The "T" in Trump stands for trade war

The impact of tariffs on equities, bonds and currencies.

What a week in financial markets. FOMC on Wednesday, core PCE on Friday and tariffs on Canada, Mexico and China on Saturday. Let’s try to figure out what this means for financial markets.

25% tariffs on Canada and Mexico, and 10% on China

Trump announced a 25% tariff on imports from Mexico and Canada - excluding energy imports from Canada, which will be hit with a 10% tariff - and an additional 10% tariff on goods from China. Canada already retaliated with a 25% tariff on 155bn USD worth of goods from the US.

Trade wars are bad for economic growth. But the US economy is much better equipped to deal with tariffs than the Canadian or Mexican economy. 34% of Canada’s GDP are exports and more than 75% of exports go into the US. Roughly 25% of Mexico’s GDP are exports and more than 80% go into the US.

The US is much more reliant on domestic consumption and will not feel retaliatory tariffs as much. Domestic consumption accounts for 70% of US GDP. Only 17% of US exports go to Canada and 15% of US exports go to Mexico. These statistics demonstrate that a trade war is significantly worse for Canada and Mexico than for the US.

The tariffs are clearly bad for the Canadian dollar, the Mexican peso and the Chinese Yuan. They will also hurt Canadian, Mexican and Chinese stock markets. I would not be surprised if US and European stock markets also react negatively on Monday. Trump signalled to the world that he is willing to announce high, universal tariffs to achieve his goals. This is bad for global economic growth just as earnings expectations and valuations are elevated.

I am not sure how bonds will react. During the first Trump administration, bonds rallied on tariff announcements, but high inflation might have changed that. Brent Donnelly laid out two explanations in his Friday Speedrun:

Tariffs are not inflationary, but similar to a tax that increases the price level once. The negative impact on economic growth outweighs the inflationary impact so that bonds go up on tariff announcements. This was the case during the first Trump administration.

The counterargument is that we live in times of higher inflation. Companies know they can increase prices by >2% and customers still buy their products. During the first Trump administration, the costs of tariffs were likely not passed on to consumers. That could be different now. If the inflationary impact of tariffs is passed on to the consumer, it could be bad for bonds.

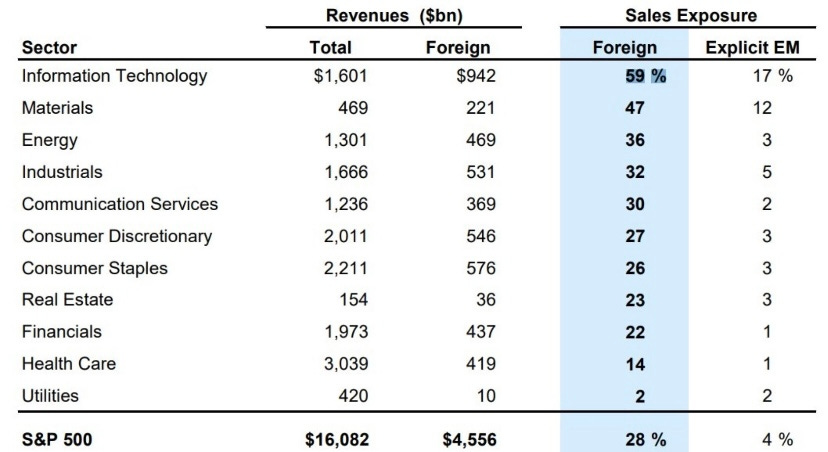

The universal tariff announcements make me cautious on my short US dollar thesis, my long US short-end thesis and my bullish view on US equities. With the trade war ramping up, we might get another deleveraging in financial markets. It is also noteworthy that a large chunk of the tech sector’s sales - 59% - are generated outside the US. If tariffs ramp up not only in Canada, Mexico and China, but also in Europe, will tech sales suffer?

The chart below shows the Nasdaq-100. Friday’s reversal, triggered by the White House’s press release announcing that tariffs will be unveiled on February 1st, gives us an indication of what we might expect on Monday.

FOMC = Non-event

Tariffs are the name of the game now. Trump’s actions will heavily influence what financial markets do. This week’s FOMC was a non-event. Everything J. Pow. said on interest rates and balance sheet runoff was expected and priced in. We did not get any new information. J. Pow. thinks that:

Inflation & employment risks are balanced. Inflation expectations remain well-anchored and the unemployment rate is low.

