Risk Management and Macro Trades in Q2-2025

Sentiment surveys are max. bearish, but positioning has "room to go". Growth scare à la 2023. Sell the short-end if it prices 3-4 cuts in 2025. More macro trade ideas for Q2-2025.

Each weekend, I take time to write down my thoughts and formulate macro trade ideas. This process has been invaluable in 2025, helping me stay organised and keep up with what is happening in the world. I hope you enjoy the articles, and I welcome comments, likes and feedback. Let’s dive in!

On March 17th, I initiated a long position in the S&P 500, anticipating a rebound in equity markets. My thesis rested on the belief that hard data remains reliable, while survey data—once again—would prove misleading. At the time, the market appeared oversold, and sentiment surveys had reached extreme levels.

Yesterday, I closed the position, locking in a (very) small profit. My trading account now sits at a year-to-date gain of 3.76%, down 1.18% from its peak. At the moment, my priority is capital preservation over profit maximisation. Typically, I hold trades for about two months, but with no compelling opportunities across asset classes aligning with my strategy, I remain in cash for now.

Looking ahead, I expect to eventually get back into the equity market to capitalise on another bounce. Even if my next three trades result in break-even outcomes or minor losses, the potential reward remains attractive—provided I can catch a sustained 1-2 month rally. For the moment, I’m sitting tight until April 2nd, when I’ll reassess based on the market’s reaction to Trump’s tariff news.

Sentiment Check: Good Reasons to Be Bearish

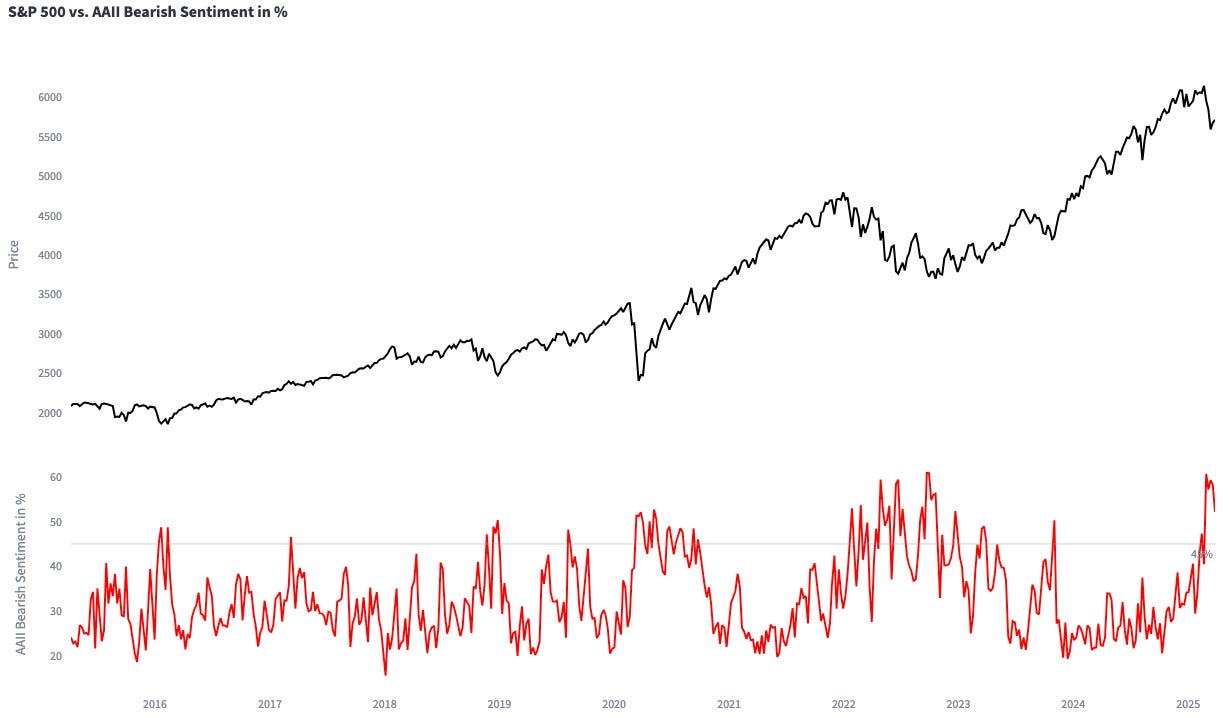

It seems nearly every macro investor out there is currently bearish—and for good reasons. Yet, markets are forward-looking discounting mechanisms. Historically, major bear markets don’t typically kick off with sentiment readings like these. Retail investors, in particular, remain overwhelmingly pessimistic:

