Inflation, Growth, and Powell's Testimony: What It Means for Markets

NFP revisions, a hot inflation print, the GDP Nowcast at 2.3%, and Powell's testimony before the House and Senate—what does this mean across asset classes?

In this article, we take a look at 1) the labor market, 2) inflation, 3) economic growth, 4) Jerome Powell’s testimony, and 5) actionable insights across asset classes. Let’s dive right in!

Labor supply constraints

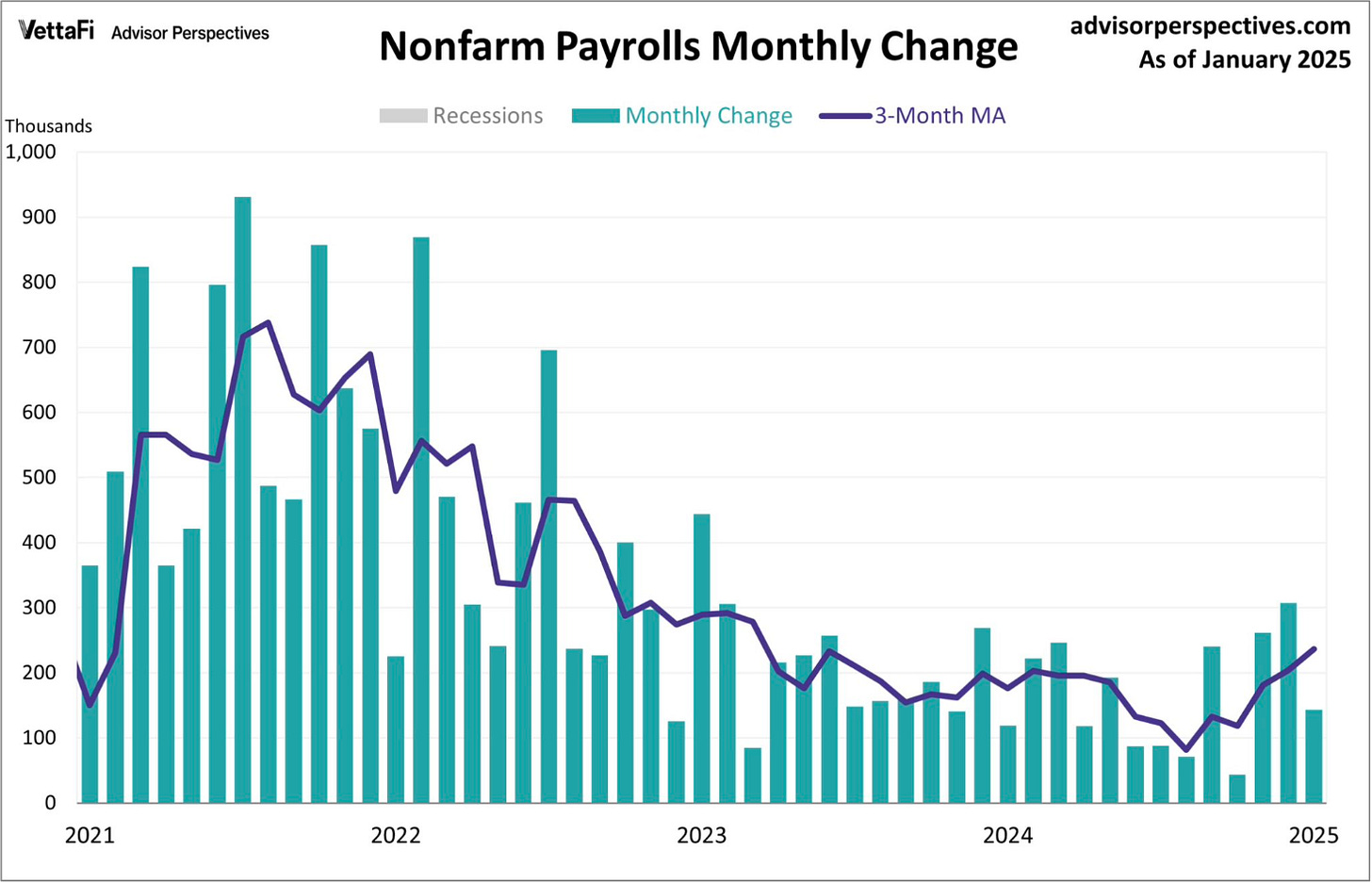

Last week’s NFP revisions indicate a resilient labor market. The 3-month moving average for NFPs stands at 237K, well above the 150-160K needed to keep the unemployment rate stable. While early signs of softening are emerging—such as the latest NFP print missing expectations—this does not necessarily signal an imminent rise in unemployment. Meanwhile, border encounters have declined by 87% since Trump took office. If deportations accelerate to 500-600K annually, labor supply constraints could intensify.

