The Tariff Race to 10%, Fiscal Expansion and Deregulation

The US consumer is in good condition. Tariffs are settling around 10-15%. Deregulation, fiscal expansion and tax cuts are coming. Equities and the US dollar continue to trade well.

Hi everyone,

This article is structured in three parts: first, I discuss my view on the US economy, then I discuss my views on interest rates, equities, and the US dollar, and finally, I share how I navigate markets in my trading account.

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

Economy: The Race to 10%

Economic and stock market sentiment has improved dramatically last week - and for good reasons. The United States’ GDP is still growing at >2% per year. The US consumer is in good condition with record-low debt levels and low interest expenses as a percentage of disposable income due to low interest rates locked in on existing 30y mortgages (avg.: 4%). At the same time, 7.2tn USD in money market fund balances pay on average 4.2% in interest income.

Source: NY Times

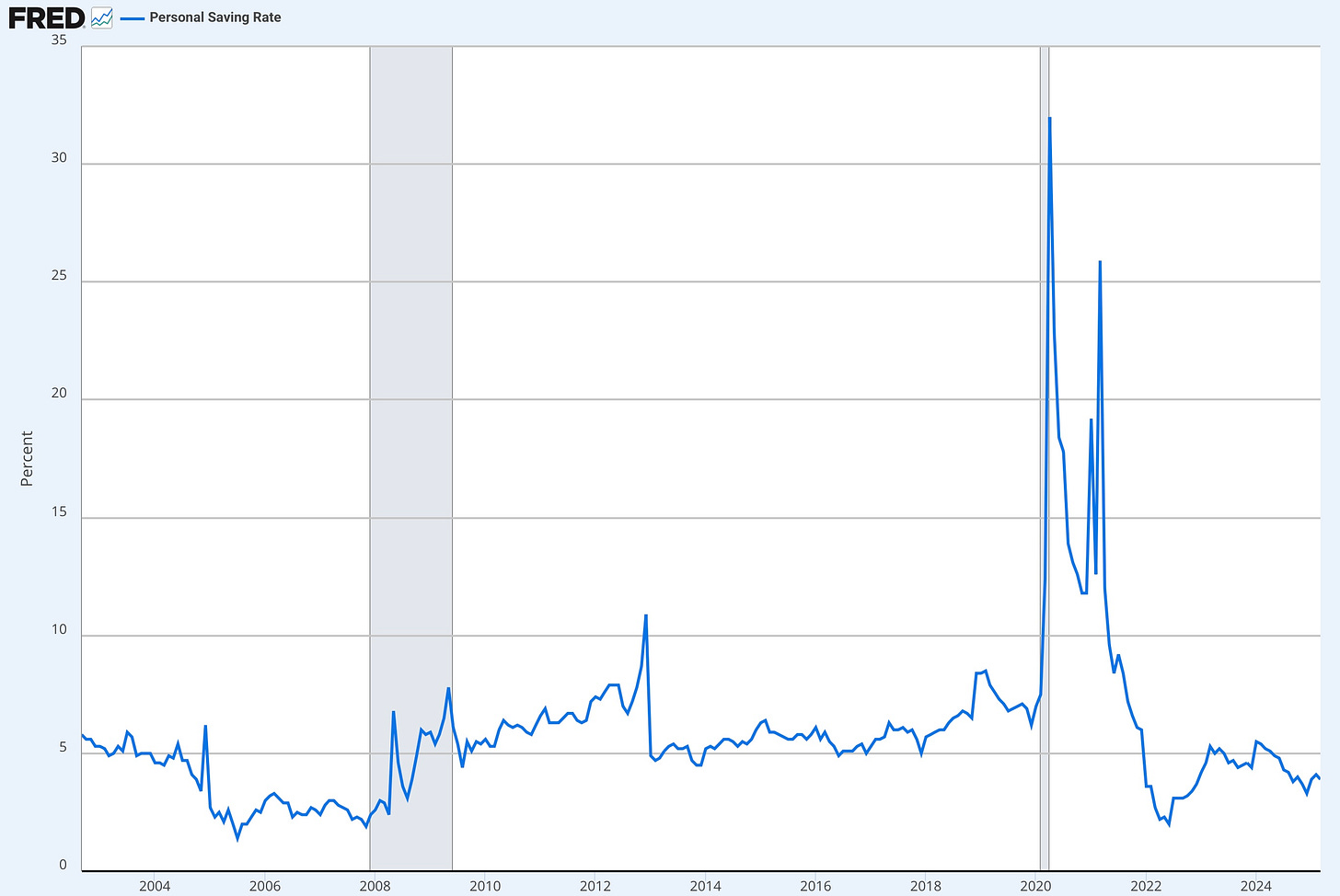

Wages continue to grow - though slower at 2.5% per year - and the S&P500 is less than 5% off it’s all-time high. Households feel rich, which is also reflected in a below pre-Covid average savings rate of 3.9%.

