From Crypto Crash to Year-End Rally, Gold Bubble, and Oil Selloff

New 100% tariffs on China. Crypto market cap down 21% in a day. The mighty U.S. dollar - and stretched positioning in gold and oil.

Dear readers,

There’s a lot to unpack this week. Nothing has changed in my trading account - I’m still long U.S. dollars. That said, some very interesting opportunities are shaping up for the final quarter of the year. Let’s dive right in.

Equities & Crypto: Leveraged Investors Got Taken Out

Friday brought a proper unwind of risk positions across the board. In total, $19.3 billion was liquidated from the crypto market, with over 1.6 million traders running their accounts to zero.

Total crypto market capitalization fell from $4.13 trillion to $3.24 trillion within hours - a 21.5% drawdown - before rebounding to around $3.7 trillion. To put that move into perspective: on October 19th, 1987, the S&P 500 recorded its largest single-day percentage loss, dropping 20.5%.

In flash crashes like this one, leveraged traders get taken out - and that’s exactly what the market needed. There was simply too much leverage in the most volatile asset class in the world. Equity markets, meanwhile, felt similarly frothy.

Early last week, several CNBC guests said things like “It’s a bubble, but it will continue,” or “I’m bearish, but I expect a year-end rally.” Comments like those suggest even the bears have climbed aboard, and that short-term positioning had become excessive.

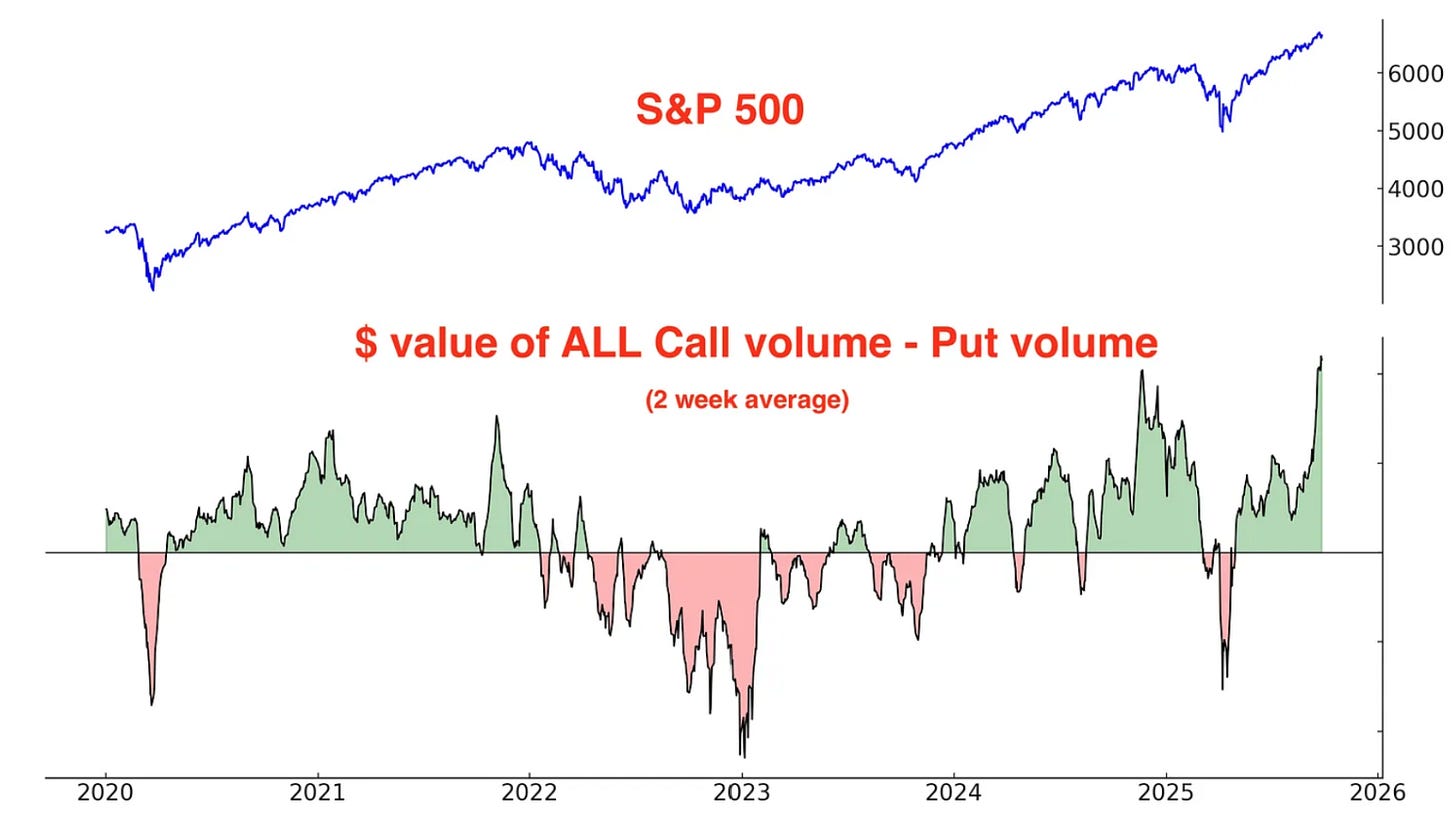

Retail investors bought $100 billion worth of equities last month, according to Morgan Stanley - the largest one-month inflow on record. Call-minus-put demand in dollar terms also looks stretched. Take a look at the chart below.