CPI - A rough ride back to 2%

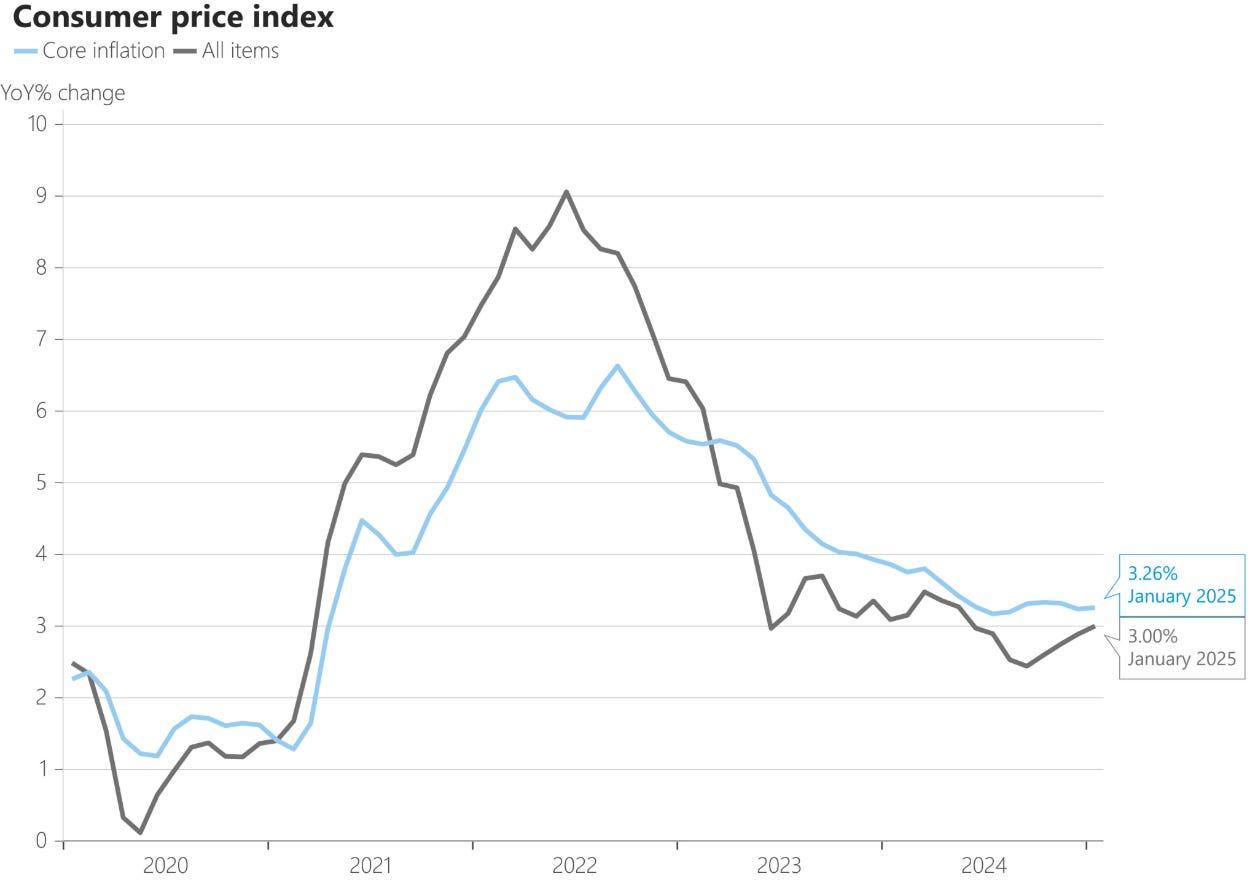

Last month’s December CPI print was heavily influenced by seasonal adjustments, making it less reliable. In contrast, this week’s CPI report was undeniably hot. Core CPI rose 3.3% year-over-year, exceeding the 3.1% forecast, while headline CPI surprised to the upside at 3.0% versus 2.9% expected. Supercore CPI surged 0.75% month-over-month, marking its highest reading since last January. While the overall trend in inflation remains downward, the path remains uneven.

Source: Nick Timiraos

Thursday’s PPI came in hotter than expected at 0.4% month-over-month, surpassing the 0.3% forecast. Surprisingly, rates rallied following the release. It seems the market took Powell’s comments from Wednesday’s testimony to heart. He cautioned against overreacting to the CPI print, emphasizing that the Fed targets PCE inflation, which he considers a more reliable measure.

Despite the stronger headline PPI, key components that feed into core PCE—such as healthcare, insurance, and airline fares—came in weaker. As a result, many economists revised their core PCE estimates lower. Samuel Tombs even described the data as “about as good as the Fed could have hoped for” on X.