On Monday, the Trump administration announced the United States is going to cut tariffs on Chinese goods to 30% from 145% for 90 days. China will lower tariffs on US goods to 10% from 125% for 90 days. That means US tariffs on Chinese goods imports return to where Trump set them on Liberation Day.

The effective tax rate the United States apply to goods imports stands at 12.6% now. Bob Elliott estimates this is equivalent to a 50bps hit to US corporate profits IF tariffs would be fully absorbed by Us companies (which is unlikely). In other words, the hit to earnings is much smaller than expected just a few weeks ago.

Source: X

Since the announcement on Monday, ocean freight bookings from China to the United States are up 275% week-over-week (source: X). Hapag-Lloyd also reported it sees a 50% surge in container bookings from China to the United States. US-China trade has largely normalized.

Many investors still seem worried about tariffs moving back up when the 90-day period is over, but what if the opposite happens and tariffs and non-tariff trade barriers - mainly from other countries - are moving lower from here? Trump said that India offered to drop all tariffs on the United States to 0% this week.

To me it seems increasingly likely that reciprocal tariffs are going to end in a „race to 10%“. Instead of a „race to 0%“, the average tariff rate the US imposes on goods imports will probably be around 10%. That is good news - I think the world economy can cope with an average effective US tariff rate on goods imports of 10%.