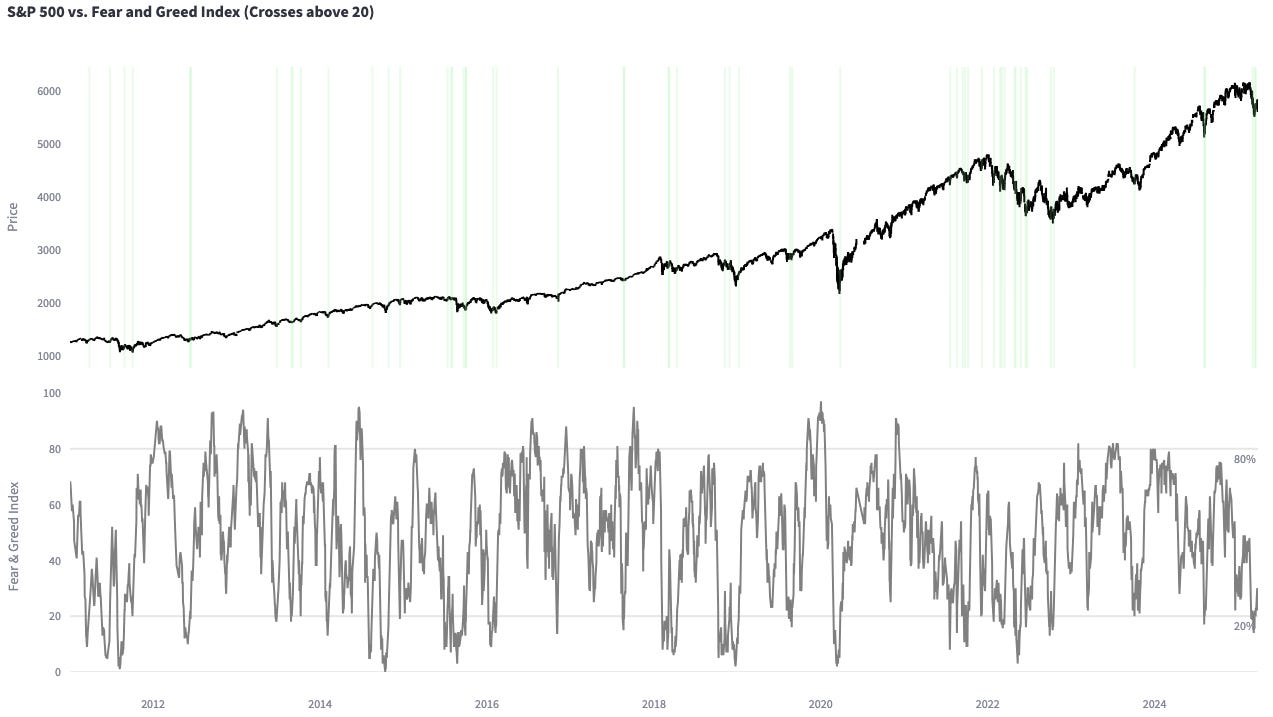

The CNN Fear & Greed Indicator is hovering near extreme levels:

