.

The Fed is firmly in “wait and see” mode. Powell made it clear at this week’s FOMC that there’s no case for preemptive cuts - the economy is solid, and inflation remains above target.

As the chart below shows, the 5-year yield is sitting right in the middle of its recent range. Without a strong macro view, it’s hard to take a high-conviction position here.

FX: Is the Dollar Poised for a Comeback?

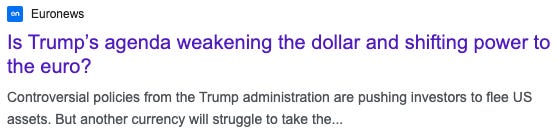

I’d argue the consensus view right now is that the US dollar will continue to weaken. The prevailing narrative is that Asian and European investors will reallocate away from the US, and that Chinese investors might sell Treasuries. Below are a few headlines from the past two weeks that reflect this sentiment:

All these headlines are surfacing while positioning is increasingly skewed short the US dollar. Two weeks ago, I moved 50% of the cash in my (EUR-denominated) trading account into USD. So far, that trade is working.

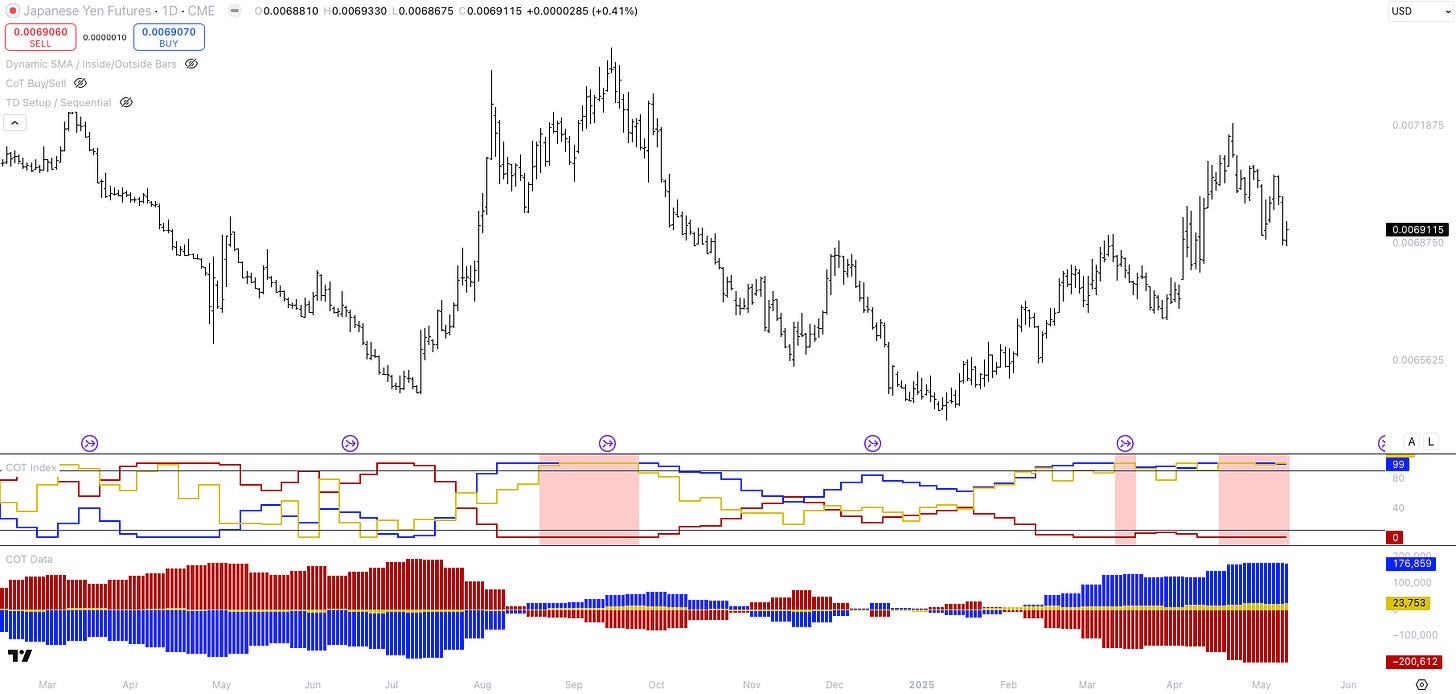

The Japanese Yen has also been weakening. Positioning is crowded long, and sentiment is extremely bearish on the US dollar - not an ideal setup to bet on JPY strength, in my view.

Last week, the S&P 500 declined 0.5%, but my US dollar long offset the move slightly. I'm still up 4.7% year-to-date - essentially flat on the week. My plan is to stay long the S&P 500 as long as the May 7th low holds, and I remain long USD for now.

I do not plan to open any other trades right now, but I am monitoring a few markets right now:

Long USD: I am monitoring short CAD, short CHF, short EUR and short JPY as possible currencies to short against the US dollar.

Long Oil: If we get further news from OPEC+ that oil output will be increased and we see speculators getting more short in the COT data, but the oil price stops going down, I could get interested in this market.

Long SOL: Bitcoin has been trading very well, and I think Solana could follow. Solana could be one of the “fastest horses” out there to bet on a risk-on environment.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Appreciate your thoughts, keep going 🍷