Financial conditions are meaningfully restrictive as measured by progress towards the Fed’s goals, i.e., inflation is falling and labor market conditions are weakening - as would be expected with restrictive interest rates.

The Fed needs to see further progress on inflation or weakness in the labor market to justify additional cuts. The Fed’s current policy is setup for further progress, but the Fed does not need to be in a hurry to adjust its policy stance.

The Fed thinks reserves in the system are abundant and no changes to the current QT policy is needed.

Again, nothing new.

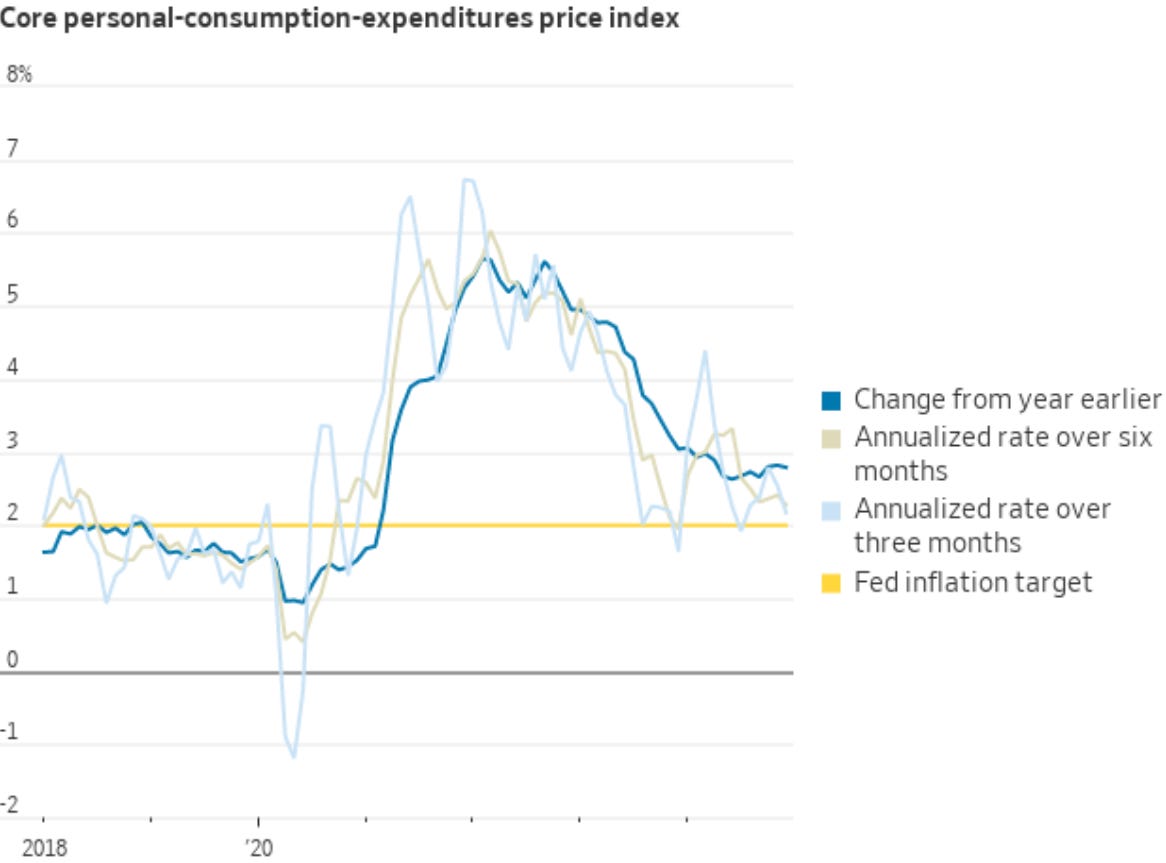

Weaker core PCE data - realistic path towards to 2%?

Friday’s core PCE came in slightly lower than expected. Both, 3-month and 6-month annualised core PCE are now running lower than the 12-month measure. 6-month annualised core PCE is at 2.3% and 3-month annualised core PCE came in at 2.2%.

Source: Nick Timiraos

With shelter inflation also on a downwards trajectory, we could get a scenario in which core PCE goes back to 2%. If that was going to happen, will the Federal Reserve cut only once in 2025? Don’t forget, Trump also wants to see lower interest rates.