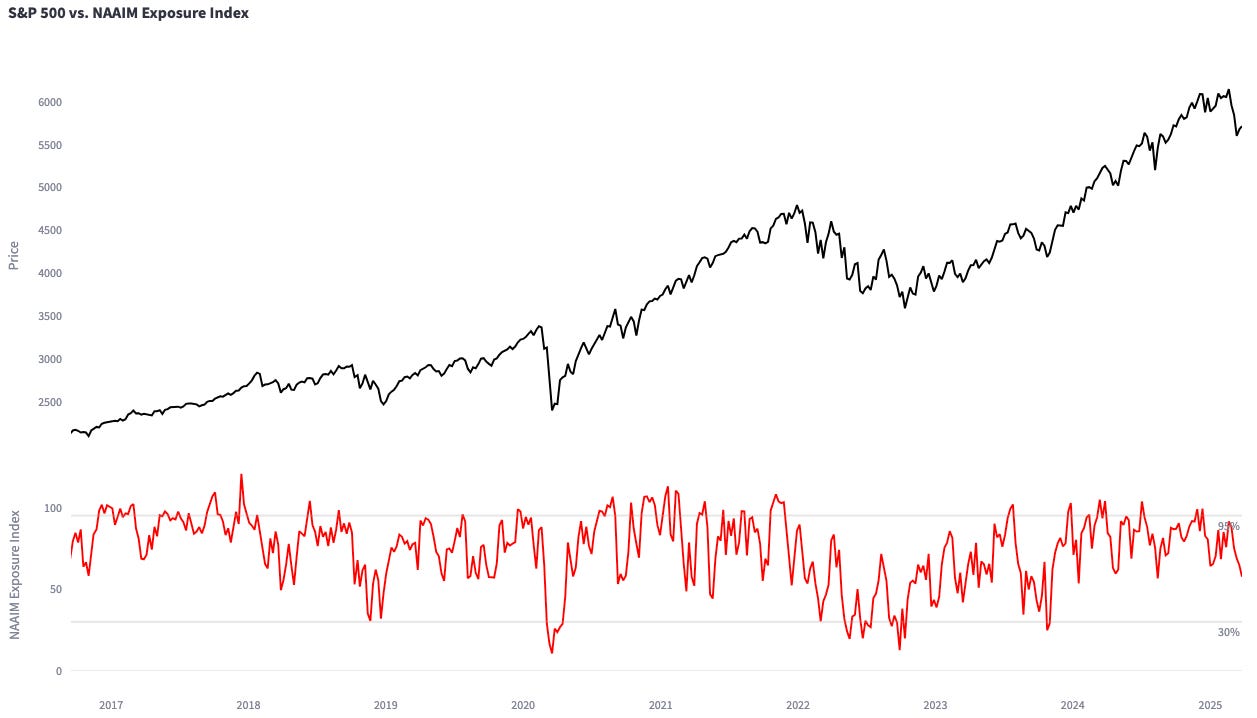

While sentiment has hit extremes, positioning tells a slightly different story—it’s not as bearish as one might expect. Household exposure to U.S. equity markets remains substantial, with allocations sitting at record-highs. Shorter-term indicators, like the NAAIM Exposure Index, have yet to signal a full capitulation:

Not every indicator needs to flash a buy signal or hit rock-bottom extremes for an opportunity to emerge. Rarely do you get a “perfect setup” where all lights turn green simultaneously. That said, we might still need a bit more pain to shake things out—perhaps the sentiment surveys are overstating the distress investors are actually experiencing.

Hard Data: Not as Bad as the Market Thinks?