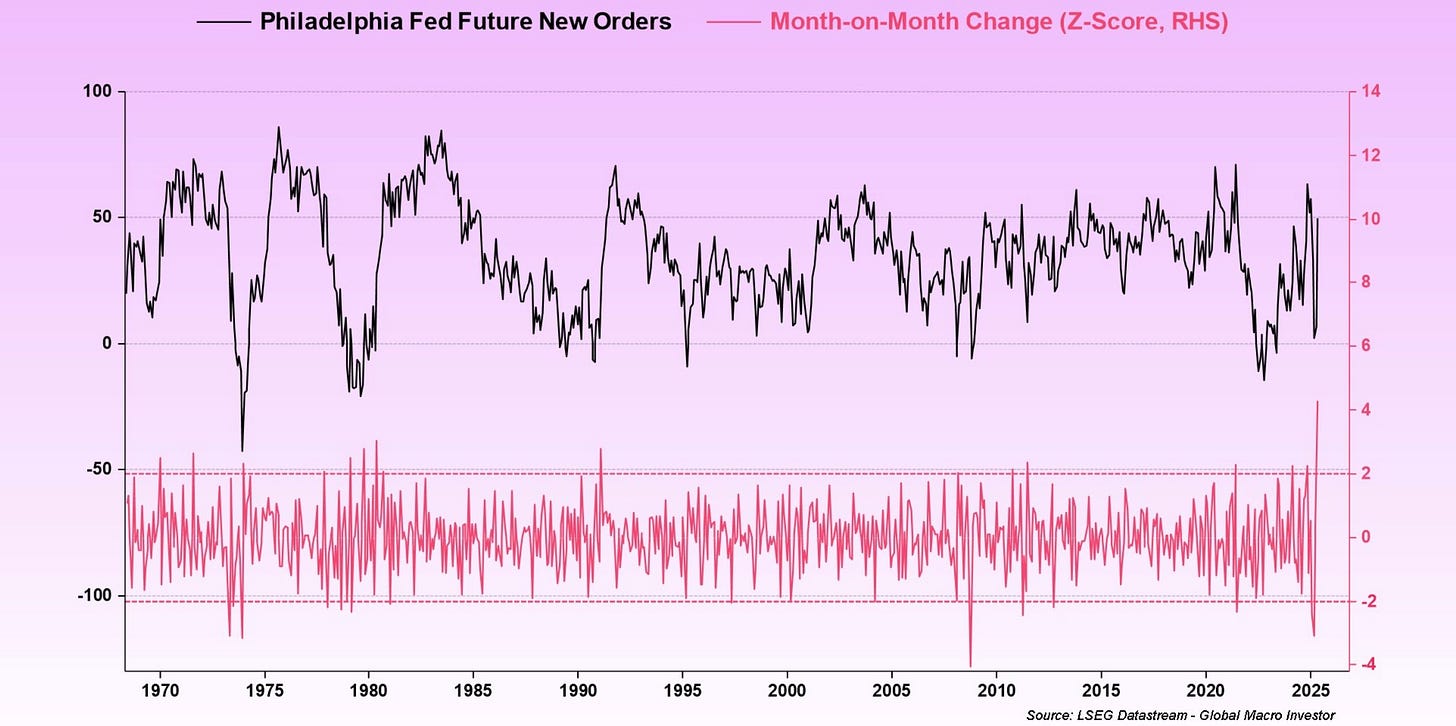

Other factors, such as Philly Fed New Orders, display strength too. Last week, we recorded the largest ever month-over-month increase. Are Trump‘s policies starting to work?

