The Return of the Greenback and Trades in SOFR and Corra Futures

I remain long US equities into year-end. Why I expect a US dollar rally. And trades in SOFR and Corra futures.

Dear readers,

I don’t know about you, but I’m looking forward to a relaxing weekend. My weeks are usually packed - trading, workouts, business dinners - leaving little time to simply sit down and unwind.

That’s why I enjoy writing on weekends. Away from the trading floor, I finally have the space to think about what’s happening in markets and the economy. It’s become an important part of how I generate trade ideas and refine my process.

Having said that, let’s dive in!

Equities - New all-time highs

The S&P 500 and Nasdaq-100 both closed at all-time highs on Friday, supported by a softer-than-expected CPI print and a wave of AI and robotics news. Two headlines stood out: Amazon plans to replace 600,000 workers with robots by 2033, and ChatGPT is launching its own browser, Atlas.

It’s hard to be bearish on U.S. equities when nearly all the world’s leading innovators are American companies. I’m an notorious optimist - I genuinely believe the world is getting better every day, and the pace of innovation is accelerating. The two headlines above are perfect examples of that.

On October 5th, I wrote: “The setup into year-end is constructive. In terms of seasonality, October 26th marks the Q4 low for the S&P500. And historically, November and December are the strongest buyback execution months for U.S. corporates.” I think that still holds true. Time to buy calls? Maybe.

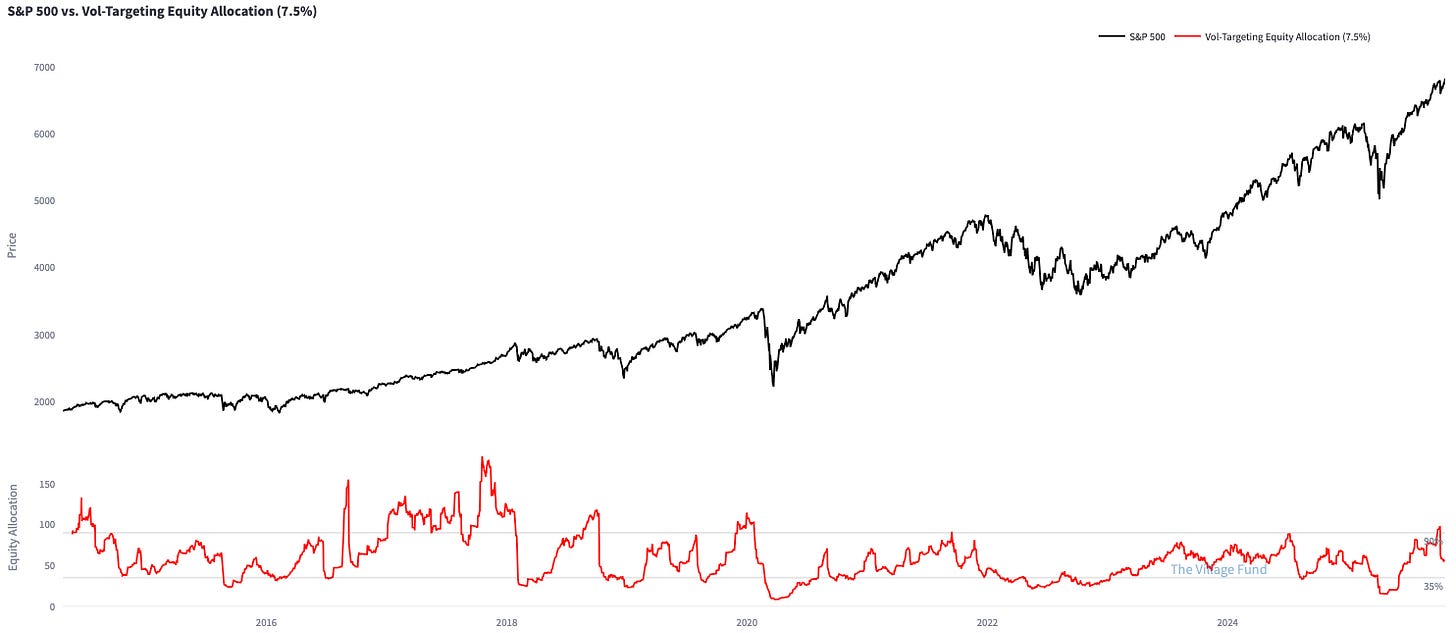

Vol-targeting funds have already cut their exposure, meaning there’s limited additional selling pressure unless realised volatility spikes again.