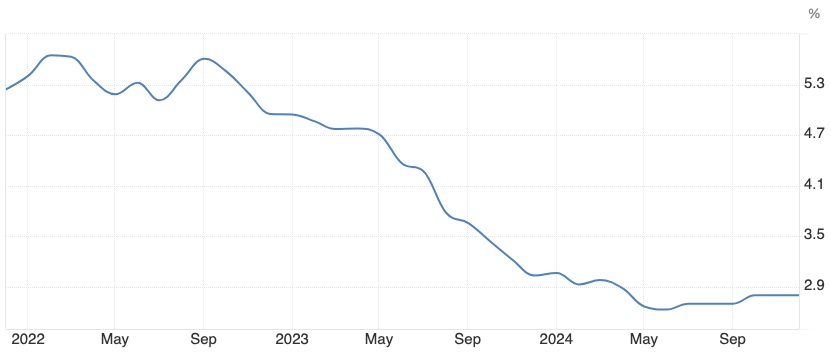

Both the Fed and the White House favor lower interest rates. With the effective fed funds rate at 4.33% and core PCE at 2.9% (see chart below), real rates sit at 1.4%—a level the Fed deems “moderately restrictive.” If core PCE falls to 2.5% and real rates approach 2%, I believe the Fed could justify a 25bps cut, framing it as a “recalibration.”

There is certainly a risk that inflation stabilizes above 2%. However, the bar for additional rate hikes remains high, meaning the Federal Reserve would likely keep interest rates unchanged in this scenario. For inflation to meaningfully re-accelerate, a supply shock would likely be required. Absent such a catalyst, I see inflation stabilizing above 2% as a greater risk than a renewed acceleration.

While many make the bearish case for inflation re-accelerating, there are also factors that could push core inflation lower. For example, the lagging shelter inflation component is poised to decline. Truflation has decelerated in recent weeks, potentially signaling disinflationary pressures ahead.

