STIR Outlook, FX Views, and Thoughts on Portfolio Construction

Euribors are pricing hikes next year. SOFR futures do not price cuts under the new Fed chair. Ethereum is up 45% in two weeks. Beta portfolio construction with discretionary & systematic alpha overlay

Hey,

It’s been another busy week at work, so this update will be a bit shorter than usual.

As always, if you find these write-ups helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these out regularly. Let’s jump in!

Portfolio Changes

S&P500: I closed my long S&P 500 futures position on Tuesday. That day, we got two key headlines: 1) Core CPI came in below expectations, and 2) Nvidia received approval to sell H20 chips to China. Both were bullish signals, yet equities didn’t respond. In fact, the Nasdaq closed lower that day.

USD: I converted most of my EUR cash into USD on Tuesday. Honestly, I’m a bit frustrated I didn’t make the move earlier. Two weeks ago, Trump rolled out a wave of new tariff announcements - and unlike in April, the US dollar strengthened instead of selling off. That felt like a meaningful shift in market tone.

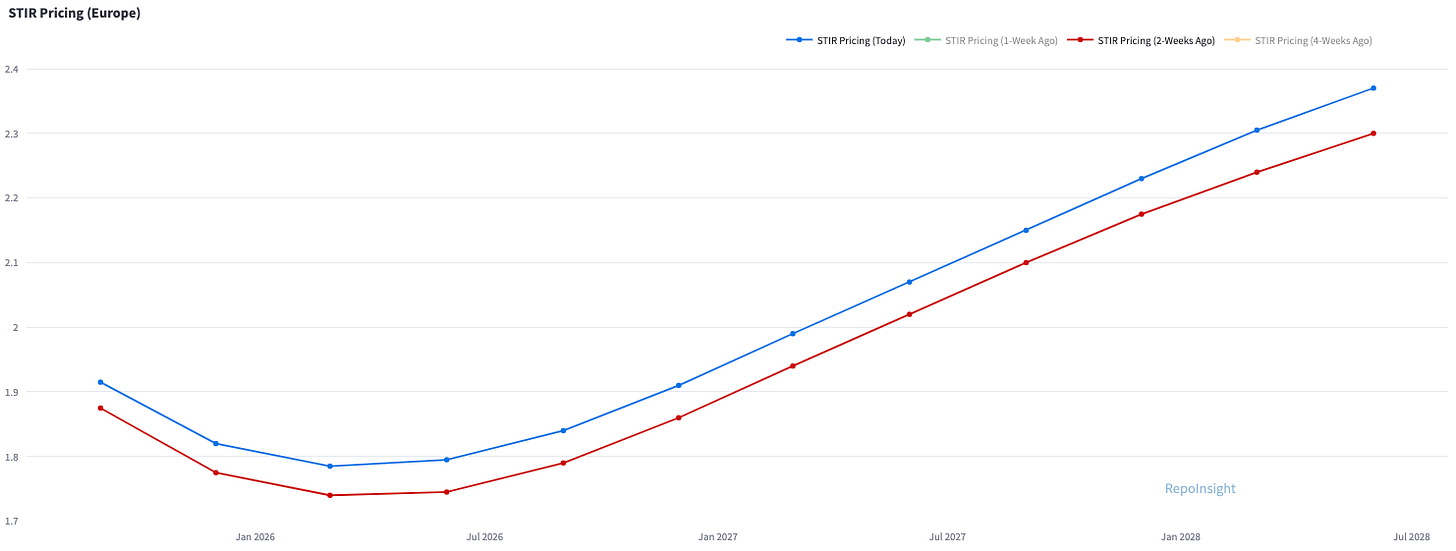

Let’s take a look at STIR markets. In Europe, short-term interest rate pricing has become particularly interesting. The bond market is now pricing in just one more cut between now and March 2026 - after that, the ECB is expected to hike rates again. The 3-month Euribor curve (see below) tells the story.