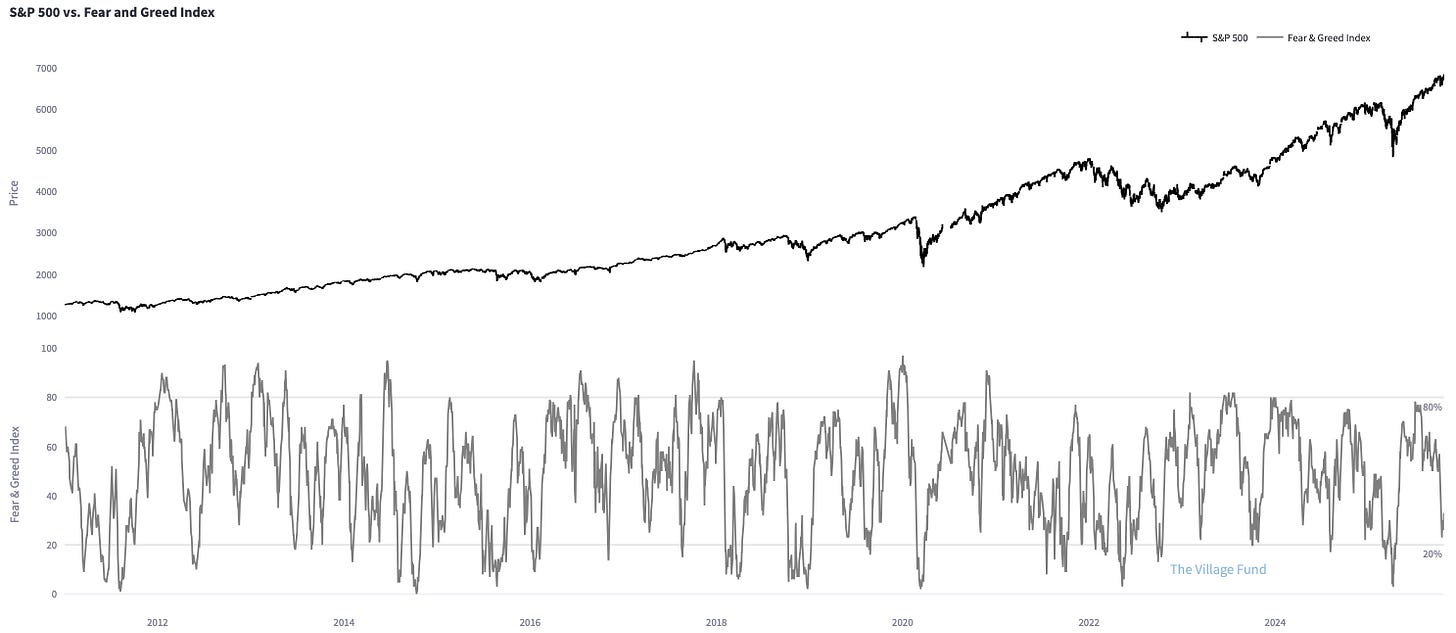

The Fear & Greed Index is showing little sign of optimism - if anything, it’s leaning toward pessimism.