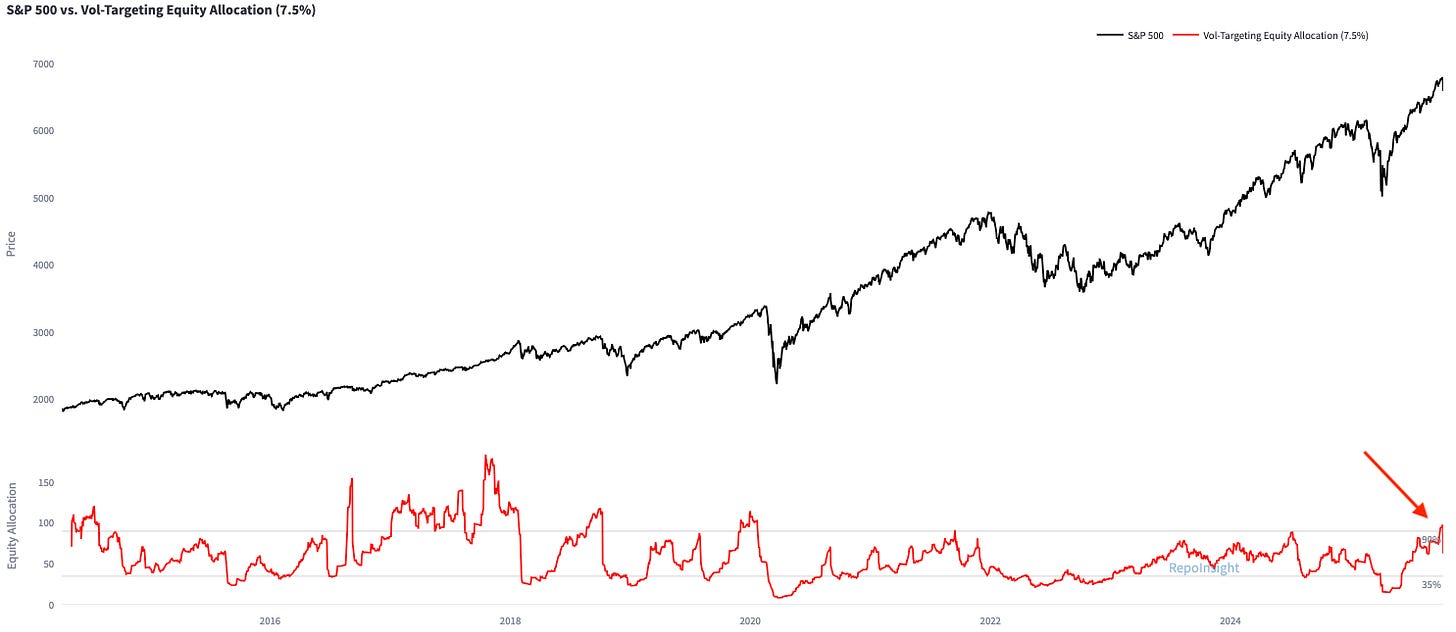

CTAs (trend followers) and vol-targeting funds are all in. Friday’s sharp increase in realized volatility means vol-targeting funds now have to reduce their exposure. Depending on how much they already cut into the Friday close, we could see additional selling pressure from this group on Monday.

And who triggered the washout? China widened its export-control regime to cover a broad range of rare earth elements, downstream magnets, alloys, chemical mixtures, and processing/refining technologies.

Exporters must now apply for licenses, and Beijing said approvals will be denied for uses tied to defence or other “sensitive” fields, with semiconductor and advanced-tech applications under close scrutiny.

China’s controls are broader than before, and can even extend to foreign products containing Chinese inputs. Keep in mind: export controls are inflationary, often leading to bottlenecks and stockpiling.

Trump immediately reacted with new tariffs. The following two headlines dropped on Friday:

TRUMP: U.S. WILL IMPOSE 100% TARIFF ON CHINA STARTING NOV 1

TRUMP: U.S. TARIFF ACTION BASED ON CHINA’S EXPORT CONTROLS

The market consensus seems to be that there will be a “rare earth metals deal” with China in the coming weeks. Trump has no interest in the status quo - i.e., maintaining both 100% tariffs and strict Chinese export controls.

But it’s tough to say what such a deal might look like. Will it mean fewer export controls and “only” 50% tariffs? Trump will attend the APEC summit in South Korea (October 30th–November 1st), and I still expect him to meet Xi and potentially negotiate a deal there.

TRUMP: HAVEN’T CANCELED XI MEETING

TRUMP: MIGHT STILL HAVE XI MEETING

Over the next couple of weeks, uncertainty will remain high — and equities do not like uncertainty. From a seasonality standpoint, October 26th marks the Q4 low for the S&P 500, with November and December typically strong buyback execution months for U.S. corporates.