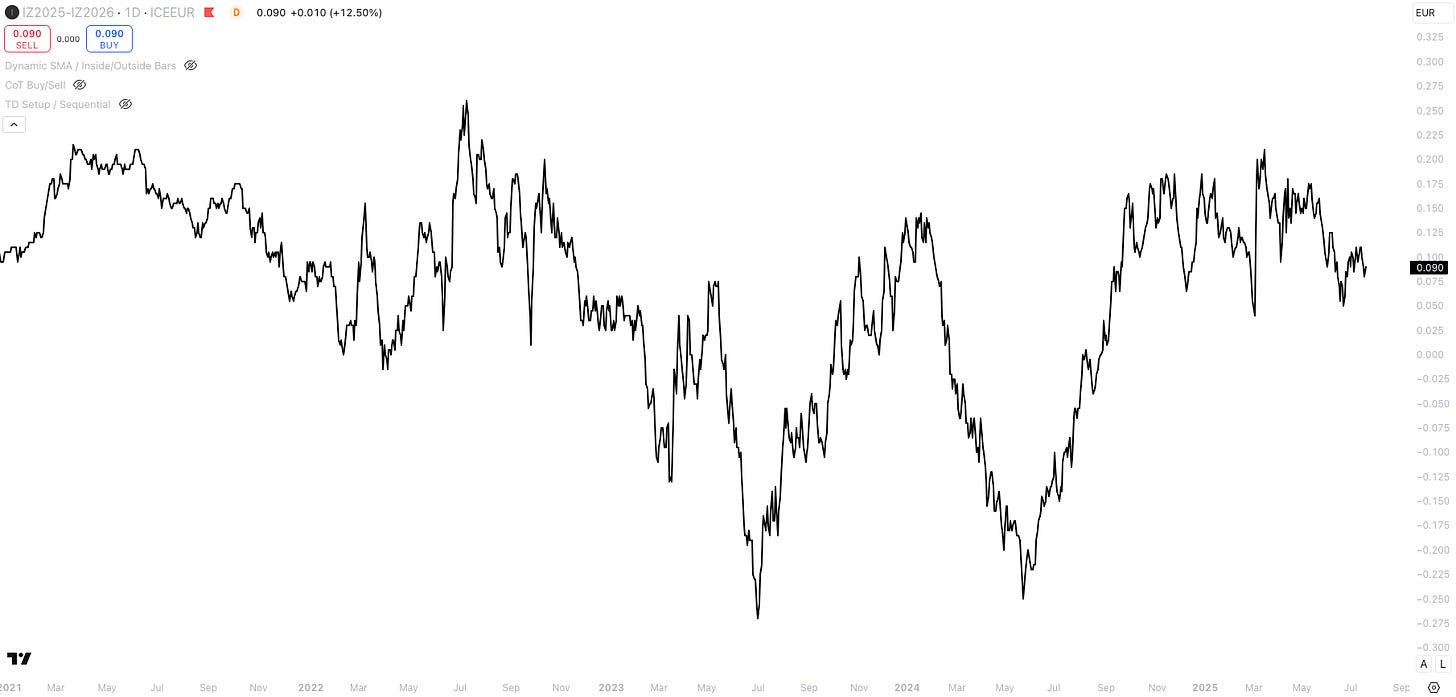

The chart below shows the spread between Euribor Dec '25 and Dec '26. Right now, the curve is pricing in 9bps of hikes in 2026. I’m skeptical those hikes will actually materialize. Even if euro area growth rebounds to 1.5%, it’s hard to see the ECB turning hawkish again.

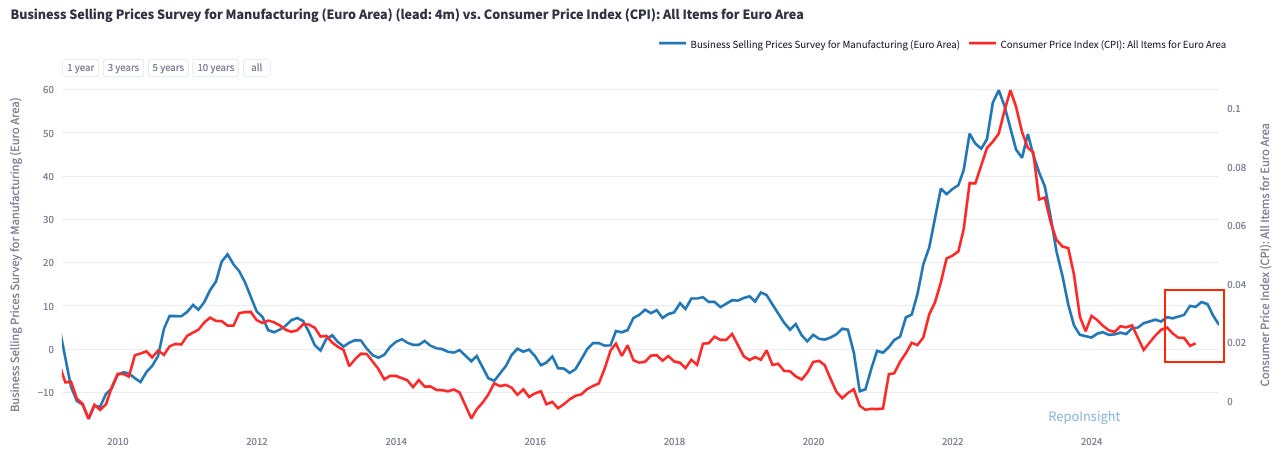

There’s little evidence of structural inflation in Europe. The business selling prices survey remains subdued, and June’s Euro Area inflation came in at 2.0%. With growth still sluggish and inflation well-anchored, rate hikes in 2026 seem highly unlikely.

