Building a Three-Layer Portfolio

How to stack passive beta, contrarian/discretionary alpha, and systematic strategies for consistent returns. And quick thoughts on STIR and Ethereum.

Hey,

Just a quick update again this week - work and coding projects are keeping me busy. Hopefully I’ll be able to share more about the coding side in the coming weeks.

The good news: I’ve backtested several strategies, and I’m happy with the results. Now comes the tricky part - figuring out how to run these strategies in the cloud. Easier said than done.

The Vision: A Three-Layer Portfolio

My goal is to run a portfolio with three distinct components:

1. Passive Beta

A globally diversified, low-maintenance portfolio across cash, equities, bonds, and commodities. The idea is to leave this untouched - maybe a quarterly rebalance - and let it harvest long-term risk premia.

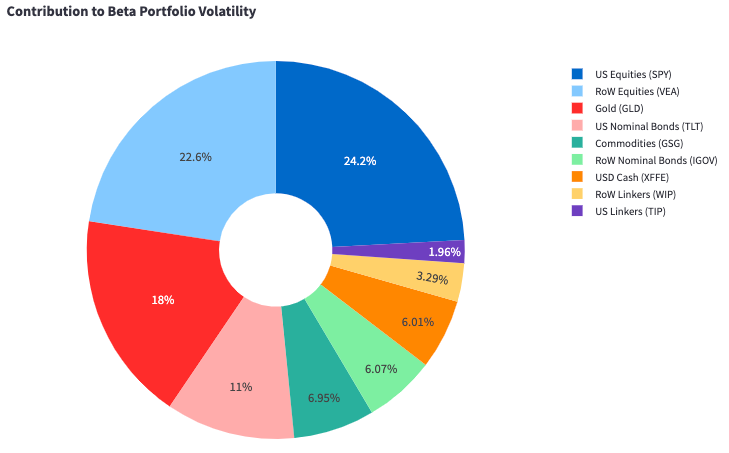

One example allocation looks like this: 40% USD cash, 10% US equities, 10% rest-of-world equities, 7.5% US nominal bonds, 5% US inflation-linked bonds, 7.5% RoW nominal bonds, 5% RoW linkers, 10% gold, and 5% other commodities.

Backtested since 2018, this strategy delivered ~4% annual returns with 6% volatility and a max drawdown of 13%. Not wildly exciting, but steady - and keep in mind that 2022 was a historically bad year for both stocks and bonds. The key is stacking uncorrelated return streams.

The below chart shows how each asset allocation contributed to the overall risk / volatility of the beta portfolio.

2. Discretionary Contrarian Futures Trading

This is the core of what I’m doing right now. I focus on contrarian futures trades, guided primarily by positioning data. The strategy is designed to generate uncorrelated alpha with low drawdowns (max ~10%) and little correlation to the S&P 500 or a traditional 60/40 portfolio. I’m targeting 10% annual returns with a margin-to-equity ratio of around 10–20%, which allows for meaningful convexity while keeping risk in check.

3. Systematic Strategies

The third leg is systematic: I’m building models to capture flow-driven seasonal patterns across equities, bonds, commodities, and currencies. So far, my backtests are encouraging - Sharpe ratios around 1.3 and return-to-drawdown ratios near 1. That means a strategy with 10% returns tends to experience 10% drawdowns, which I find acceptable given the low correlation to the rest of the portfolio. I’m still refining these models, but the goal is to add a steady, scalable return stream with minimal discretionary involvement.

I’m still working through how each strategy fits together at the portfolio level - especially once margin requirements come into play. Most likely, the passive beta component will need to hold a 40–50% cash allocation to ensure there’s enough margin available and to keep overall portfolio leverage in check.

I’ll keep you posted as I make more progress. This is my main ‘big’ project right now, which means I have less time for deep macro thinking - but stick with me, I’ll get back to that soon!

Portfolio Update

Trading is hard - and the past two weeks were a mental grind. I felt like my views were broadly right (e.g., on STIR or Ethereum), but I didn’t capitalize on them. Either because:

I’m restricted in what I can trade,

the ideas didn’t fit my contrarian futures framework, or

I just wasn’t “100% on it.”

Instead, I tried going long USD vs EUR (again) - and got stopped out. The trading account is still up 6.6% YTD, but in hindsight, I should’ve stayed on the sidelines. I was probably frustrated about missing the JPY move, and being overloaded with work didn’t help either.