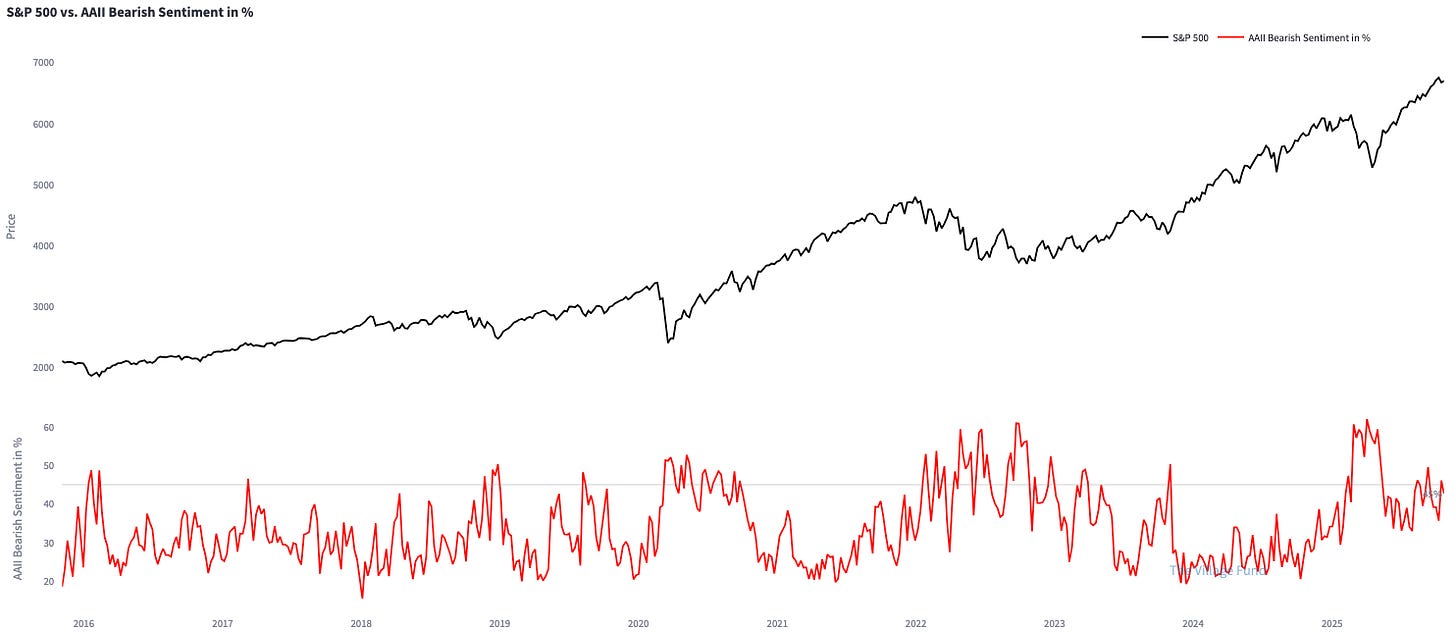

Retail sentiment tells a similar story: according to the AAII Sentiment Survey, 42.7% of investors remain bearish, well above the historical average of 31%.

Meanwhile, financial conditions remain easy. The Federal Reserve is likely to halt QT and cut rates, real yields have declined sharply since Trump took office, and the OBBB will add further fiscal stimulus in 2026. With equity markets at all-time highs, the U.S. consumer also feels wealthier (wealth effect!).