My base case is tough sledding into the end of October, followed by a constructive Trump–Xi meeting at the summit, and then bullish flows into year-end. The only thing that worries me about this view is that it feels close to consensus — and I’m willing to adjust it if the news flow changes.

The US Dollar is Back! Still the best Fiat Currency?

I’m long equities in my long-term investment accounts, but flat in my active trading account. The only position in my EUR-denominated trading account is long U.S. dollars. The points below summarize last week’s roller coaster:

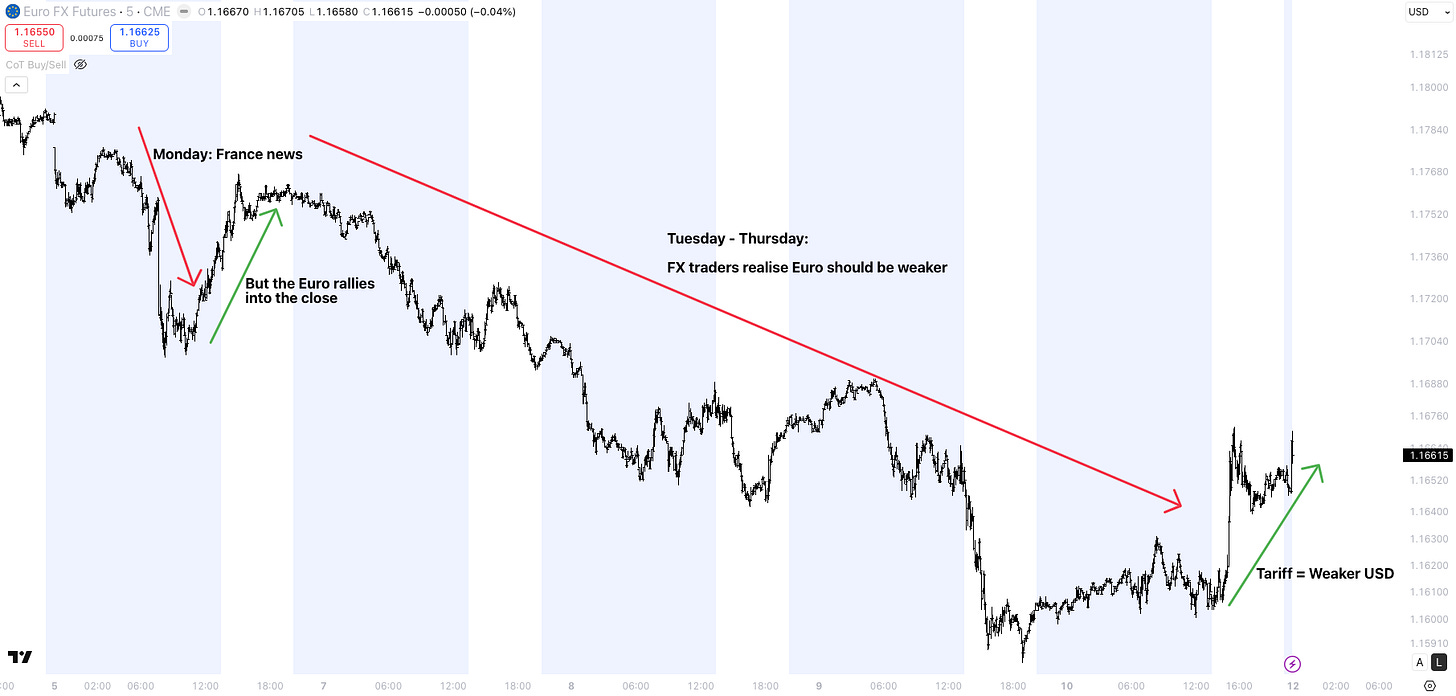

Monday: The Euro fell more than 0.7% against the U.S. dollar after the news out of France but recovered almost all its losses by the end of the day.

Tuesday to Thursday: It felt like the market took a step back and concluded that, among all fiat currencies, the U.S. dollar still stands out as one of the best options.

Friday: Tariff headlines spooked markets, and the U.S. dollar weakened again.