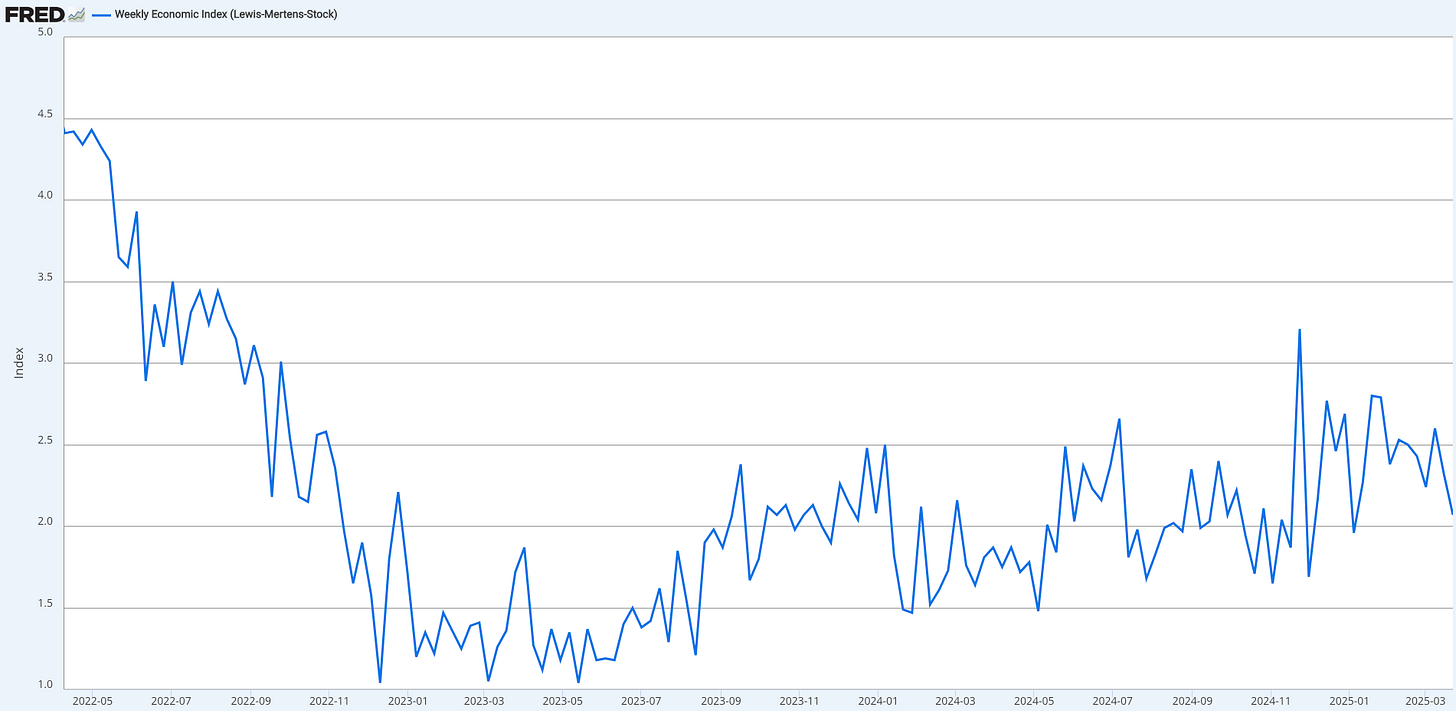

Equity valuations are stretched, earnings expectations are lofty, and tariff threats are injecting uncertainty into the minds of business leaders. From the outside, this mix looks grim and leads to investors dialling back risk. Yet, the hard data isn’t as dire as the market seems to believe. The NY Fed GDP Nowcast projects 2.8% growth for Q1 2025 and 2.6% for Q2 2025. The Weekly Economic Index hasn’t shown any meaningful slowdown either.

For now, the data doesn’t fully support the recent equity drawdown. But markets look ahead, and tariff uncertainties are already eroding consumer confidence, which could dampen consumption down the line. Meanwhile, cuts to the fiscal deficit are poised to remove a GDP tailwind that supported growth in recent years.

There’s also buzz around DOGE proposals to slash 25-35% of the federal workforce—roughly 800,000 jobs. That alone could push the unemployment rate up by 0.5%, and that’s before factoring in contractors, consultants, and broader ripple effects, which could easily double the impact.

Friday’s personal income and spending data triggered another equity sell-off. Spending rose 0.4% (below the 0.5% expected), while income surprised to the upside at 0.8% (versus 0.4% anticipated). The market’s reaction likely stemmed from weaker services spending: real personal spending on services grew at just 2.27% year-over-year—the softest reading since August 2023 (2.24%) and September 2023 (2.17%).

Back in 2023 when real personal spending on services was weak, growth concerns weighed heavily on markets. The S&P 500 began sliding in early August, a decline that stretched through late October. Over those three months, the peak-to-trough drawdown reached 11%.

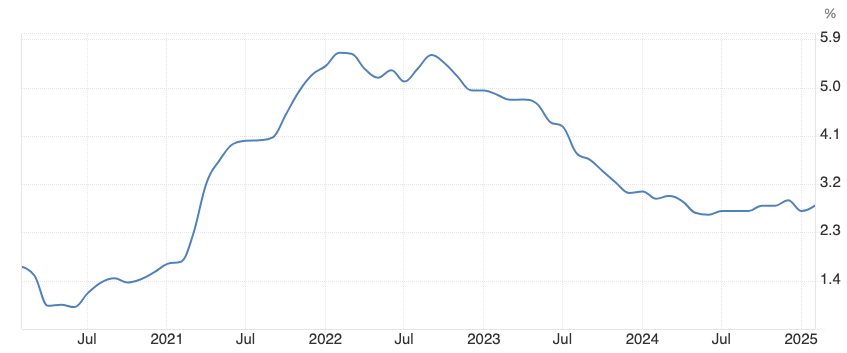

Then, a shift occurred. U.S. 10-year yields started to ease, and equities began to sense that a recession wasn’t in the cards. Between mid-October and the end of December 2023, the U.S. 10-year yield dropped from 5.02% to 3.78%. This retreat in yields marked a notable loosening of financial conditions, providing a tailwind for equity markets.

