The Art of Doing Nothing

In a week with few actionable moves, restraint is the real trade.

This week’s article was a tough one to write - I’ve been feeling a bit of writer’s block. At the moment, I don’t have high conviction in any new trades. Aside from Trump threatening to impose 50% tariffs on the European Union, there hasn’t been much new (and relevant) macro news. Still, I wanted to share a few thoughts on what I’ve been watching.

Rates: 10Y Fairly Priced?

The 10-year Treasury yield seems reasonably valued here. If we assume 1.5–2.0% real growth, 2.0–2.5% inflation, and a 0.5–1.0% term premium over the next decade, that gives us a range of 4.0–5.5%. At 4.50%, we’re pretty much in the middle. Without a strong macro view, I’m not inclined to take a position. My preference in fixed income is to fade extreme mispricings - and I don’t see one today.

FX: US Dollar Under Pressure

The US dollar has been weaker than I expected over the past two weeks. Here are some possible reasons:

European equities are cheaper than US equities and may benefit from upcoming fiscal stimulus. Underweight global funds might start re-allocating.

30-year Japanese government bonds (JGBs), when currency-hedged, yield ~7%, compared to ~5% for US Treasuries. That yield advantage could draw flows away from the US.

Recession risks in Europe, Japan, and Canada are arguably higher than in the US. That could make global bonds more attractive than US bonds.

Foreign institutions like Dutch and Canadian pension funds have historically been under-hedged on their USD exposure. With recent dollar weakness, they may be increasing FX hedges - which puts additional selling pressure on USD.

Technically, several currencies are testing important levels. The Euro has retested its breakout level and held up well last week.

The Swiss Franc might be breaking out of a 14-year base.