Source: X

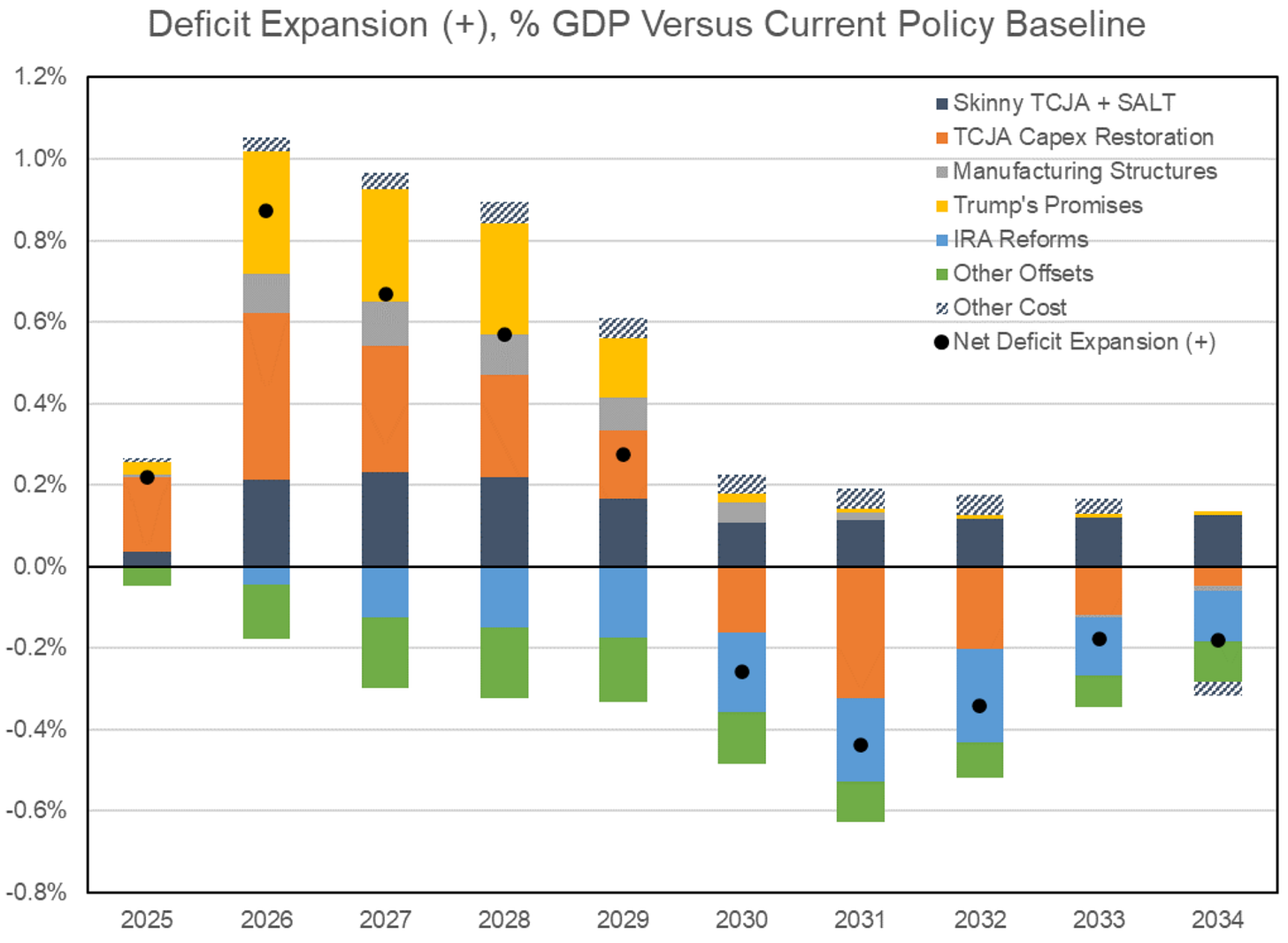

Tariffs are only one part of the story. Last week‘s news also pointed towards higher fiscal deficits. The rolling US deficit remains at ~2tn USD - DOGE and other initiatives had little to no impact. The new Ways & Means bill draft proposes a 1.5tn USD deficit expansion on top of of the TCJA extension. Relative to expectations, i.e., the latest policy baseline, this implies an additional deficit expansion of 0.2% of GDP in 2025 and 0.87% (!) of GDP in 2026.

Source: X

Tariffs were growth-negative, but deregulation, tax cuts and fiscal deficits are the *new* story and growth-positive. We are talking about tax breaks on overtime through 2028 or tax breaks on tips. And do not forget that retail investors have bought the dip in size - those buys are in-the-money now. The wealth effect meets deregulation and tax breaks.