Tariffs introduce uncertainty and volatility. In the short-term, they could result in job losses. The Fed’s dovish reaction function and core PCE running closer to 2% in combination with bond markets pricing 1.5 interest rate cut in 2025 make me cautiously bullish the US short-end.

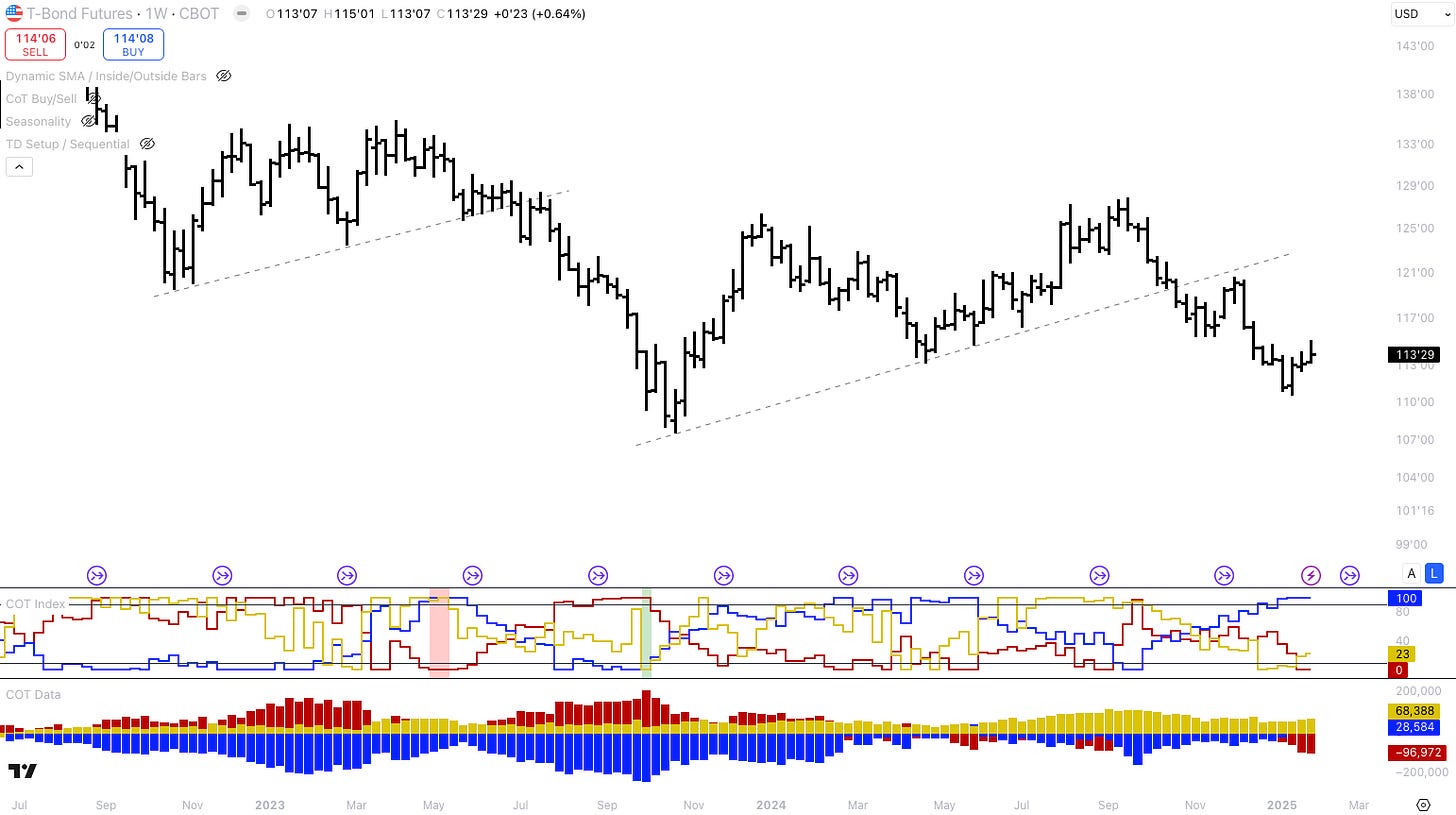

The next Quarterly Refunding Announcement (QRA), in which the US Treasury publishes coupon auction sizes, will be released tomorrow, February 3rd. This could be an important data point for the long-end. If Bessent decides to increases coupon auction sizes and term out the debt, the long-end could react negatively.