US exceptionalism - There is no need to think in absolutes

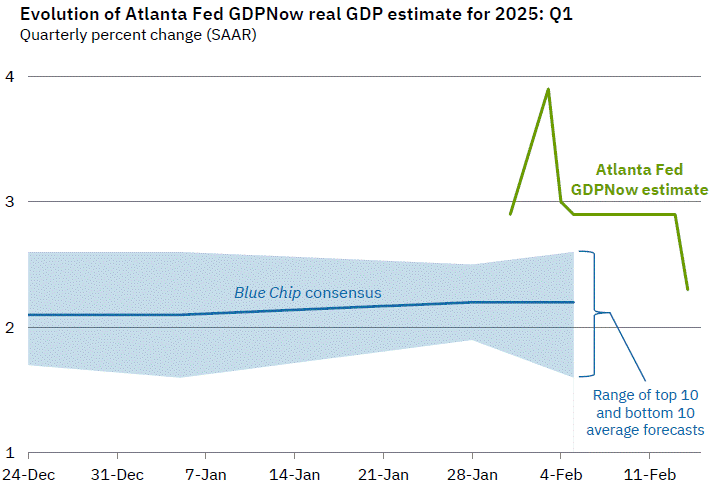

In markets, there’s no need to think in absolutes. It’s not about choosing between “recession” and “no recession.” The devil is in the details. It’s enough to anticipate 1.5% GDP growth over the next twelve months instead of 2.5%. What matters is how that view compares to market expectations. Currently, markets are pricing in “U.S. exceptionalism” and GDP growth above 2% in 2025.

Friday’s retail sales report underscored the market’s sensitivity to weaker growth data. Sales declined -0.9% month-over-month, well below the -0.2% forecast. In response, rates rallied, and the short end (U.S. 2Y future) is now trading higher than pre-CPI levels from Wednesday. The Atlanta Fed’s GDP Nowcast dropped to 2.3% following the retail sales release.

Since September, the U.S. 10-year yield has risen from 3.6% to 4.48%, while the dollar index has climbed 7%. Financial conditions have tightened, and with a lag, this will eventually filter into the real economy, weighing on growth. If the U.S. government also reduces its fiscal deficit, the resulting fiscal drag could further dampen economic activity. The bull case for fixed income rests on shelter inflation driving core inflation down to 2% and growth underperforming expectations.

Comments from J. Powell on QE and the SLR

This week, Powell testified before the House and the Senate. In his testimonies, he made some interesting comments on QE/QT and the Supplementary Leverage Ratio (SLR). Powell said "QE is a tool we only use when rates are already at zero”, he thinks reserves are “meaningfully above ample”, and there are “ways to go” on the balance sheet runoff. His comments that “reserves are ample” and “QT will continue” were unsurprising, given that reserve balances as a percentage of total bank assets remain significantly higher than during the September 2019 repo spike.

Powell made it clear that QT will continue for some time. His remarks suggest the Fed will only halt QT if signs of funding stress emerge in money markets—which, at present, they have not. Even if the Fed stops QT, that doesn’t mean QE will restart; the more likely scenario is a stable balance sheet rather than expansion through QE.

That said, the Fed can introduce new facilities to inject liquidity into markets. My best guess is that it will roll out a centrally cleared repo facility where dealers must pre-position collateral, similar to the discount window—but without the stigma. This would allow the Fed to supply reserves to the banking system without resorting to QE.