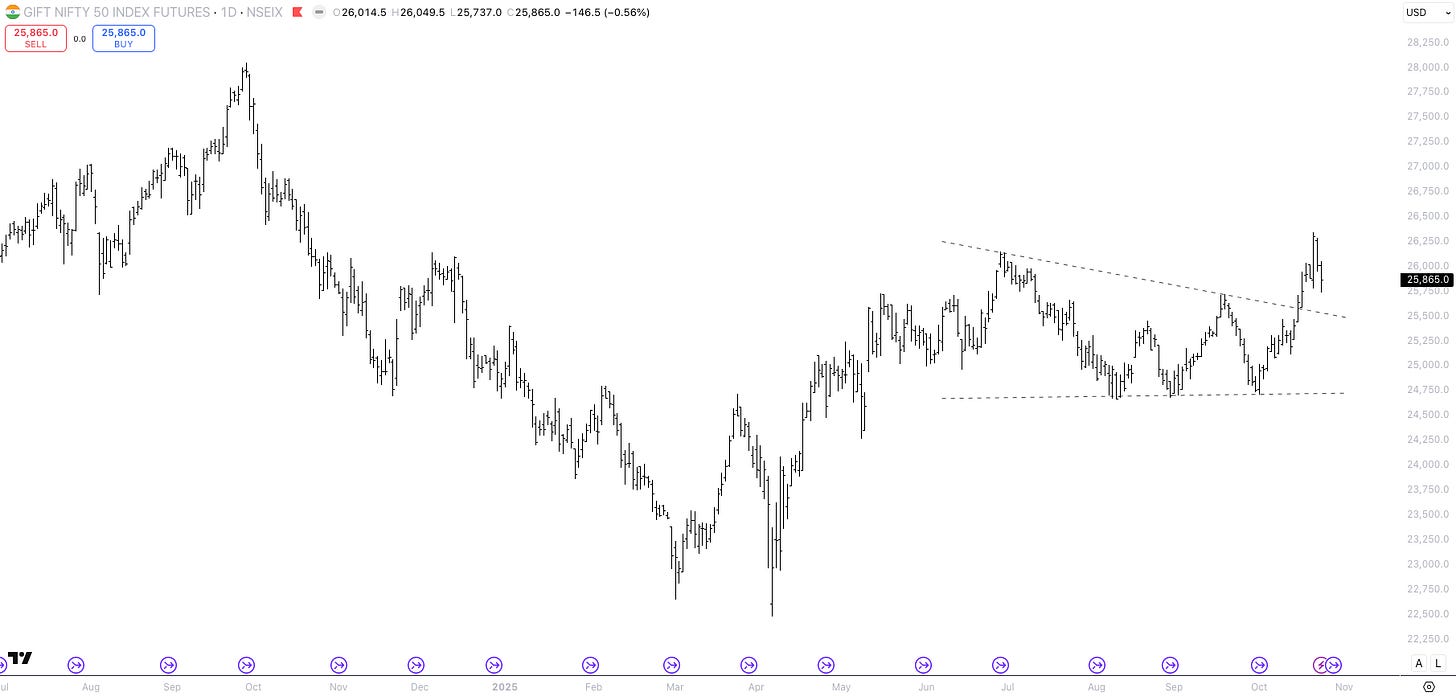

Most of my long-term investments remain in U.S. equities - primarily the S&P 500 and Nasdaq-100. However, I have “diversified” geographically and added exposure to the Indian stock market. I laid out my reasoning in last week’s article.

Macro - US 10-year yields, CPI release and the US dollar

Friday’s CPI report was notable: both headline and core CPI printed below expectations (3.0% vs. 3.1%). The deceleration was largely driven by softer shelter inflation (+0.2% m/m), while core services ex-housing held steady at 3.2% y/y - still above the pre-COVID trend.

Despite the softer data, U.S. 10-year yields rose after the release - a textbook news failure. The bond market likely pre-priced the disinflationary trend over recent weeks. U.S. 5-year yields, for instance, have fallen much faster than the actual pace of inflation moderation.

Danny Dayan wrote a great article about the US 10-year yield and why the Fed’s reinvestments into long-end Treasuries instead of bills and lower maturity coupons is suppressing 10-year yields. The price action post-CPI release could be the market confirming its time to fade the rally in US rates.

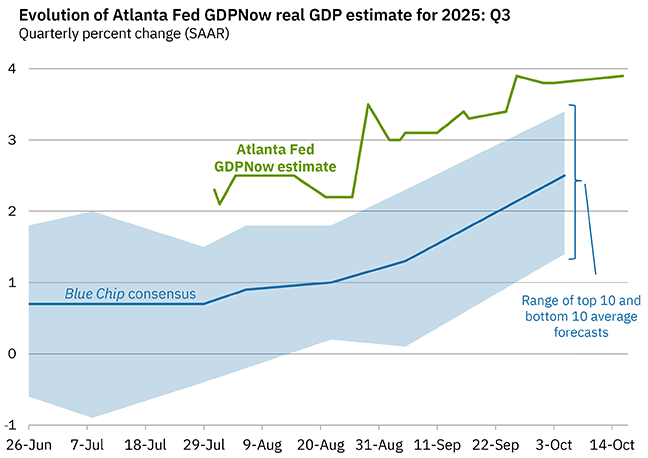

The Atlanta Fed’s GDPNow model is projecting 3.9% growth in Q3 2025 - hardly a slowdown. While the labor market is softening, that weakness is largely supply-driven.