It is also worth noting that the CoT data shows that small and large speculators are long(er) the long-end now. I typically ignore the CoT data for UST futures, but the CoT data for the 30y T-Bond future is less polluted by future bond basis trading. As I am looking to trade the short-end from the long side and the US dollar from the short side, shorting the long-end might be a good hedge.

Equities - Is the sentiment towards equities too optimistic?

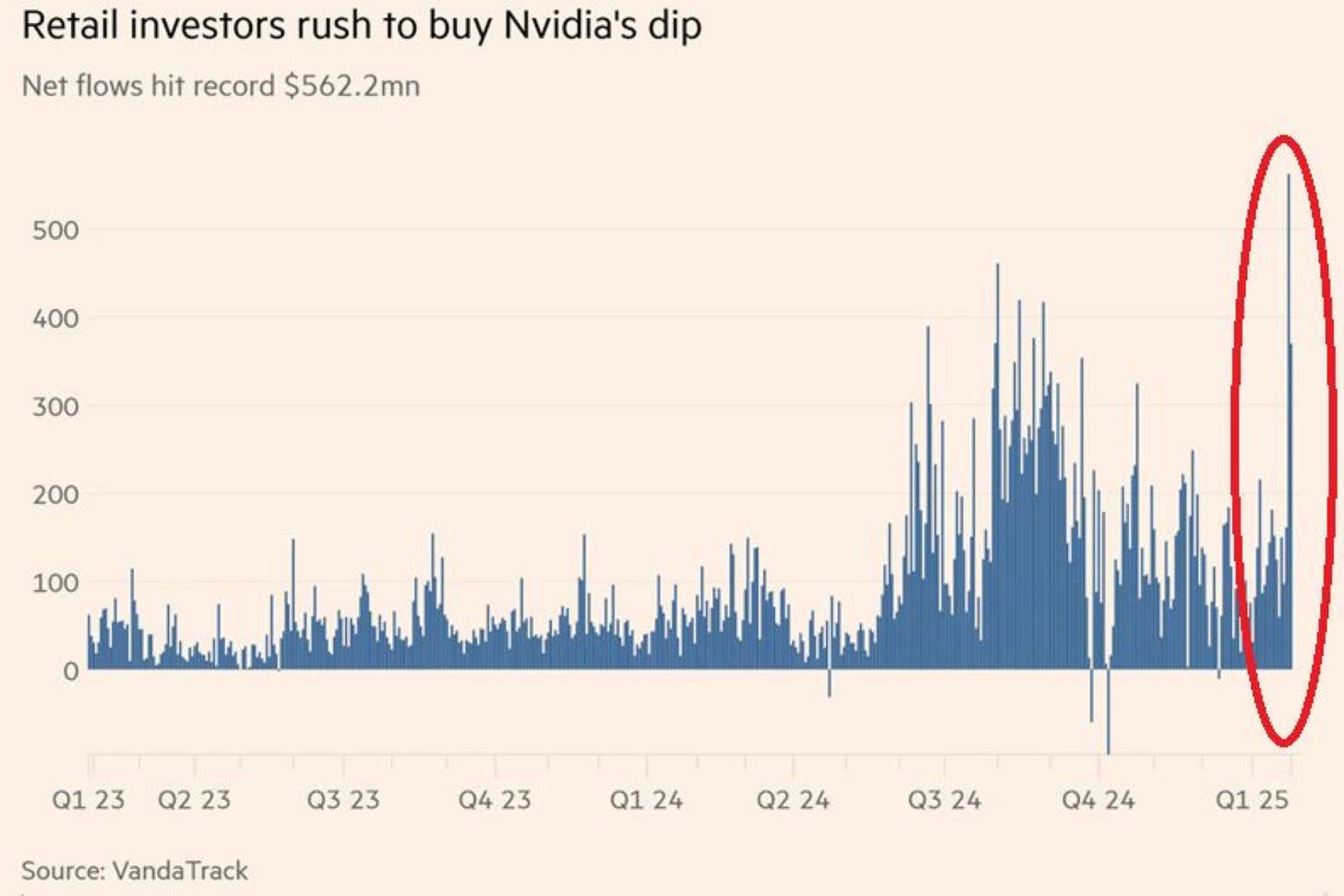

I am a more cautious about equities at the moment, mainly for sentiment reasons. For example, the NVIDIA dip was bought heavily by retail investors.