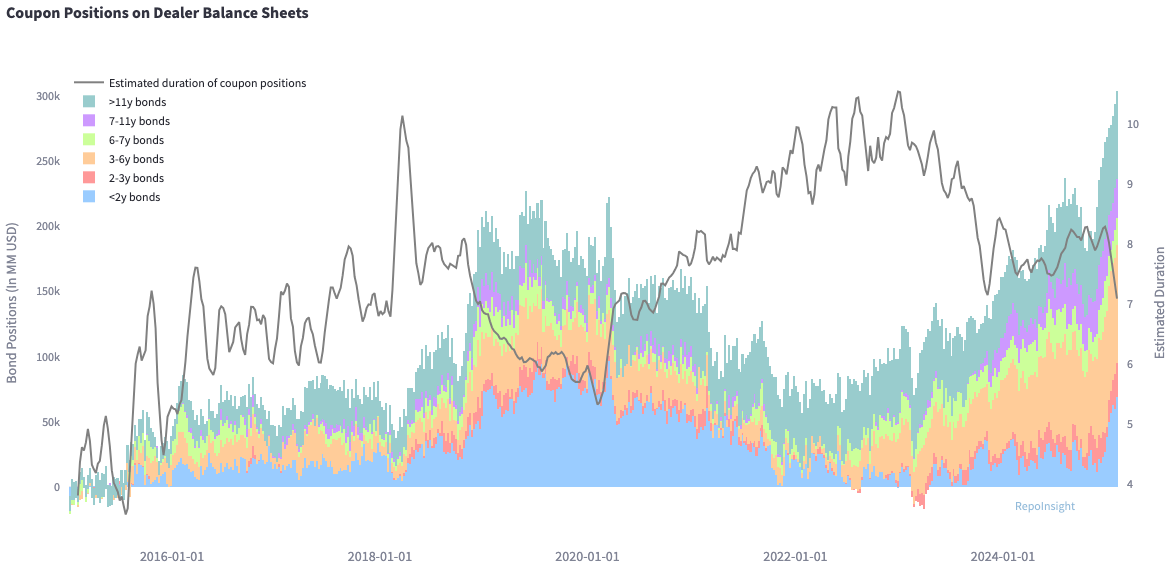

During his testimony, Powell also acknowledged concerns about liquidity in the Treasury market: “I have for a long time, like others, been somewhat concerned about the levels of liquidity in the Treasury market. The amount of Treasuries is growing much faster than the intermediation capacity has grown, and one obvious thing to do is to reduce the effective supplemental leverage ratio.”

The SLR is a capital requirement that mandates banks to hold a minimum percentage of Tier 1 capital against their total leverage exposure, including assets like USTs and reserves at the Fed. Lowering the SLR would allow banks to hold more USTs on their balance sheets. During COVID, USTs were temporarily exempt from the SLR to improve Treasury market liquidity. Currently, primary dealers are already holding significant amounts of USTs on their books.

What are the two main effects of lowering the SLR?

Many banks are balance sheet-constrained. Lowering the SLR would free up trillions in balance sheet capacity, allowing banks to buy more USTs and extend additional balance sheet capacity—i.e., leverage—to clients.

A lower SLR is positive for swap spreads. USTs would see stronger demand relative to swaps because primary dealers would face fewer balance sheet constraints when holding USTs. As a result, swap spreads tighten—a trend already underway.

In short, a lower SLR is broadly positive for financial markets, as it increases available balance sheet capacity and leverage.

A tough week if you are long US dollar

Entering 2025, the market is and still remains long US dollars. However, with elevated growth expectations, the long U.S. dollar thesis has become less compelling. When economic data comes in strong, the US dollar does not react much anymore, but when weaker data comes in, the US dollar sells off. The U.S. dollar performs well when the U.S. economy outpaces the rest of the world, a dynamic that has played out over the past few months and is likely already priced in.

The bull case for the U.S. dollar was also driven by tariffs, but Trump has repeatedly delayed them—most recently, reciprocal tariffs were postponed until April 1st. To summarize: 1) The market remains long U.S. dollars, 2) Economic data is no longer surprising to the upside, 3) Tariffs have been delayed, 4) The Fed is unlikely to hike, with rate cuts largely priced out, and 5) U.S. equities have underperformed international markets year-to-date.

I have made the case for long GBPUSD and long AUDUSD for some time now. Both ideas have worked well. Stronger European economic data, no tariff threats to the UK, higher inflation in the UK suggesting sustainably higher rates, and hopes for an end to the Ukraine-Russia war are all positive for the British Pound. GBP even shrugged off the dovish BoE rate cut last week.

My long AUD thesis was primarily based on stronger Chinese equity markets and commodities, such as copper. However, I’m becoming more cautious with AUD now, as I believe Chinese equity markets may be due for a reversal, which could trigger some AUD selling.