Oil prices have also rebounded in recent days - a potential signal that yields could follow. My big picture technical view on the US 10-year yield:

Assuming U.S. yields move higher, what does that mean for the dollar? In my view, the U.S. dollar remains the undisputed global reserve currency and GOAT among all major fiat currencies. The only real alternative, the Euro, continues to face deep structural challenges:

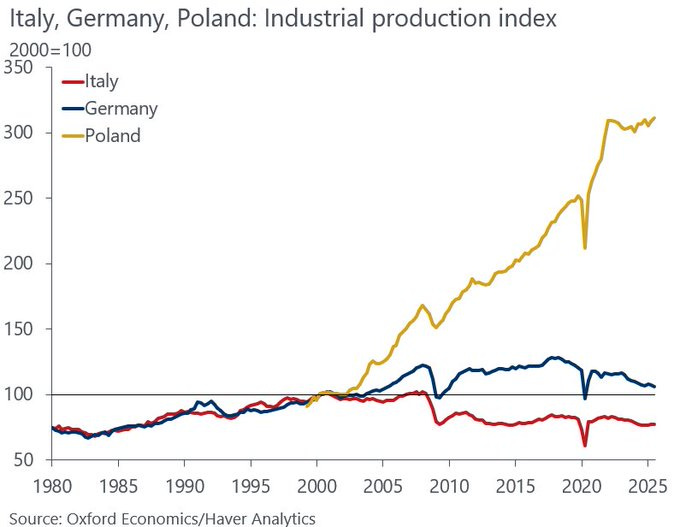

Demographics, ideological policymaking, flawed immigration systems, overextended social programs, energy dependence, export reliance, and excessive debt - Europe is falling behind. Take a look at Europe’s economic engine - Germany - versus the United States:

Germany’s foreign minister cancelled his trip to China this week after Beijing showed little interest in hosting him. Meanwhile, Eastern Europe is strengthening; Poland, for example, has become a serious competitor to Germany.