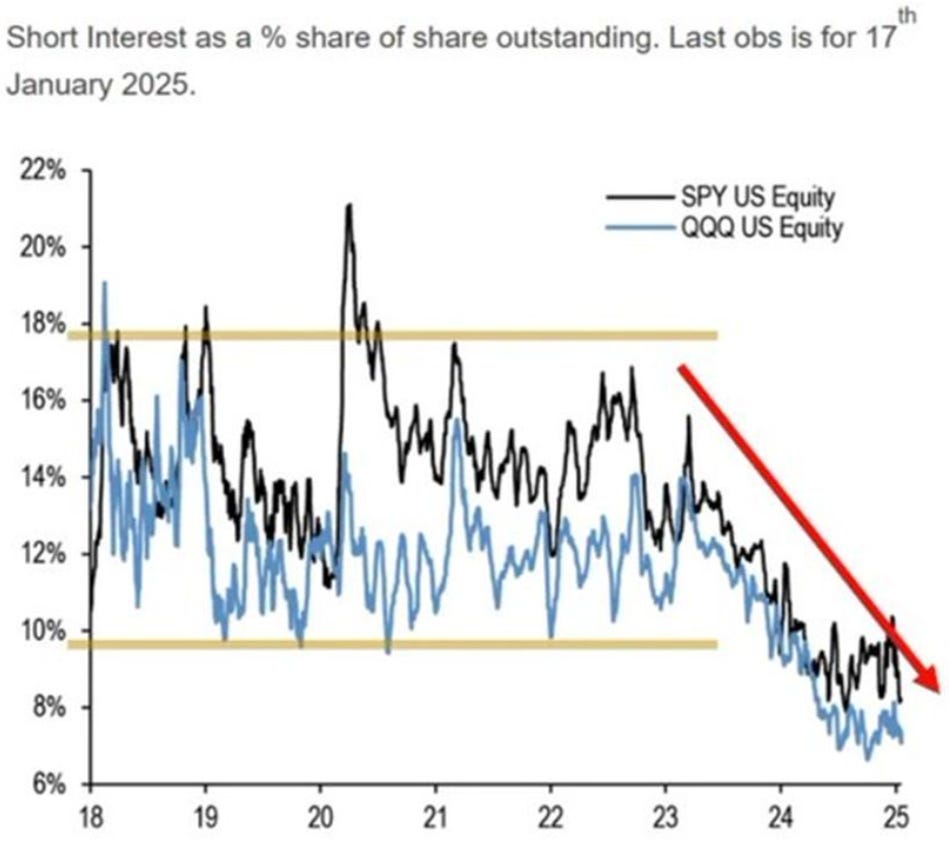

Short interest is low in the Nasdaq-100 and S&P500, as pointed out by Bob Elliott on X.