Chopfest in fixed income

I am leaning bullish the short-end for a few weeks now. So far, it has been a chopfest with sideways action. The latest price action was bullish - the US 2y future is trading higher than where it was pre-CPI release. I think the risk/reward for a long US 2y future position is still favourable. If economic growth remains robust and inflation stabilises above 3%, the Federal Reserve likely does not cut rates this year. In that scenario, this trade loses money. However, if the economy slows down and shelter inflation decelerates, which then pushes core inflation closer to 2%, the bond market could price 50-75bps of cuts instead of 25bps in 2025.

Equities - It is tough to short an asset with upward drift

Equities remain an interesting case. While valuations and earnings expectations are elevated, I’ve emphasized over the past few weeks that high valuations alone are insufficient. There needs to be a catalyst for a sell-off, and even if one emerges—such as the JPY deleveraging from July/August 2024—equities would require a steady stream of negative news for a prolonged sell-off. Equities tend to have an upward drift over time due to growing earnings, which makes it difficult to short them.

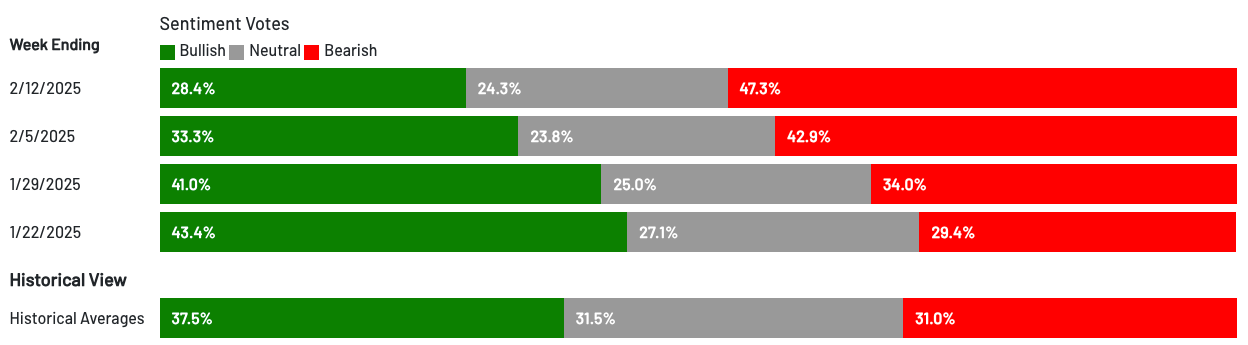

Tariffs could have been a potential catalyst, but with most of them delayed, the credibility of the "tariff threat" is weakening. Markets are pricing out both the probability and magnitude of tariffs, becoming increasingly more desensitised to its potential impact. Not to mention that equities rarely sell off when the sentiment is bearish. And right now, the retail investor sentiment as measured by the AAII survey is surprisingly bearish considering we are trading close to all-time highs.