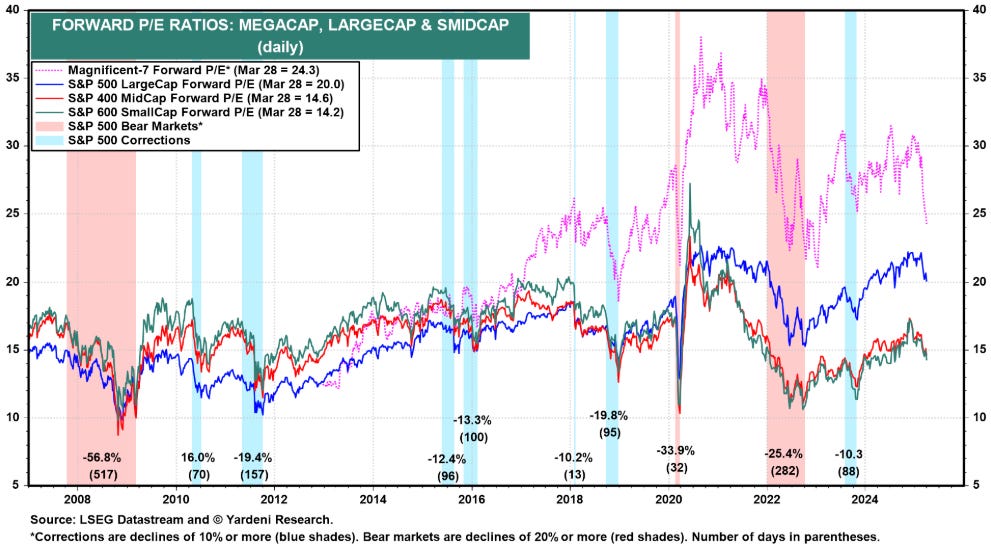

It’s worth noting that when equities kicked off their rally in 2023, valuations painted a mixed picture. Large-cap, mid-cap, and small-cap P/E ratios sat lower than today, while the P/E ratios of the ‘Magnificent 7’ stocks were higher. Keep in mind these are forward P/Es, which means they depend on whether NTM EPS materialises.

If equities drop another 5% amid tariff uncertainty, but the economy sidesteps a recession and earnings climb 5-10% in 2025, P/E ratios could start looking reasonable again. The critical question remains: will the U.S. economy slip into a recession?

Currently, I’m leaning toward a slowdown rather than an outright recession. A shrinking fiscal deficit, DOGE initiatives, and tariffs are almost certain to cool the U.S. economy. Yet, a recession doesn’t feel imminent—the hard data remains too resilient to suggest otherwise.

Here’s an interesting twist: Friday’s higher-than-expected PCE inflation print sparked a bond rally. U.S. 10-year yields dipped despite the hotter inflation data. Even if the short end of the yield curve would price out rate cuts for 2025 due to higher inflation prints, will the 10-year yield align with the White House’s preferences? A lower yield could certainly juice economic activity—similar to late 2023.

For now, I’m staying on the sidelines, though I’m eager to catch the next major upswing. Sentiment surveys are hinting at a bottom, but they might be premature. I will wait for equities to rise on negative news, paired with my indicators flashing green. At that point, the risk-to-reward ratio for betting on an equity rally should be favourable.