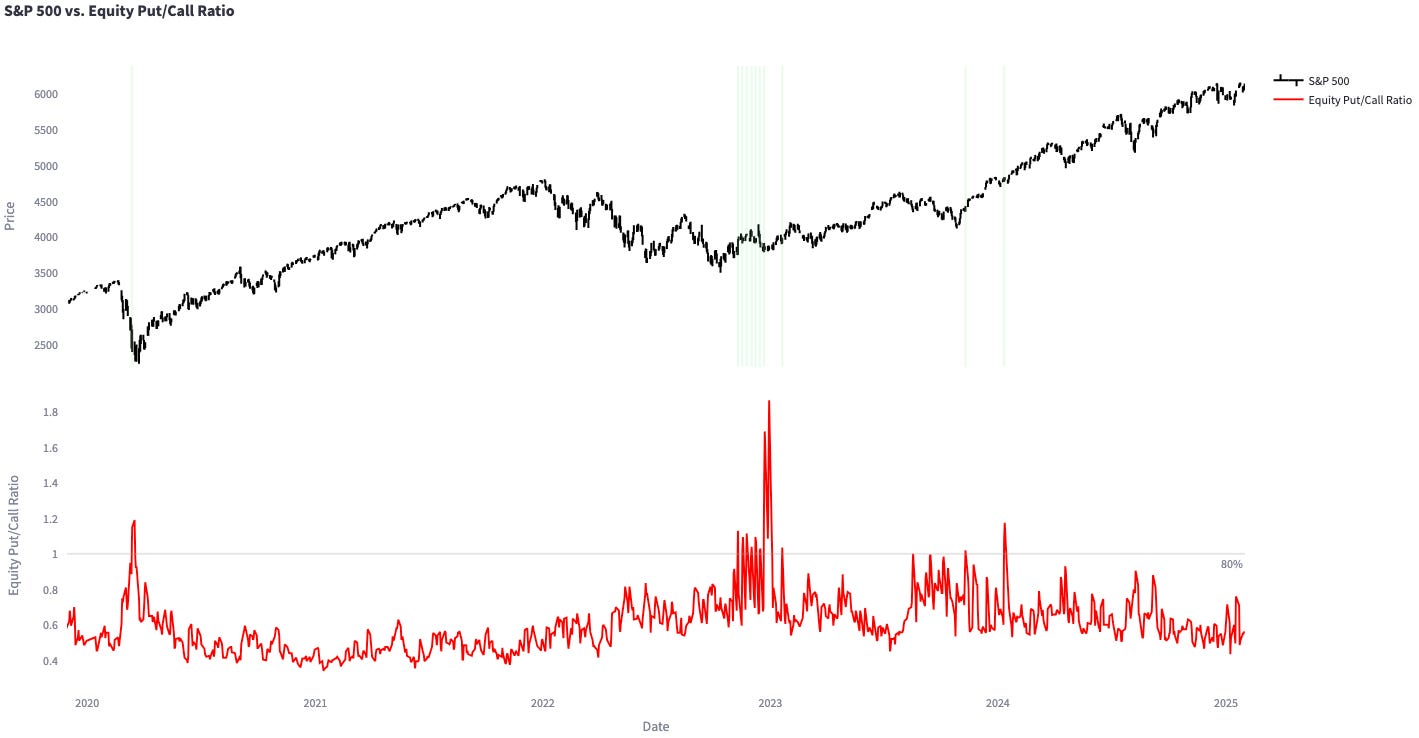

The equity put/call ratio is close to its lows.

Tariffs are clearly negative for economic growth globally. With elevated earnings expectations and valuations, tariffs could be the catalyst for equities to trade lower. I will wait for the stock market’s reaction on Monday to get a better feel for how much is already priced in. As of now, the S&P500 trades within 2% of its all-time high.

FX - How much was already priced in?

Everyone is long US dollar - for good reasons. But financial markets are a discounting mechanism. Tariffs are not unexpected. The question is how much was already priced in? I am cautious on my short US dollar trade. The Canadian dollar is going to sell off on Monday.