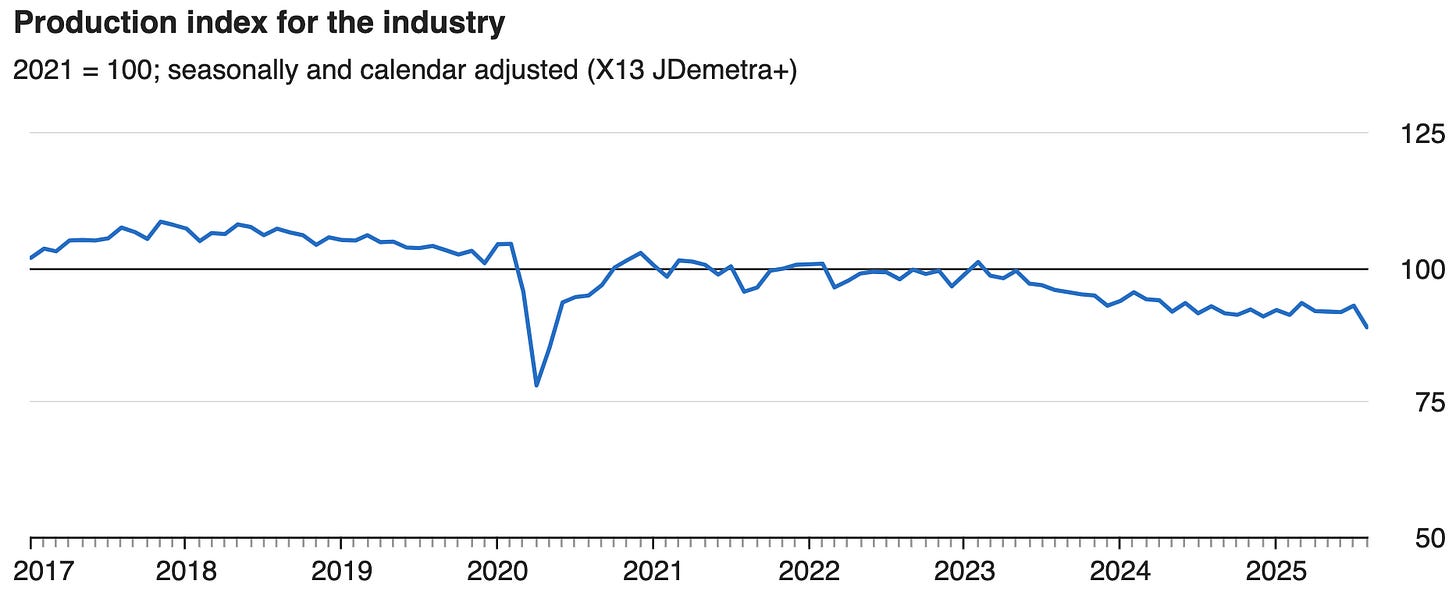

One of the main catalysts for the weaker euro was disappointing German data. On Wednesday, Germany’s industrial production came in far below expectations: –4.3% m/m vs. –1.0% consensus. Given how heavily Germany still relies on manufacturing, this data point does not support the idea of a Eurozone growth re-acceleration.

On Thursday, Germany’s trade surplus widened to €17.2 billion in August (consensus: €15.2 billion). But the details revealed underlying weakness: exports declined 0.5% m/m (expected +0.3%), while the larger surplus was driven by an even sharper 1.3% m/m drop in imports, pointing to weak domestic demand.

France is facing political turmoil, and Germany won’t be Europe’s economic engine anytime soon. The Euribor futures spread (Dec ’25 minus Dec ’26) hit new lows on Friday, now pricing 6 bps of cuts. The entire Euribor curve shifted lower (blue: today, green: one week ago).

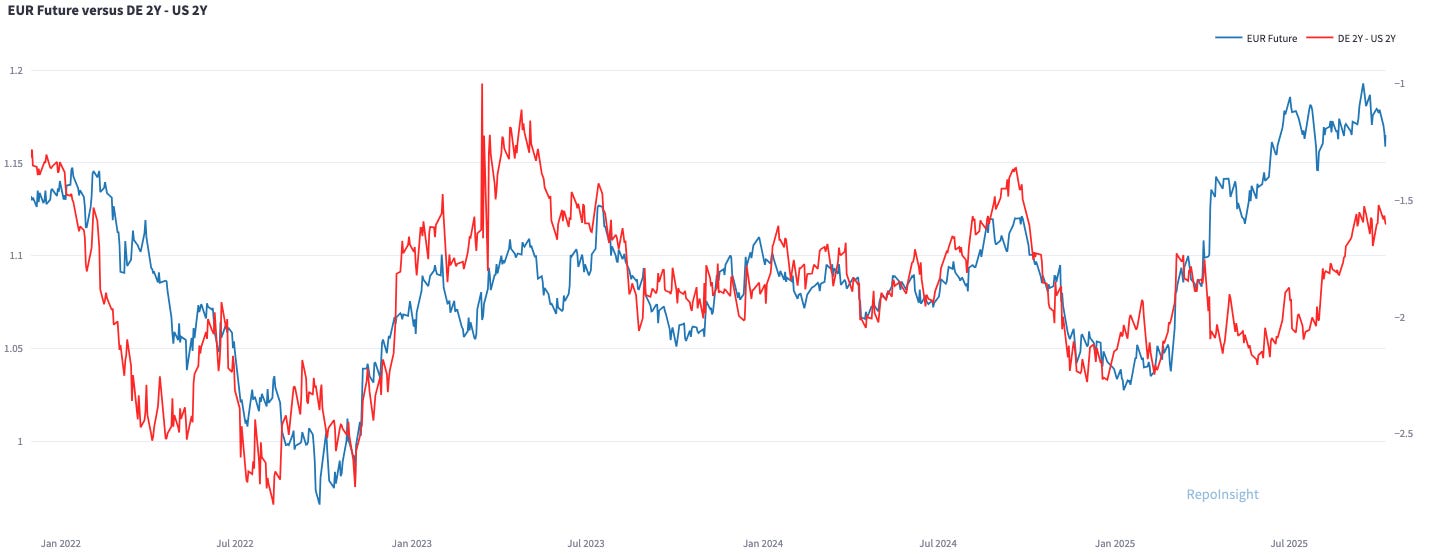

And yield spreads are starting to matter again - the 2-year Germany vs. 2-year U.S. yield spread still implies a weaker Euro.