Front-End Pricing and Inflation

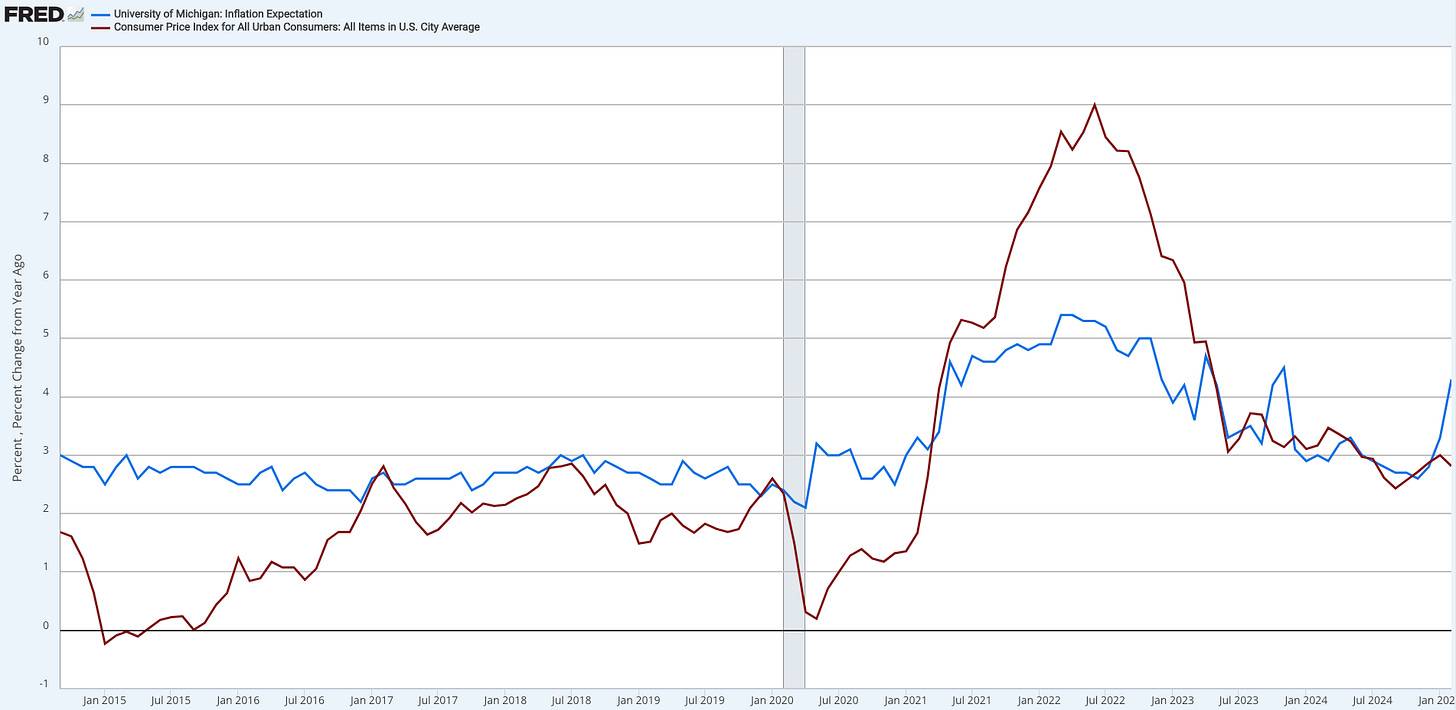

According to the CME’s FedWatch tool, bonds are currently pricing in three rate cuts for 2025. However, with Friday’s core PCE inflation print exceeding expectations, inflation expectations from the University of Michigan (UoM) survey ticking higher, the unemployment rate near historic lows, and hard data holding firm, this pricing seems a tad rich.

Inflation remains a tricky story. Real-time gauges like Truflation suggest U.S. inflation has already dipped below 2%.

Yet, the University of Michigan’s inflation expectations survey points to a re-acceleration, likely fuelled by tariff concerns.

Core PCE, meanwhile, sits at 2.7% year-over-year. The Federal Reserve projects it will climb to 2.8% by the end of 2025—and even then, they anticipate two cuts next year.

Bonds appear to be riding some momentum. Despite Friday’s hotter-than-expected core PCE data, they rallied—a signal that there might be more room to run. This suggests even more cuts could be priced out of the front-end.

If equities stumble over the next 1-3 weeks and the front-end prices 3-4 cuts for 2025, I’d view that as an overreach worth fading. In such a scenario, shorting SOFR December 2025 futures could be a smart play, betting on the Fed delivering only 1-2 cuts instead. For now, I’m staying neutral on bonds.

Final Thoughts on Potential Macro Trades

I hope you found this newsletter insightful. For now, I do not see many opportunities that align with my trading style, so I am staying on the sidelines. But I would like to offer a few thoughts on trades that could develop later this year:

In the currency space, shorting JPY would have paid off nicely. I opted for a long S&P 500 position instead, expecting the two trades to move in tandem (short JPY equates to betting against a safe-haven asset). I should have gone short JPY instead of long S&P500 — I would still be in the trade.

NZD has traded weak in recent days, and positioning has eased from its extremes over the past few weeks—both factors keeping me from going long.

Long European equities or EUR ranks among the most consensus macro trades out there. But Europe’s rally, particularly in Germany, occurred because of debt-fuelled stimulus rather than structural reforms. Europe is still a bureaucratic monster that regulates, not innovates. Positioning in the Euro isn’t crowded long yet, but it’s trending that way, potentially setting up an appealing short opportunity later this year.

Silver has enjoyed a strong run since January and may be nearing crowded-long territory. It’s an asset I’m monitoring closely for a possible tactical short. In the long-run, let’s say 3-5 years, I think silver is a great investment with a compelling fundamental bull case around AI and solar energy.