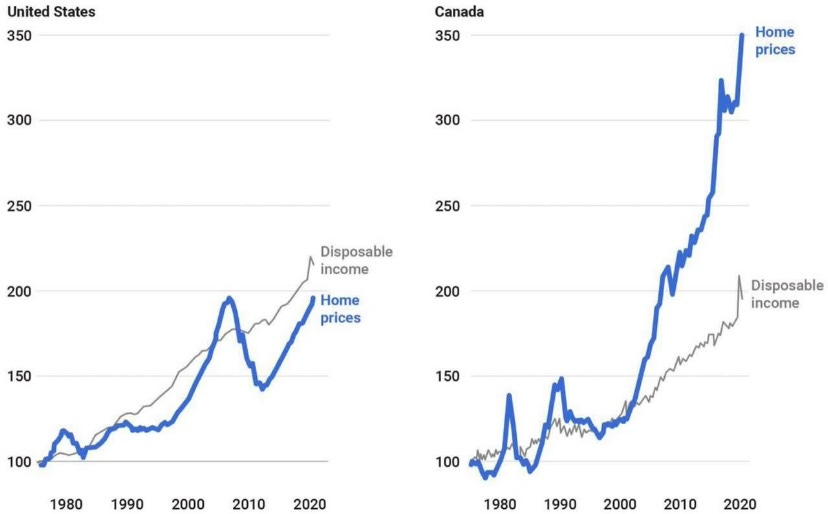

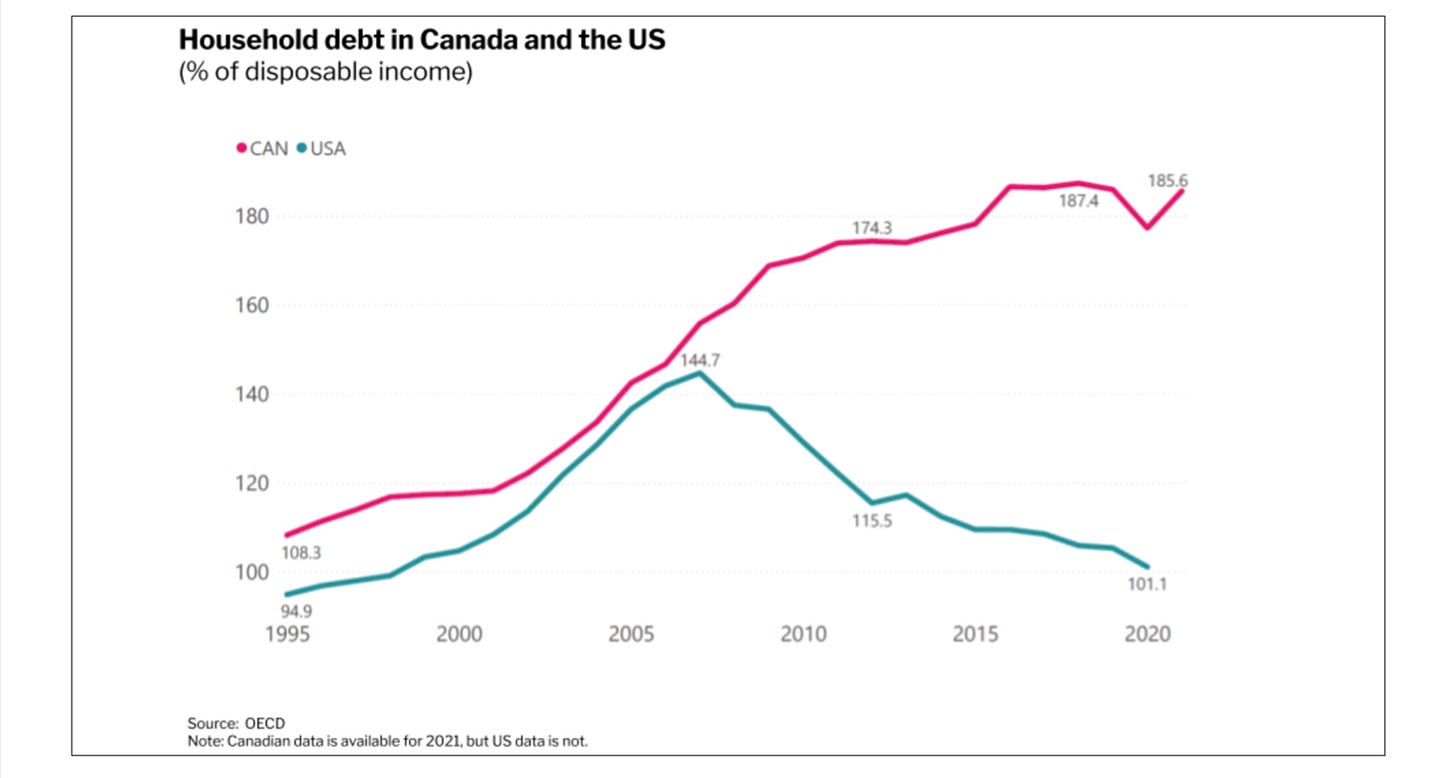

What is the worst case for the Canadian dollar? Let’s take a look at the housing market and debt dynamics. The Canadian housing markets has been booming in the past 20 years. But disposable incomes did not increase at the same speed.

This means that the boom in house prices was financed with debt in Canada. The average private household in Canada is over-leveraged (at low interest rates). If tariffs remain in place for too long and Canadian companies start laying off employees, mortgage payments will not be met. This is where the real pain begins in Canada.

I will also watch how EUR and GBP react to the tariff news. I am long GBP and the trade is still in-the-money, but I would not be surprised if that changes tomorrow.

The Australian dollar is a good proxy to gauge whether the tariffs on China were expected. If AUD rallies tomorrow, I would interpret it as bullish (but I think chances of that happening are low).

Crypto markets were open over the weekend. All major coins sold off (see Solana below).

In summary, I am going to stay nimble and small, and focus on protecting downside. Optimistic sentiment, elevated earnings expectations and high valuations are not a good starting point when a trade war begins. There is a catalyst for a sell off in risk assets now. I will re-evaluate my thoughts next week. I hope you enjoyed this article - make sure to subscribe so you do not miss the next article!