I think there’s room for the Euro to reprice lower, but I also expect more volatility from here. I’m not sure how the market will digest the tariff headlines, or whether that could lead to short-term U.S. dollar weakness.

The Gold Bubble - Time to fade it yet?

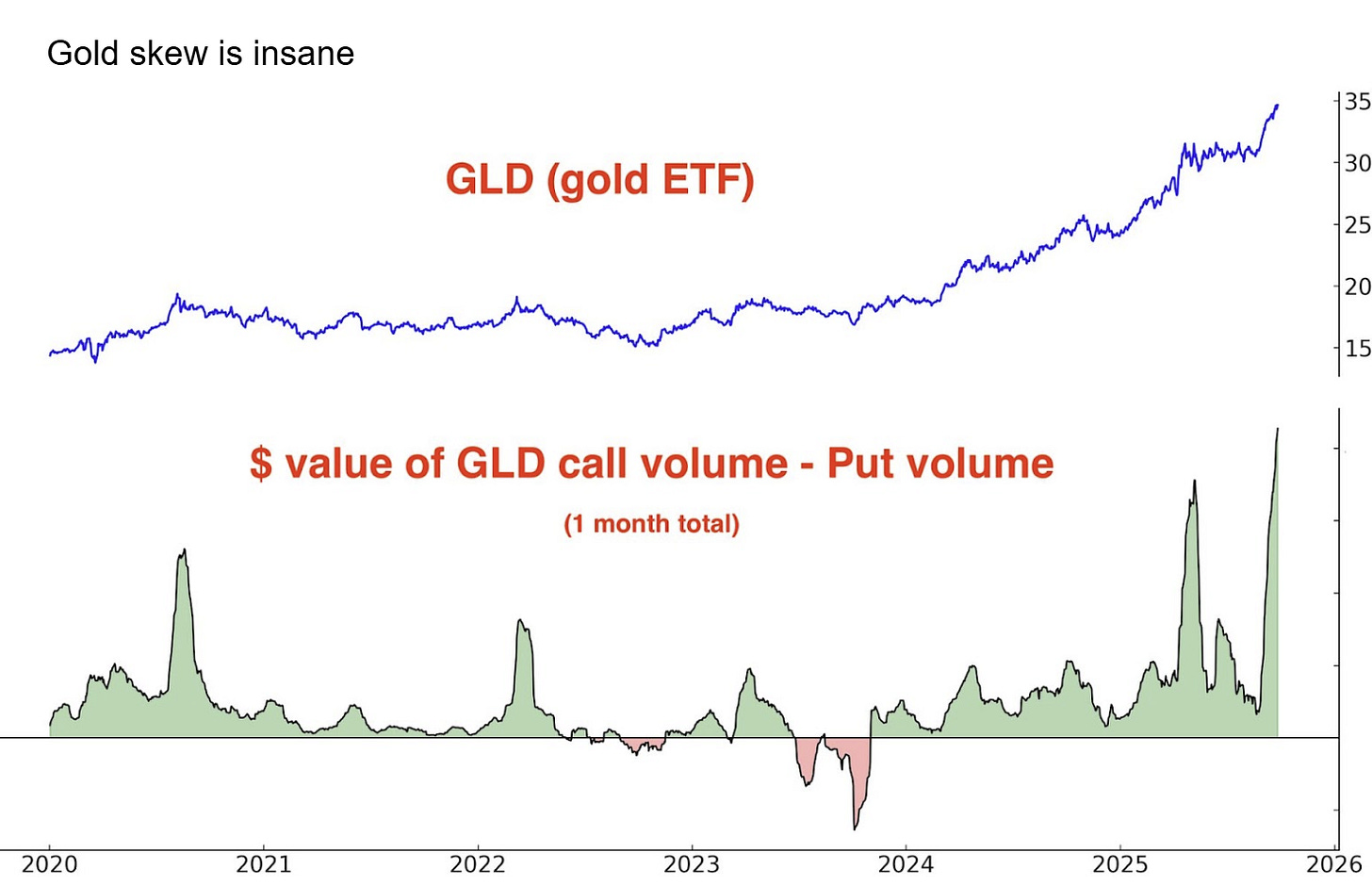

To be clear, I’m a structural gold bull - but in the short term, this move has probably gone too far. Take a look at the chart below, which shows the dollar value of calls minus puts.