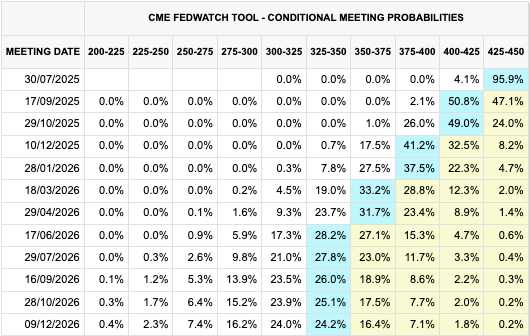

Turning to the U.S.: Trump is turning up the heat on Powell. Markets are pricing three rate cuts during Powell’s remaining term. But what’s more striking is that STIR pricing implies the next Fed chair won’t cut rates for several months after taking over. That seems unrealistic, especially under a Trump administration pushing aggressively for easier policy.

Only 7bps of cuts are currently priced between September 2026 and March 2027.

If Powell stays cautious and delivers just 2–3 cuts during the remainder of his term, but Trump continues pressuring the next Fed chair, it’s likely we’ll see more easing priced in for that period.

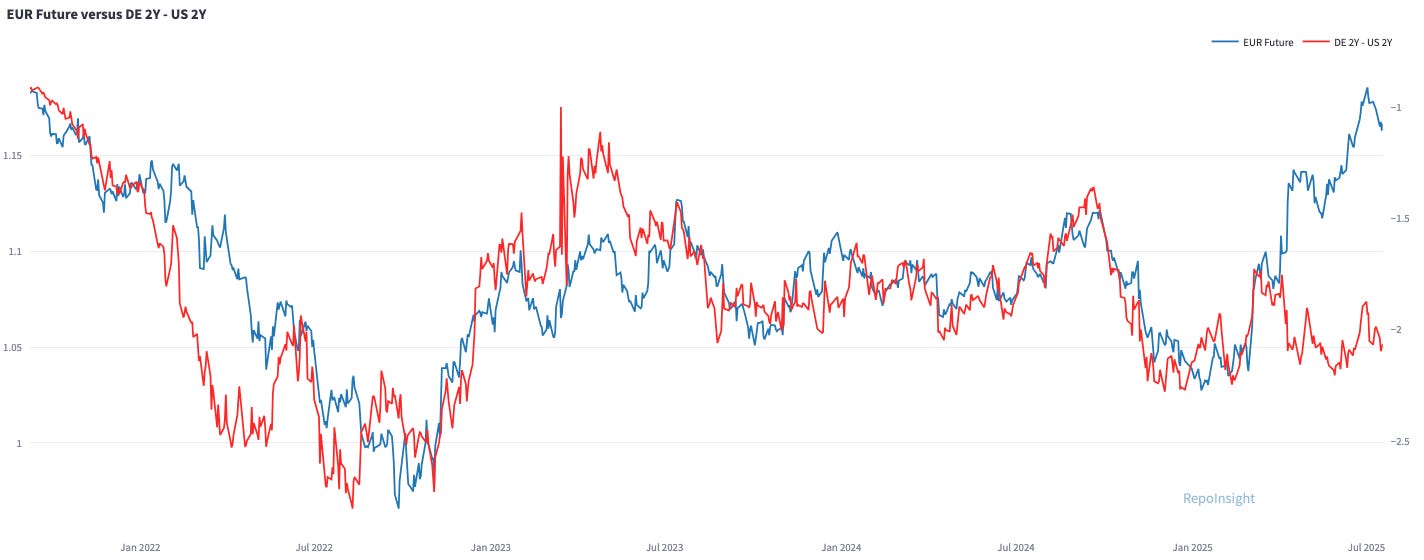

If the Euribor curve prices out hikes and Powell stays on hold longer than expected, the yield differential should shift in favor of the U.S. dollar. Since Liberation Day in April, the 2-year Germany vs. 2-year U.S. yield spread has decoupled from EURUSD.