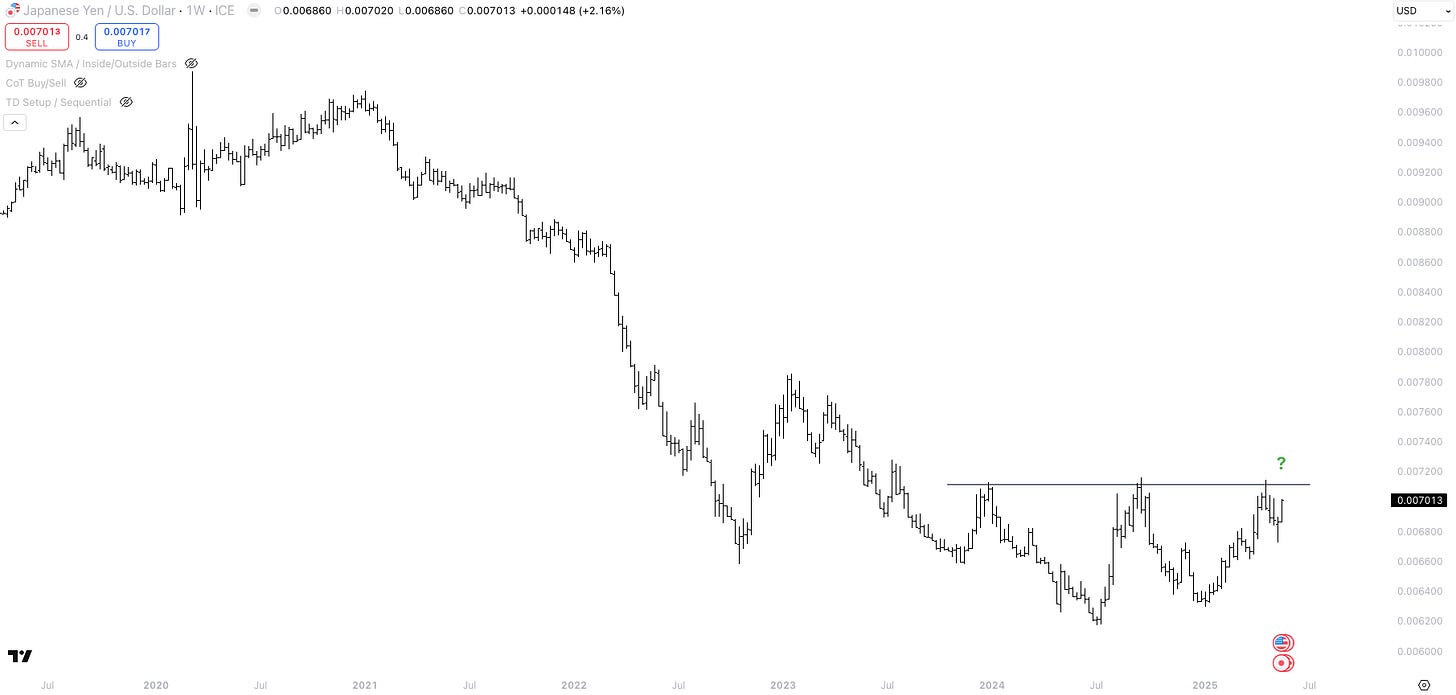

The Japanese Yen could be bottoming here. While I remain skeptical (given Japan’s 240% debt-to-GDP, demographic headwinds, and poor growth outlook), the price action is strong - and sometimes that matters more than fundamentals.

Fiscal Outlook: One Big (Expensive) Bill

I’m still long US dollars in my EUR-denominated account. The position is roughly flat now. If weakness continues into next week, I’ll likely close it.

On Thursday, Trump’s “One Big Beautiful Bill” narrowly passed the House, 215–214. It’s a strong signal that fiscal deficits will remain high - likely in the 6.5–7.0% of GDP range. Notably, Scott Bessent has shifted from calling for 3% deficits to saying the US must “outgrow spending.”

The bill would raise the debt ceiling by $4 trillion and includes measures that are likely to boost consumption:

Tax exemption on tips for workers earning under $160,000 (through 2028)

Exemption of overtime pay from income tax (through 2028)

Deduction of up to $10,000 in interest on loans for American-made vehicles

These policies are pro-growth and could support consumption into 2025 and beyond.

Equities: Not as Bearish as the Crowd

While many macro commentators remain bearish, I’m still long the S&P 500. The consumer remains in solid condition, fiscal policy is loose, and the corporate profit hit from 10–15% tariffs looks manageable. Meanwhile, deregulation and tax cuts could further support the economy starting in Q3/Q4 2025.

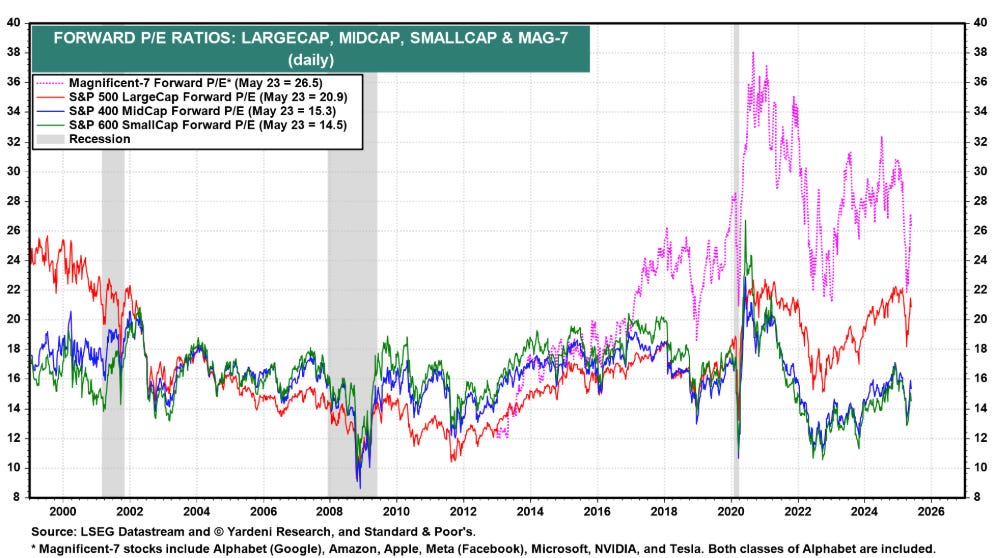

On April 26th, I wrote about the “ultimate pain trade”: an S&P 500 rally to 6000. Many active managers remain underweight US equities and are trailing benchmarks. With forward P/Es elevated, they may find it difficult to re-enter.