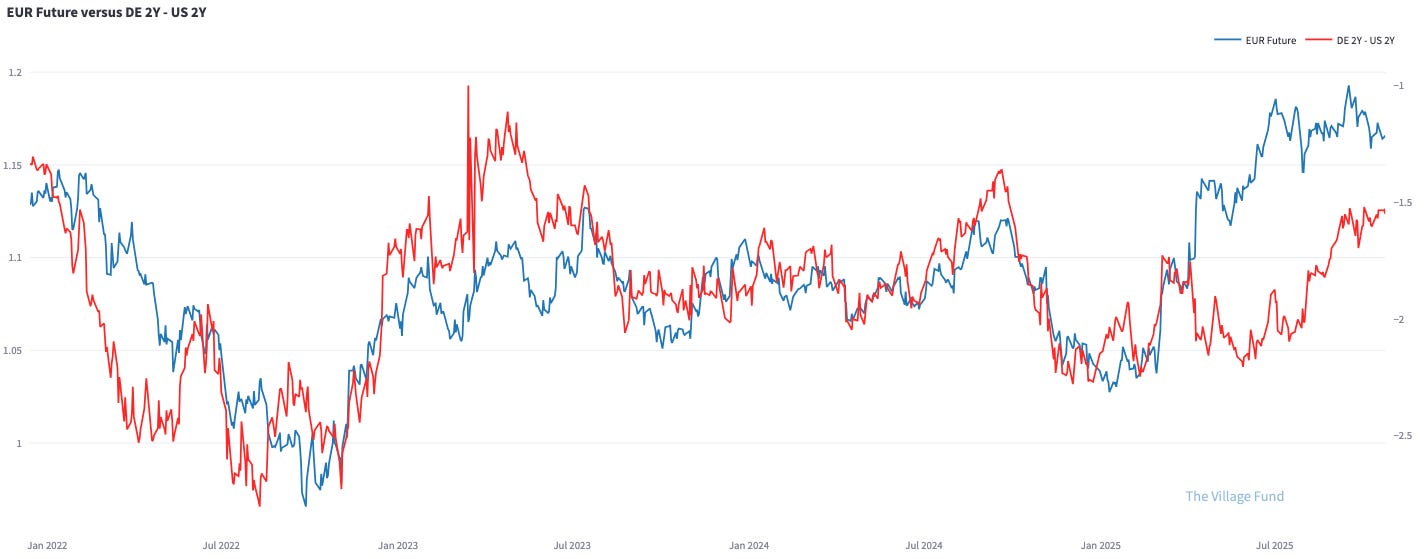

The Euro is not an alternative to the US dollar. Euro Area GDP grew by 0.1% in Q2-2025. Europe’s export-oriented economy needs a weaker Euro to remain competitive internationally. The market is starting to realise this. Yield spreads are implying a weaker Euro at ~1.12.

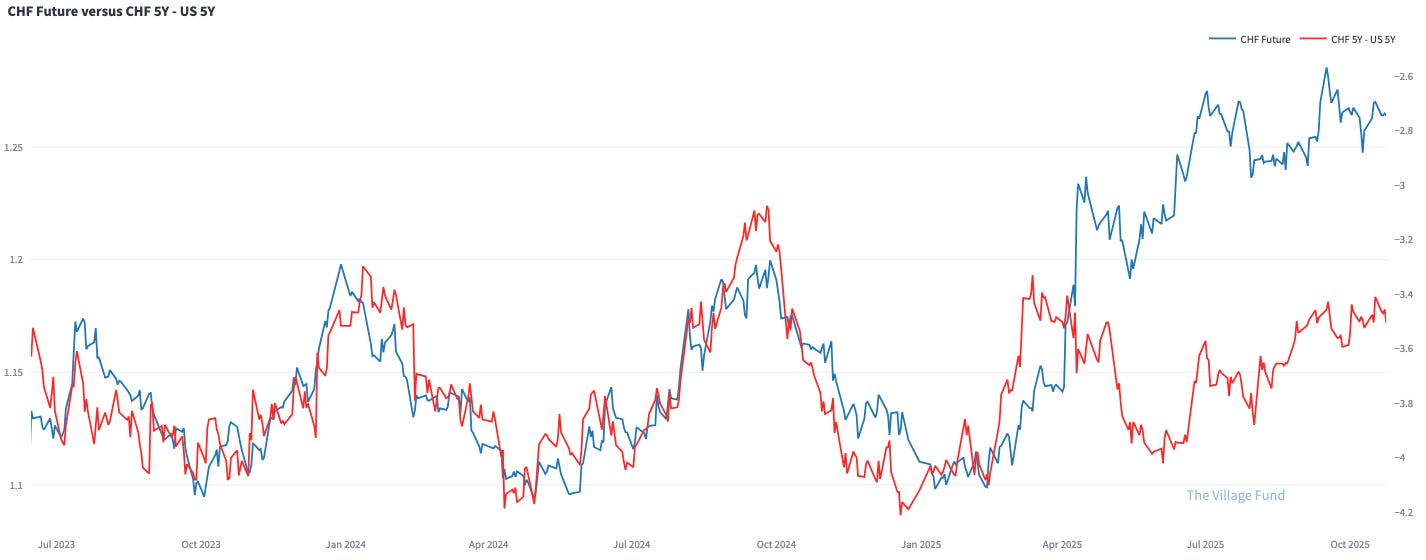

It looks similar for the Swiss Franc - the discrepancy is even wider.

The Dollar Index is forming a multi-month base. Friday’s reversal candle can be interpreted as a news failure. I will re-visit my thesis if the US dollar index falls below Friday’s low.

As for the Euro, I’d turn more confident in the bearish case once it drops below the trend line.

The below strategy goes long the Euro five days before the FOMC, and it goes short the Euro five days after the FOMC. The next FOMC is on October 29th - I expect Euro weakness post-FOMC.