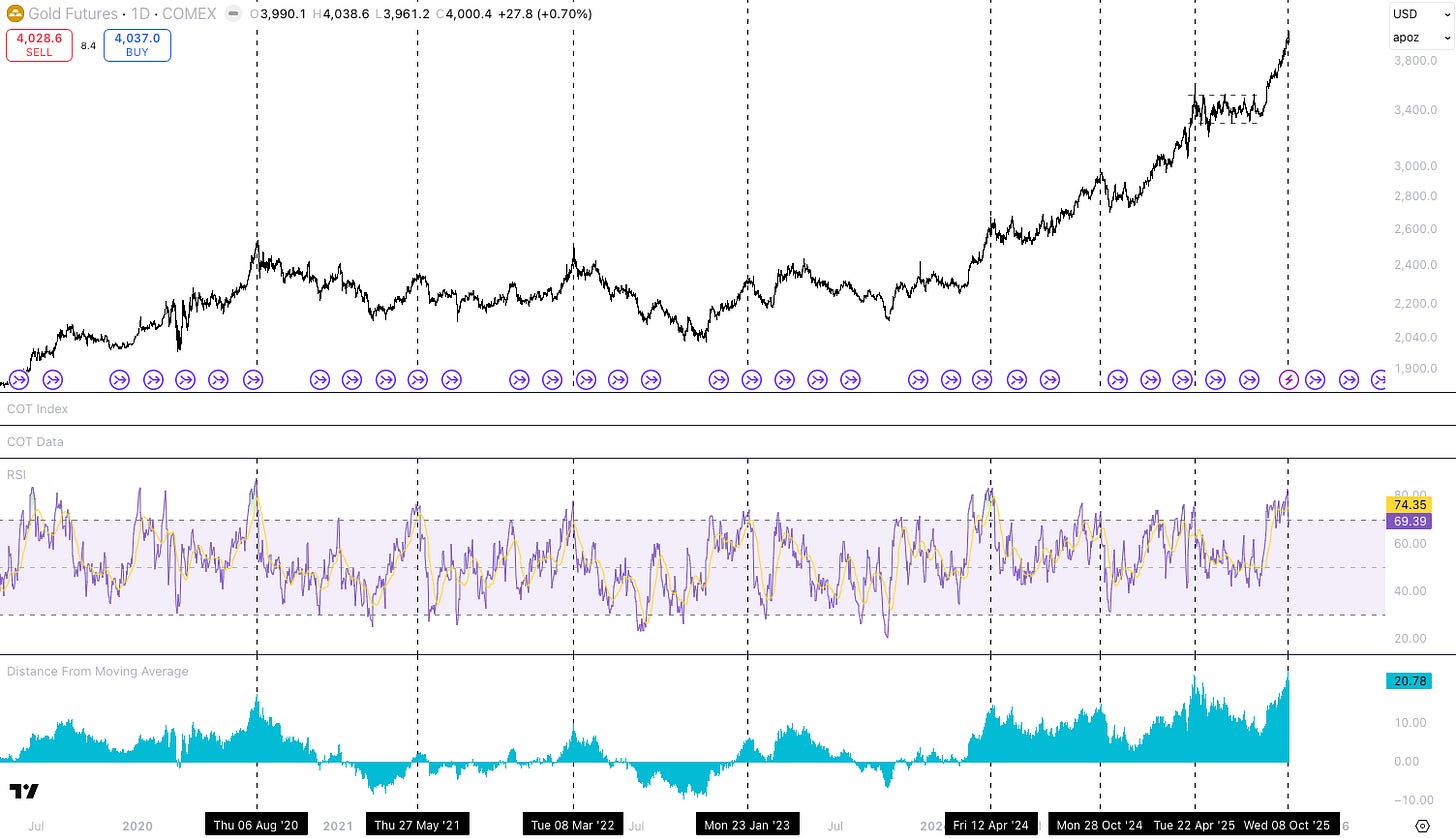

The next chart shows the RSI and the distance from the 200-day moving average. Based on these two technical indicators, it looks much more likely that gold pulls back from here.

Volume in GLD has been very high over the past three trading days, yet there’s been no price progress. Could this be distribution volume?