CoT data offers a decent snapshot of how stretched currency positioning is — especially among trend-followers. Large speculators (blue) and small speculators (yellow) have built sizable long positions in the euro. Yet over the past two weeks, the euro has traded notably weaker - a sign that positioning could now be a headwind.

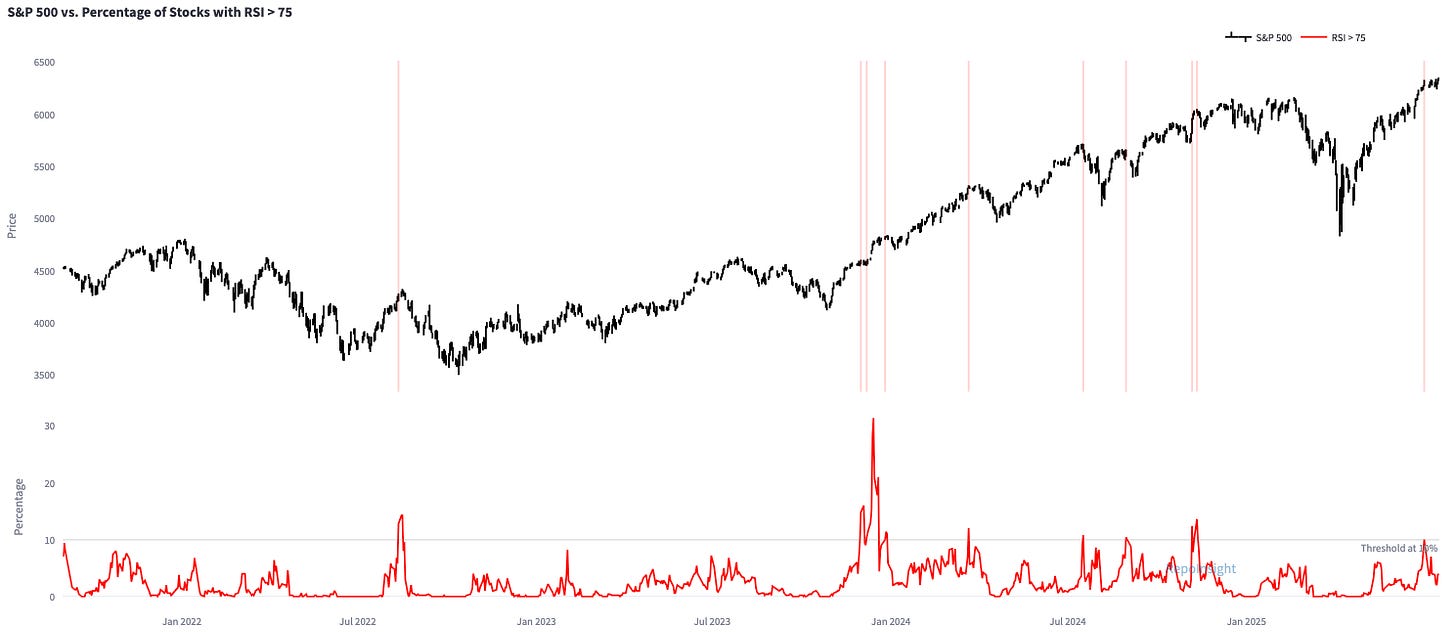

Equities might chop sideways through the summer. The number of S&P 500 stocks with RSI readings above 75 has climbed meaningfully. That doesn’t necessarily mean a correction is coming, but it does suggest increased volatility is likely in the near term.