If the economy slows, earnings expectations may be too optimistic. According to FactSet:

2025 EPS growth is expected at +9.1%

2026 EPS growth is expected at +13.4%

Yet revenue forecasts are just:

+4.9% in 2025

+6.2% in 2026

That implies analysts expect meaningful margin expansion, which might be tough to achieve in a slower economy.

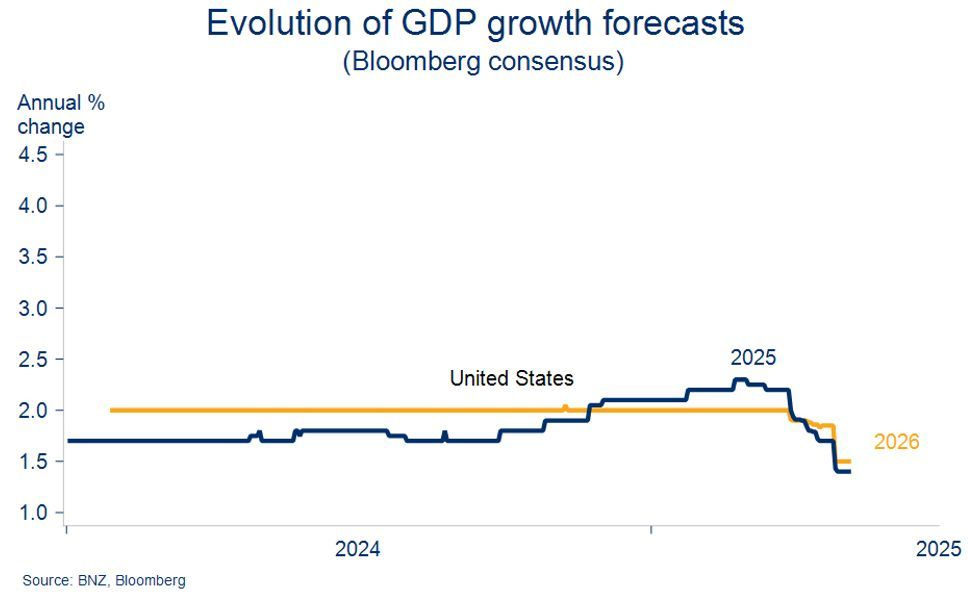

At the same time, economists have begun revising down their US GDP forecasts. Bob Elliott recently shared a chart on X showing that the Bloomberg consensus no longer expects 2.5–3.0% growth in 2025 or 2026. It’s a dynamic that reminds me of 2022 — economists forecasted recession, but bottom-up equity analysts had the more accurate view.

In summary, I remain long the S&P 500 and long US dollars — positions that didn’t perform well last week. My trading account is currently down 1.9% from its highs, but still up 6% year-to-date. For now, I’m holding both trades. I don’t see anything actionable in FX at the moment, though I’m keeping an eye on the Japanese Yen and Swiss Franc for potential short setups. Likewise, I don’t see attractive opportunities in metals like gold and silver, or in energy markets such as crude oil. When the picture isn’t clear, I believe it’s best not to force trades. I’m staying patient and waiting for better risk-reward setups to emerge.

Thank you for your piece Mr. Repo!

Probably one of the most overlooked and toughest skills to have: not to trade at all.

I have found it very hard in my own account, after China-US deal I haven't been able to pin point good risk-reward trades, and fell pray to some biases, like chasing, that ended up costing me money.

For active accounts, staying still is not as easy as it sounds, and, IMHO, just shows how tough the mental aspect of this game is.

Thank you for the piece and for the honesty!

Best,

Valentino