Trades - STIR & FX

I am running three trades right now in my active trading account:

I am long USD vs. EUR since Sep17

I got long SOFR June 2027 versus SOFR June 2026 on Tuesday, Oct21

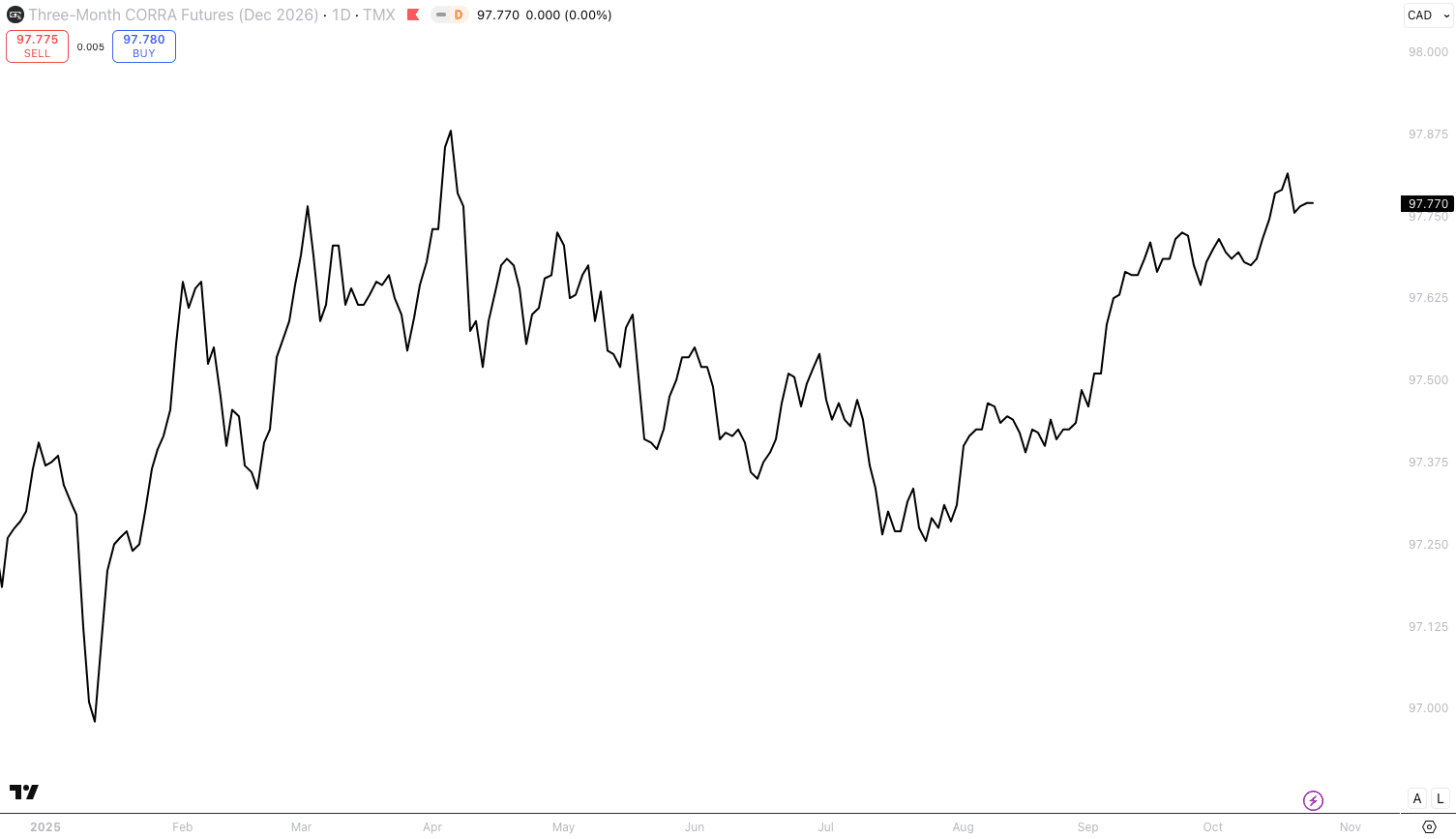

I got long Corra Dec’ 2026 on Thursday, Oct23

My usual trading process relies heavily on CoT data, but with the data delayed due to the government shutdown, I’ve been looking at STIR trades in more detail. I’m not yet sure whether it’s wise to deviate from my process, as STIR trading isn’t part of my typical CoT-driven, contrarian framework.