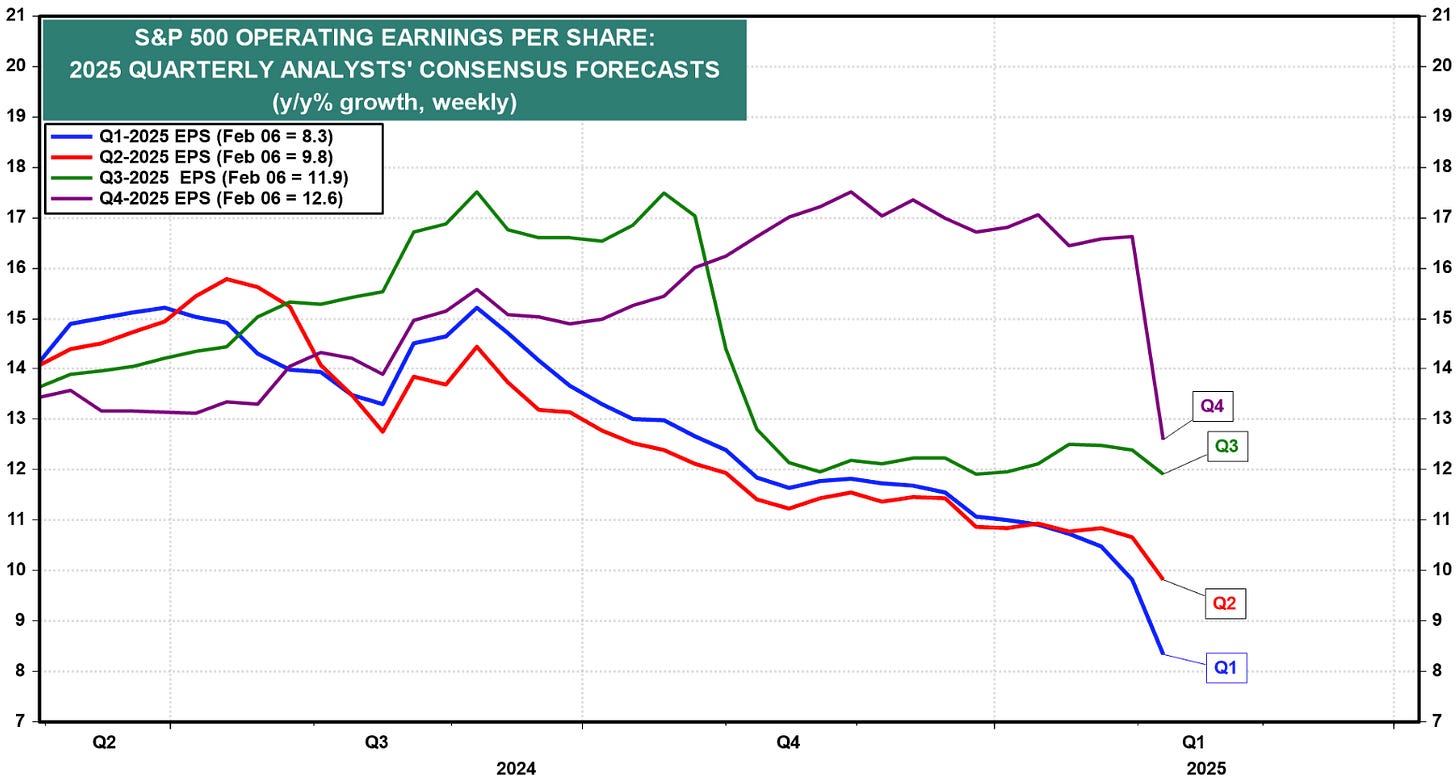

For equities to sell off meaningfully, earnings would need to disappoint. However, Q4 earnings have surprised to the upside—consensus expected +8.2%, but earnings rose by +13.3%. Expectations are certainly higher now, yet companies continue to exceed them. Interestingly, analysts have lowered earnings expectations for Q1, Q2, and Q3 of 2025. While macro analysts believe expectations are elevated, could analysts actually be too pessimistic? That would set the stage for the ultimate turnaround.

Gold - Is it time to rethink the investment thesis?

I have been invested in gold with 5-10% of my net worth in the past four years. At the moment, my allocation is lower. The environment remains positive for gold, and I like having an uncorrelated asset in my portfolio. However, a reduction in government spending ("DOGE") and the potential for a peace deal in Ukraine - which would reduce geopolitical risks - could dampen demand for gold. Friday's price action, with gold falling despite bonds rallying and the U.S. dollar selling off, was a concerning sign.

Crypto - BTC positioning turning positive again

If rates rally and equity markets strengthen, could crypto start to perform again? I came across two interesting headlines this week:

Abu Dhabi’s sovereign wealth fund purchased $436 million in BTC ETFs in Q1. Is this the beginning of sovereign wealth funds buying crypto?

Hedge fund Millennium Management reported holding $2.6 billion in BTC and $182 million in ETH ETFs. Is this solely related to crypto basis trading (long the ETF, short the futures), or does it reflect directional risk? Either way, it signals growing crypto adoption.

Bitcoin seems to be stabilizing—could the next trade be rotating out of gold and into BTC?

I hope you enjoyed this article. I am planning to write about my views and trade ideas more often on Substack. Subscribe, so you do not miss them - it is 100% free.