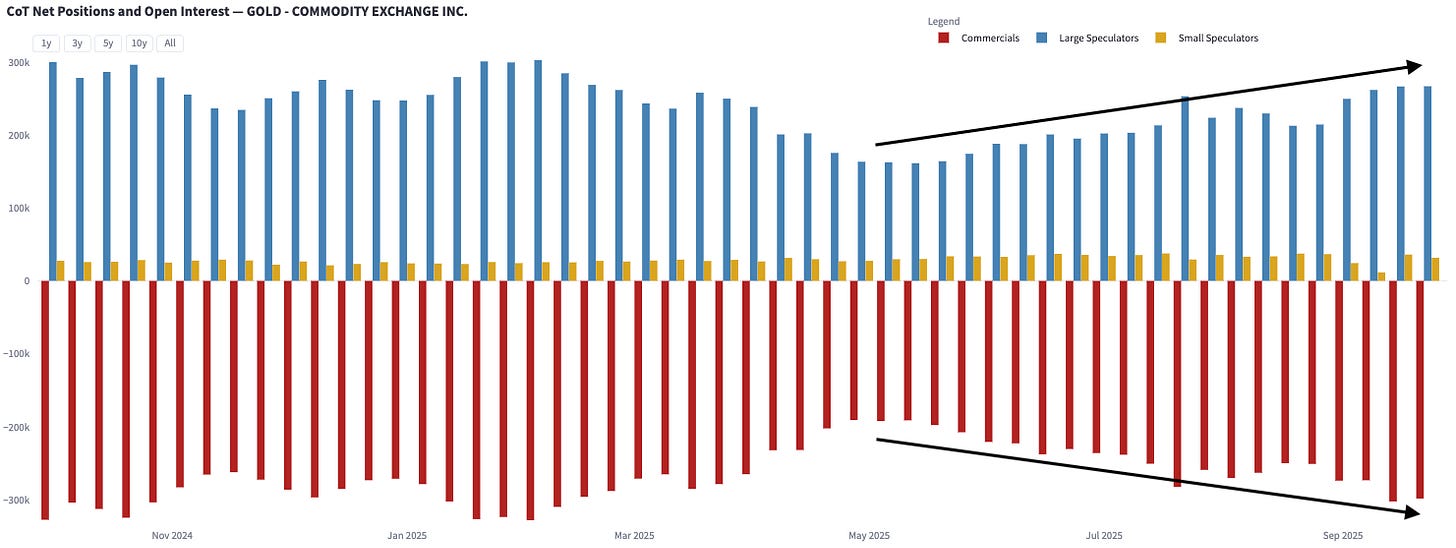

Due to the government shutdown, we haven’t had any new Commitment of Traders (CoT) data for the past two weeks. The latest release is from September 23rd, showing that large and small speculators have been building long positions in gold.

Short gold is a tactical trade I’m considering in the coming days, though I’m not sure what a good entry looks like yet. A few scenarios I’m watching for:

More tariffs or escalation between the U.S. and China — but gold closes down

A liquidity-driven bull market where equities close up but gold closes down

Some geopolitical news, yet gold still closes down

Oil Got Crushed - Is everyone short yet?

Trump wants lower energy prices. In his view, energy costs drive a large share of overall inflation. I wouldn’t be surprised if the U.S. lifts sanctions on Iran following the Gaza ceasefire. If that move leads to peace in the Middle East and lower oil prices, Trump would likely support it.

Trump: “Iran wants to work on peace now, they’ve informed us. And they’ve acknowledged that they’re totally in favour of this deal.” (Oct 9th)

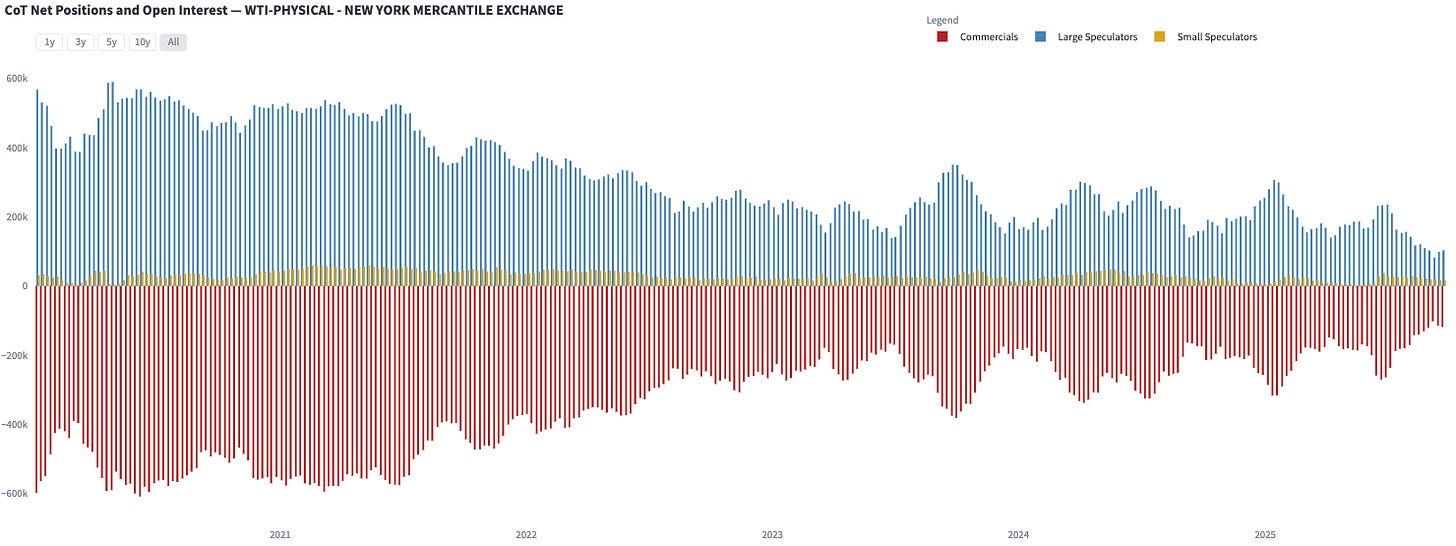

My ideal scenario was oil trading lower and sentiment turning even more bearish. Based on the latest CoT data (September 23rd), speculators are the least long oil in years.

In fact, money managers could be the most short in history right now - we’ll find out once U.S. government employees return to work and release updated data.