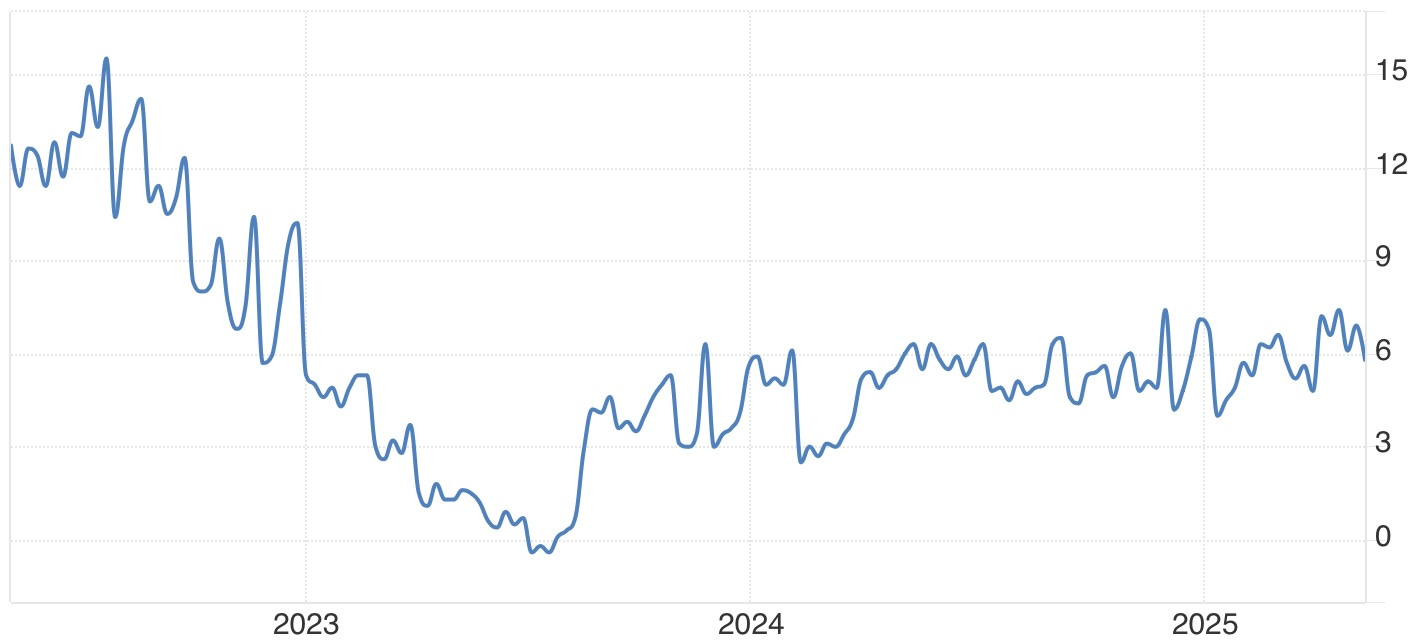

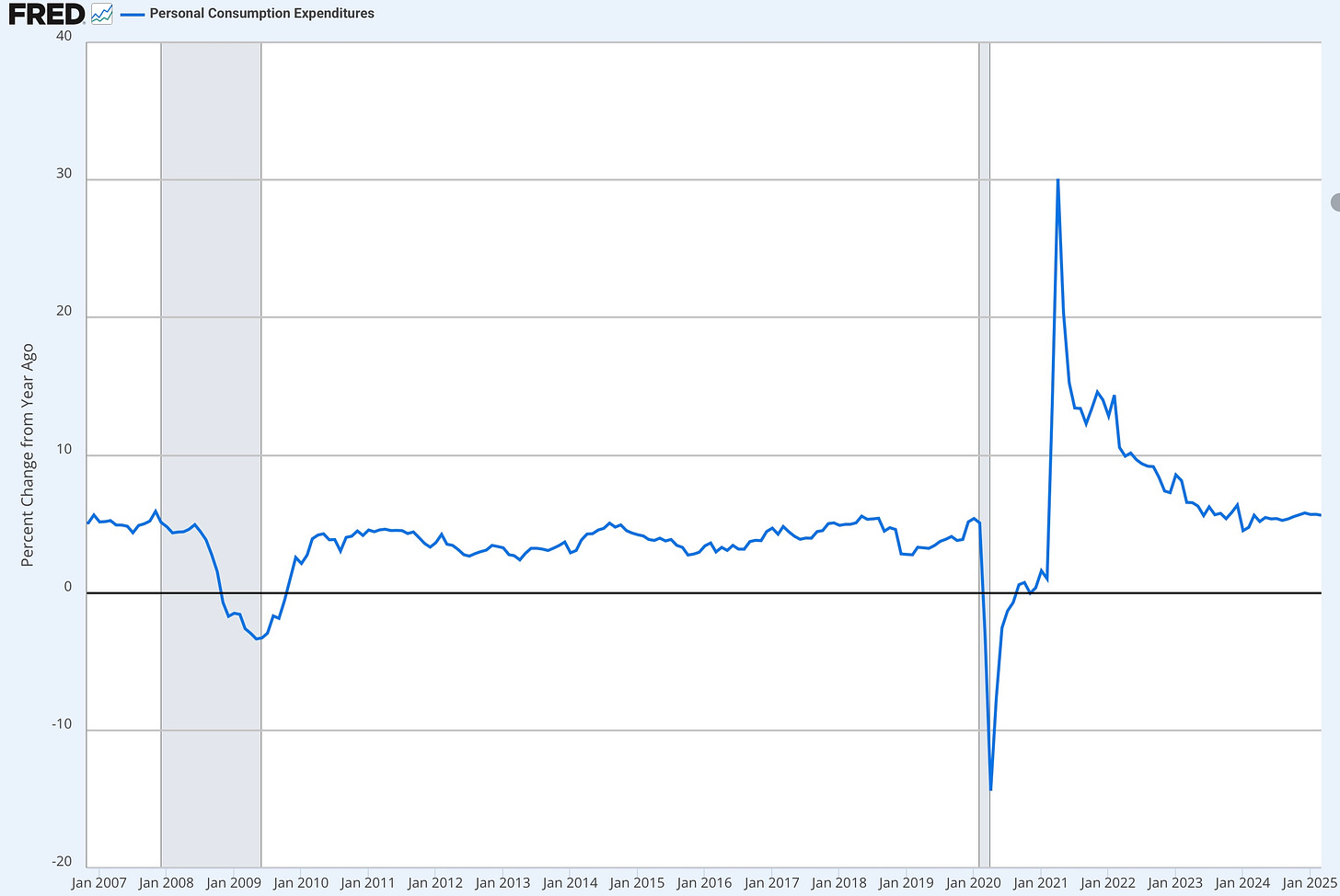

Judging by consumer confidence surveys, the US consumer was clearly worried about tariffs. But the consumption data does not reflect any weakness. Retail sales printed largely in line with expectations and the March data was revised upward to 5.2% YoY growth. Redbook sales are running at 5.8% YoY too.

Source: Trading Economics

Personal consumption expenditures are stable and growing at 5.6% YoY.

Source: FRED

Across the ocean - in Europe - growth has come in slightly stronger too. The latest UK GDP print came in at 0.7% QoQ, which was much stronger than expectations. GDP growth in the Eurozone came in slightly weaker at 0.3% QoQ - but still in line with expectations. With much larger German fiscal stimulus and joint European debt issuance and defense spending, Eurozone GDP growth could accelerate from here.

Bond yields have risen last week - mainly due to higher growth expectations. But last month‘s inflation data surprised to the downside. Headline inflation came in at 2.3% vs. 2.4% expected and core inflation printed in line with expectations at 2.8%. Producer prices rose by 2.4%, which was also lower than expectations of 2.5%.