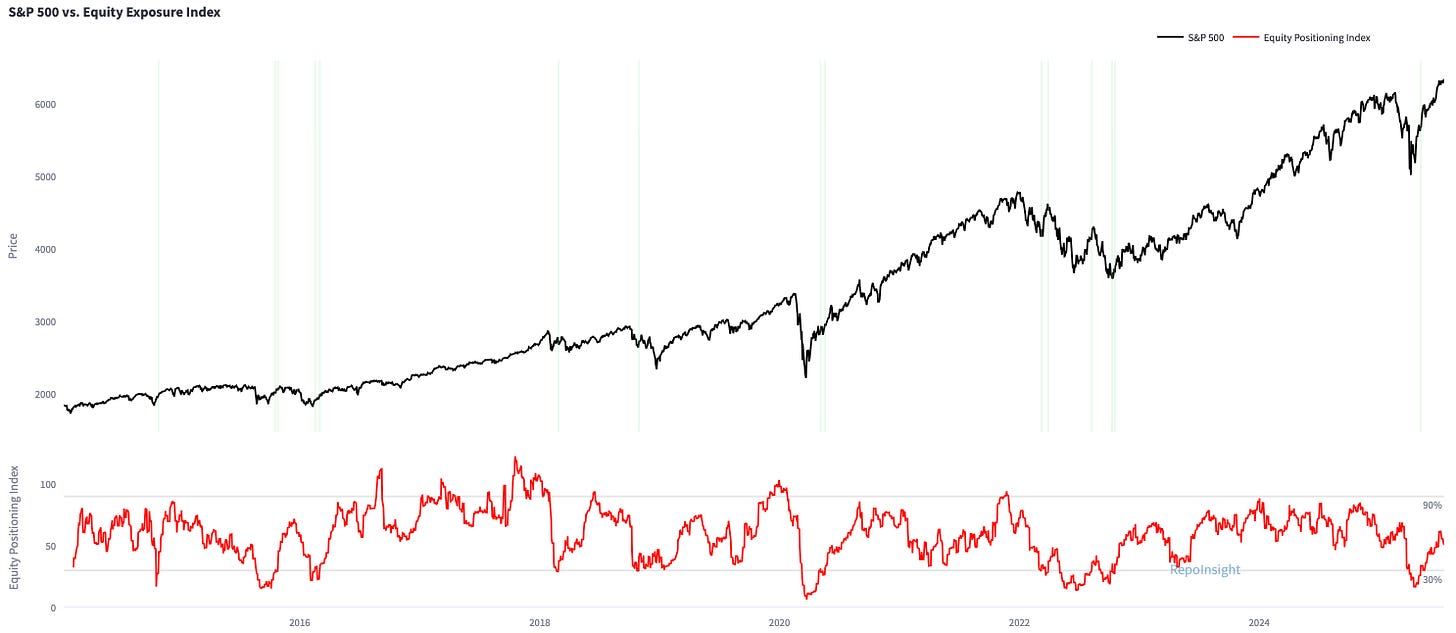

Tactical equity positioning looks neutral. Across futures markets, vol-targeting strategies, and active managers, positioning doesn’t look stretched in either direction. I’m still long equities in my long-term investment accounts, but I’ve reduced risk in the trading book by closing my S&P 500 futures position.

Ethereum thesis pays off. My Ethereum idea gained +45% in just two weeks. On July 18th, Trump signed the GENIUS act, which establishes a regulatory framework for stablecoins, into law. Since most stablecoins run on the Ethereum blockchain, this development could boost Ethereum’s on-chain activity and value.

My trading portfolio is up 7.5% year-to-date, with notably lower drawdowns and volatility compared to the S&P 500. That return was achieved despite some constraints - for example, I didn’t take the short JPY trade, which could have added another 3–4% YTD.

I’m exclusively trading futures, maintaining a margin-to-equity ratio of roughly 10–20%. This means you could combine a well-diversified beta portfolio with a sufficient cash buffer and layer this alpha strategy on top.

Here’s an example beta portfolio allocation: 40% USD cash, 10% S&P 500, 10% rest-of-world equities, 7.5% US nominal bonds, 5% US inflation-linked bonds, 7.5% rest-of-world nominal bonds, 5% rest-of-world inflation-linked bonds, 10% gold, and 5% other commodities. Since August 2018, it has returned about 4% per annum with 6% volatility and a maximum drawdown of 13%.

If you can build a passive beta portfolio delivering 4–5% annual returns and successfully overlay alpha strategies targeting around 10% per year, the combined portfolio could achieve an attractive return profile — think 12–15% returns with about 10% volatility and max drawdowns in the 10–15% range. But that’s just the beginning…

My ideal portfolio consists of three components: 1) passive beta, 2) discretionary alpha, and 3) systematic strategies. Right now, I’m backtesting a range of systematic approaches across various asset classes. The chart below shows the cumulative performance of all the systematic strategies I’ve tested so far.

I wouldn’t run the systematic strategies at full size, but if I can add around 20% of the return—roughly 3–4% annually—with low volatility, limited drawdowns, and low correlation to the existing beta and alpha positions, the overall portfolio return profile becomes very compelling.

There are still a few details to work out, like optimal sizing, margin requirements, and transaction costs. Ultimately, my goal is to build a diversified portfolio combining passive beta, discretionary contrarian alpha, and systematic strategies across multiple asset classes.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Great article Mr. Repo!

Thank you for sharing!