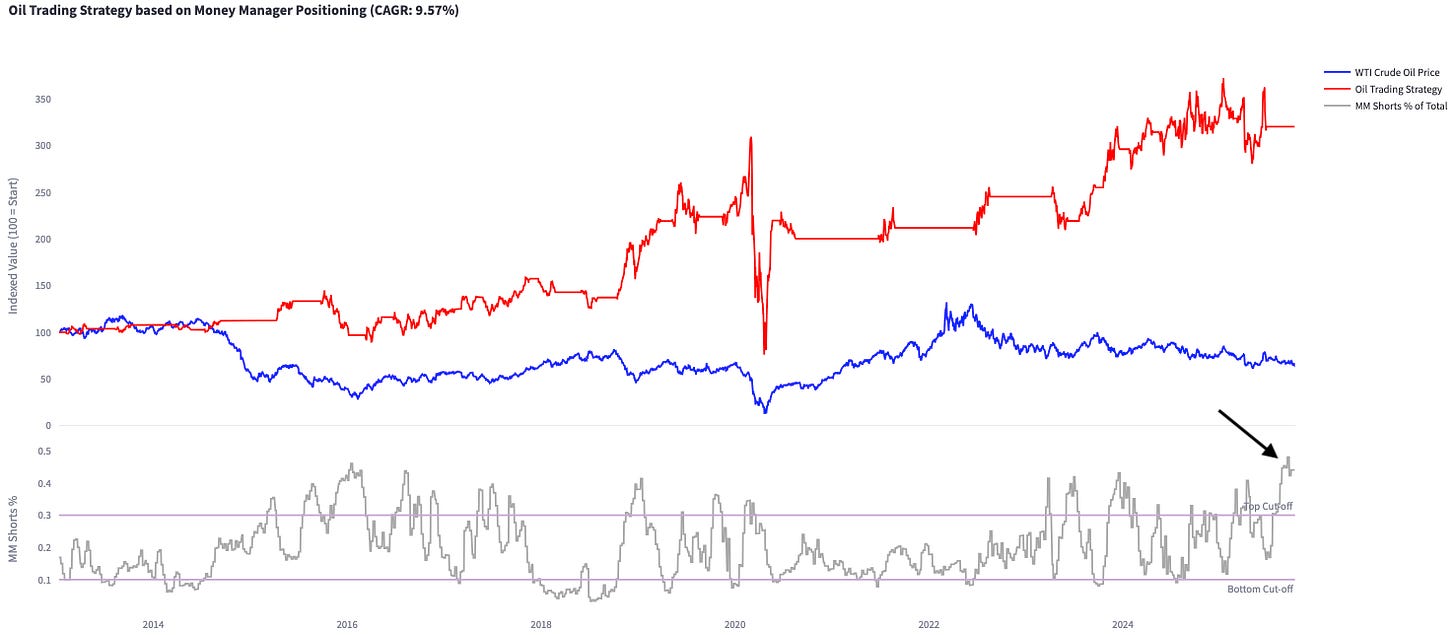

Earlier this week, I combined all strategy signals into one oil model. The strategy shifts between 50% short and 150% long. At the moment, the model is 50% long, supported by bullish inventory data. However, technicals and positioning data are not yet supportive of further long exposure.

Extreme bearish positioning could set up a great opportunity to get long oil later this year. I’ll continue to monitor price action and news flow closely in the weeks ahead.

Tail risk: Global long-end yield meltdown scenario

I have strong views on Euribor and CORRA futures. Both Europe and Canada are barely growing, and the tariffs have acted as major deflationary impulses. In both cases, I think more rate cuts than currently priced in will materialise. I don’t have strong opinions on the long end of the curve at the moment. However, there is a “meltdown scenario” or tail risk that I wanted to outline.

In Japan, the ruling Liberal Democratic Party elected Sanae Takaichi as its new leader, making her likely to become the country’s first female prime minister. In France, Prime Minister Sébastien Lecornu resigned just hours after naming his cabinet, making his government the shortest-lived in modern French history. Both events are not great for global long-end bond yields.

Takaichi is a proponent of expansionary fiscal policy. That means more debt issuance despite Japan’s debt-to-gdp ratio of >250% and core inflation above target at 3.3%. The “Takaichi-trade” is long Japanese equities and short JPY. The Japanese Yen and JGBs have lost their safe haven status and Japan’s 30-year yields are at 3.21% and rising.

France’s debt-to-gdp ratio is “only” 114%, but the cabinet cannot agree on a budget. Despite Europe’s 60% debt-to-gdp limit and maximum 3% deficit rule, France wants to continue to run ~5% fiscal deficits. There is strong resistance to structural reforms, e.g., increasing the pension age.

Japan and France are the backdrop. The trigger for a long-end meltdown is the Supreme court. If the Supreme court rules that Trump imposing IEEPA-based tariffs exceeded presidential authority and the tariffs need to be paid back, a substantial share of the tariff revenue would be lost. According to JPM, without IIEPA-based tariffs, the effective tariff rate would drop from 13-14% to 5%.

I think that’s a tail risk worth monitoring. The Supreme Court will hear oral arguments on November 5th, with a decision likely in the following months. It’s difficult to trade such a scenario, but it’s worth keeping on the radar.

Thank you Mr. Repo!

A great piece once again!

Best,

Valentino