Interestingly, Powell mentioned this week that the Federal Reserve might reconsider average inflation targeting, i.e., a 2% *average* inflation target over time that allows for periods of higher and lower inflation. Powell acknowledged that we might enter a period of frequent supply shocks, which means it is even more critical that inflation expectations remain anchored. A strict 2% target might be better suited than average inflation targeting to achieve such outcome.

POWELL: MAY BE ENTERING PERIOD OF MORE FREQUENT SUPPLY SHOCKS

POWELL: APPROPRIATE TO RECONSIDER AVERAGE INFLATION TARGETING

In summary, the US administration is unlikely to cut expenditures, in fact, it might run even higher fiscal deficits. The effective tariff rate on goods imports is increasingly likely to settle somewhere around 10-15%. Tax cuts and deregulation are coming and labor supply will remain constraint. That is a recipe for stronger US growth, but also inflationary pressures.

Fixed Income: When Growth, Inflation and Term Premia Reprice Higher

I am still on the sidelines in fixed income. If bonds sell off aggressively from here as growth and inflation expectations reprice higher (core CPI is still 80bps above target), we could get the opportunity to fade the move. Last week, US 10y yields increased by 6bps to 4.45 %. They are now trading in the middle of their range and without a strong macroeconomic view, I do not think the risk-to-reward to go either long or short is particularly attractive.

Despite the news about fiscal deficit expansion and Moody’s downgrading the United States’ debt, US 30y yields have found support at 5%. Even if you are bearish the long-end, you might have to trade around this level or at least expect some resistance.

In my opinion, for the inflation fire to reignite and headline CPI to re-accelerate, there needs to be a supply shock. Without a supply shock, I do not see CPI accelerate meaningfully. Supply shocks are unpredictable, which is why I do not trade based on the expectation that a supply shock will drive inflation higher.

If bonds - and specifically the long end - continue to sell off due to growth, inflation and term premia repricing, we could get an opportunity to go long at higher yield levels and bet on the pendulum swinging the other way if no supply shock occurs. That would be my ideal scenario to go long the long-end, either via futures, call options or ETFs.

Focusing on the short-end, if most cuts for the next six months get priced out, we could get an opportunity to go long SOFR futures. The Federal Reserve’s next move is most likely to be a cut - not a hike. If the short-end prices out almost all cuts, only one or two bad economic data prints could make the pendulum swing the other way. In my opinion, in these kinds of scenarios the risk-to-reward to go long SOFR futures is the greatest.