That said, I view STIR as the purest form of macro trading. I’ve made several successful STIR calls this year, but I’m still uncertain whether incorporating them consistently will enhance my risk-adjusted returns. I suppose there’s only one way to find out!

Some examples from this year that give me confidence I can improve my risk-adjusted returns trading STIR:

January 25th: I highlighted that the SOFR curve is pricing only one cut in 2025.

June 22nd: I highlighted that SOFR December 2028 contracts provide value at 3.59% (now: 3.21%).

August 9th: I wrote that Euribors pricing 6bps of hikes in 2026 seems unrealistic. Since then, Euribors have repriced to 15bps of cuts.

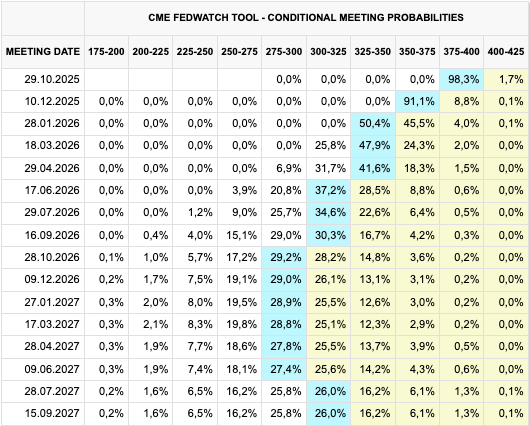

I got long SOFR June 2027 versus short SOFR June 2026 at -0.19 on Tuesday. Most SOFR cuts are priced in Jerome Powell’s term, i.e., before May 2026. From June 2026 to June 2027, there is less than one cut priced into the SOFR curve.

I think there is a decent chance J. Pow cuts less than expected and the new Fed Chair will cut more than priced in. I also think this trade is asymmetric:

If the US economy and inflation slows, more cuts could get priced into the June 2026 to June 2027 part of the curve.

If the US economy and inflation re-accelerates, cuts could get pushed out, i.e., fewer cuts from Dec’25 to Jun’26 and more cuts from Jun’26 to Jun’27.

I am not 100% confident about the timing, which is why my risk tolerance is low. I am out if the position if it runs more than 3bps against me.

I also went long CORRA Dec 2026 at 97.765 on Thursday. As I’ve written before, I think the Canadian economy is in trouble - unemployment is rising, tariffs are growth-negative and disinflationary, the housing market is correcting, immigration is slowing, and the private sector is heavily indebted.

Currently, CORRA futures (Dec ’26–Dec ’25) are pricing in 2bps of hikes - a setup that reminds me of Euribor pricing a few months ago. I believe the Bank of Canada will ultimately have to cut rates more than the market is pricing.

The main risk to this trade is a re-acceleration in the U.S. economy, which would spill over to the Canadian economy. If that happens, the SOFR curve would likely price out cuts. In that scenario, my U.S. dollar position would probably benefit. In that sense, the Corra Dec’26 trade is partially hedged.

Dear Mr. Repo,

Thank you for a great piece once again, truly great insights.

I'm biased because I have similar trades/views on my own account (long USDCAD instead of Corra, but same rationale; short UST10y, same rational regarding stronger US economy, pricing and -key- the news failure you mentioned about Friday's CPI)

What I didn't get from your piece is what's the DXY's news failure you talked about? you would've expected the greenback to close higher? Given higher yields? or what?

I guess I can understand that you could've expected higher DXY on the backdrop of higher 10y yields?

But at the same time, lower CPI print could be interpreted bearish DXY, don't you think?

In any case, I thought we'd have more movement on the USD and not 4 days in a row of pretty much the exact same closing price.

Thank you for the piece and for taking some questions.

Best,

Valentino