Equities: Nothing Changes Sentiment Like Price

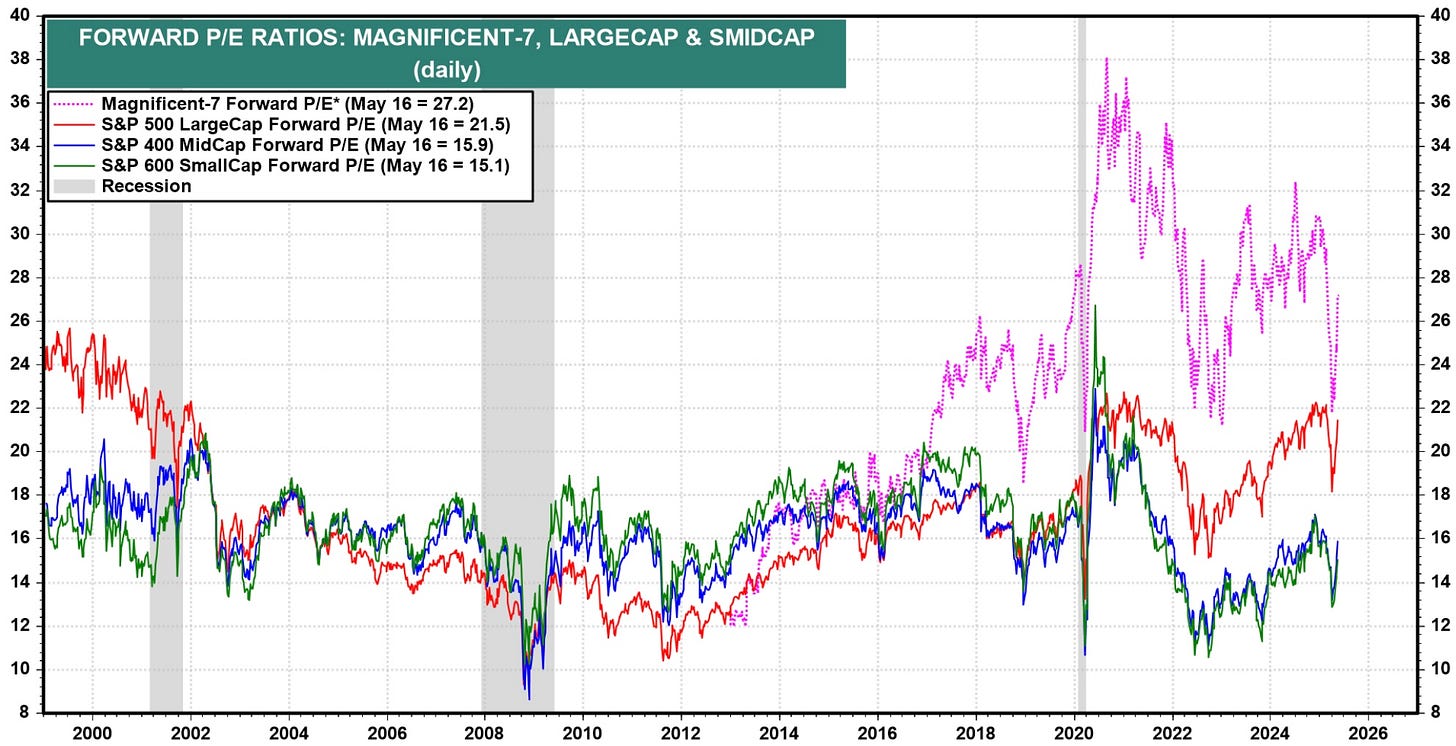

I laid out my bullish case for equities a few weeks ago in this article. I highlighted that valuations are not cheap, but have come down quite a bit (especially for the Mag-7). I also pointed out that since earnings grow over time, the stock market experiences upward drift. For equities to sell off for longer periods, we need a constant flow of growth-negative news, e.g., a deterioration in labor market data, etc.

With last week‘s developments in mind, the outlook flipped by 180 degrees. Instead of growth-negative news, we could get more growth-positive news. So far, equities have traded well and shook off negative headlines. Last week felt like every time equities sold off, short sellers stepped in and pushed the market lower only to get stopped out at the end of the day when equities rallied. That is bullish price action.

Since 1980, S&P500 EPS growth was ~6%/year. In the last decade, S&P500 EPS growth was ~10%/year. I don’t see why S&P EPS cannot continue to grow by 6-10%/year in the future. Multiples are not cheap, but they are also not outrageously expensive. The S&P500 is trading at a forward PE of 20.4x. Mag-7 at 25x forward earnings are not expensive compared to 2018-today either. Mid and small caps at 14-15x look cheap relative to where they have trade in the past decade.

Source: Yardeni Charts

The market climbs a wall of worry. I am still long the S&P500 in my trading account. Right now, my plan is to hold the position for a few weeks. In my long-term investment account, I sold gold and bought the S&P500 on April 22nd. Since then, the S&P500 is up 12.5% and gold is down 6.8%. I have not reversed positions yet and my gold allocation remains below 5%.

FX: The US Dollar Comeback Is Playing Out

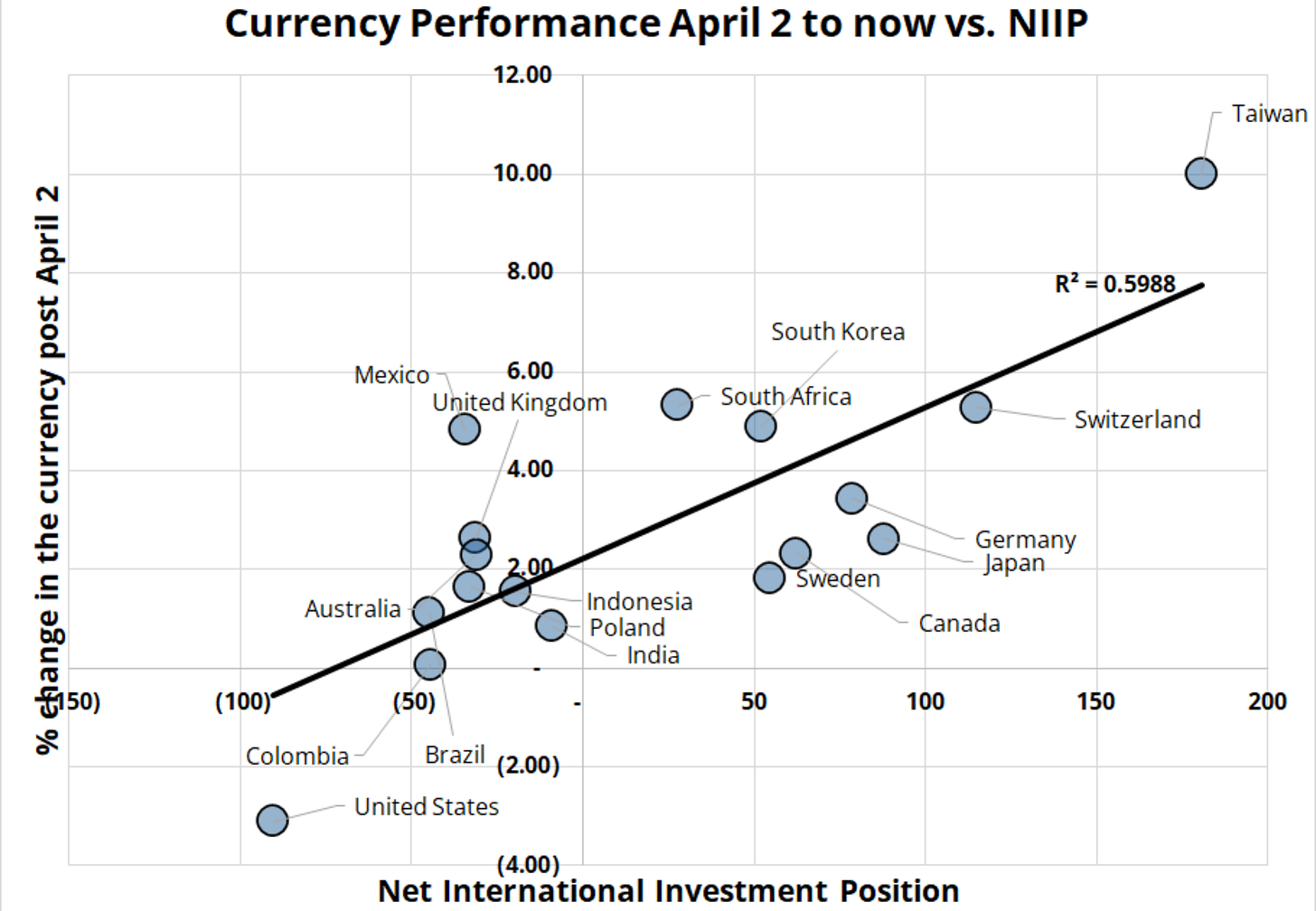

I remain bullish USD, but I took some profit on my short EURUSD position (roughly 1/5 of the position size) on Monday, May12th. I laid out the „US Dollar Comeback“ thesis last weekend (see here). It is mainly driven by 1) bearish US dollar sentiment and positioning, 2) tariff normalization and 3) investors realizing that the United States is still the best place to do business and invest.

The below chart from Brent Donnelly, which compares FX performance to net international investment positions (NIIP), is interesting. In my opinion, it supports that FX performance was (partially) driven by worries about capital returning to their home markets.

NIIP is the difference between the external financial assets and liabilities of a country. In the case of the United States, it tells you there is a lot of foreign capital invested in the US assets, which could leave and lead to selling pressure on the US dollar.

Source: X

With Trump pulling back on tariffs, confidence in the United States is returning. The S&P500 is trading close to all-time highs, but this dynamic is not reflected in currency markets to the same extent.

My trading account is up almost 8% YTD. I was long S&P500 and USD going into the announcement on Monday. For the time being, I am not looking to add new trades. Some thoughts:

Long USD: I think it is still worth looking at long US dollar positions, particularly vs. the Swiss Franc (CHF) or the Japanese Yen (JPY). Positioning is getting crowded long JPY/CHF and both currencies have been trading weaker.

Long Gold: If gold continues to sell off and sentiment becomes more bearish, I might try go long the precious metal, but I do not think the time has come yet.

Fixed Income: I laid out my scenario to get long either the long-end or the short-end.

I have been on the move this weekend and wrote this article entirely on my iPhone and iPad. Next week, I’ll be back at my desk with access to my dashboard and models, and I’m looking forward to sharing a more detailed update.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Thanks for the summary.