Still, the past two weeks reminded me of an important truth: consistency and focus are everything. Great outcomes don’t happen when your attention is scattered. Two difficult weeks mean nothing over a multi-year horizon. The best advice I can give - and follow - is to find what matters most, and then pursue it relentlessly for years.

Here are a few quick thoughts from this weekend:

Russell 2000: Positioning looks very bearish, which could unwind soon. That said, chasing laggards like the Russell feels risky - it has clearly underperformed the Nasdaq and S&P500. I’ll keep an eye out for an entry (likely in small size) to get equity exposure.

EUR positioning: Still building. I’m staying patient and on the sidelines for now.

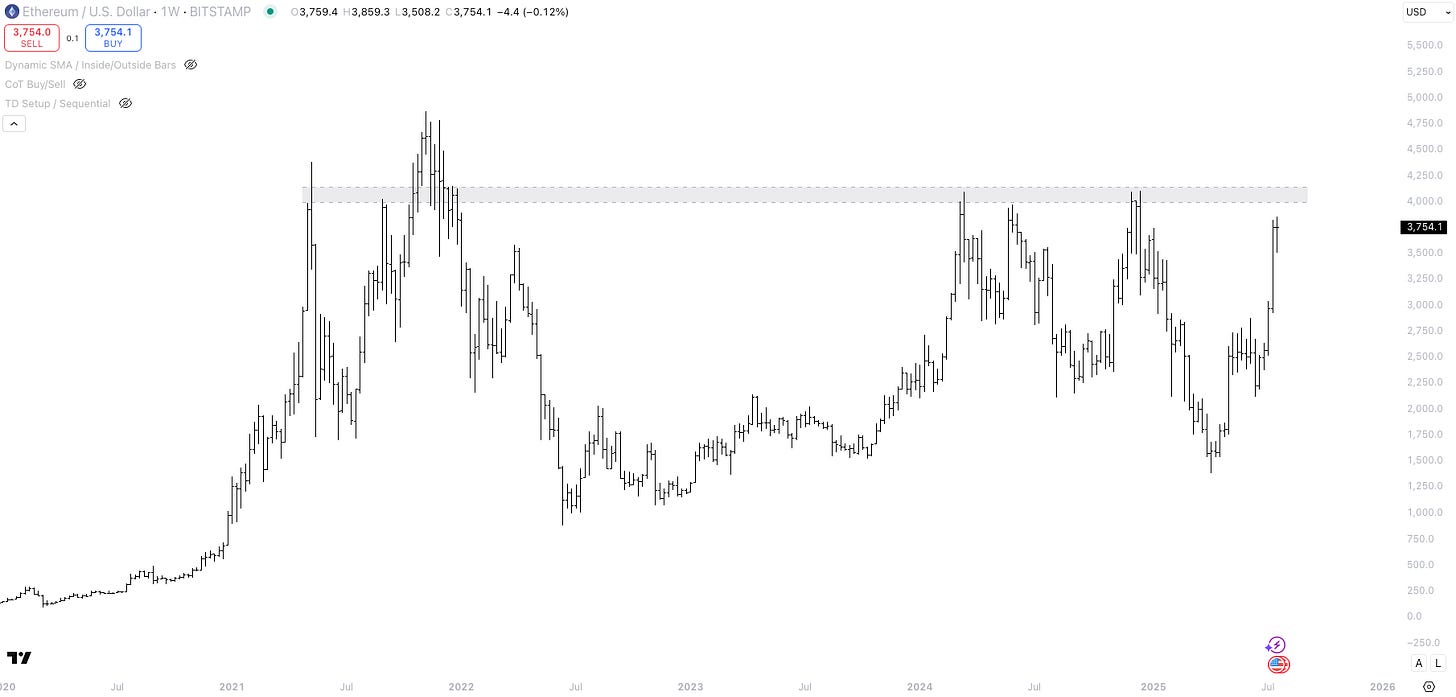

Ethereum: Approaching $4,000, which will likely act as resistance (more thoughts below)

Next week is huge - we have the QRA, FOMC, NFP, ISM Manufacturing, US GDP, plus BoJ and BoC pressers. There’s no reason to take big risk ahead of that. By next weekend, we’ll have a much clearer picture.

Now, a few thoughts on STIR and Ethereum…

STIR Pricing - The belly versus the long-end of the SOFR curve

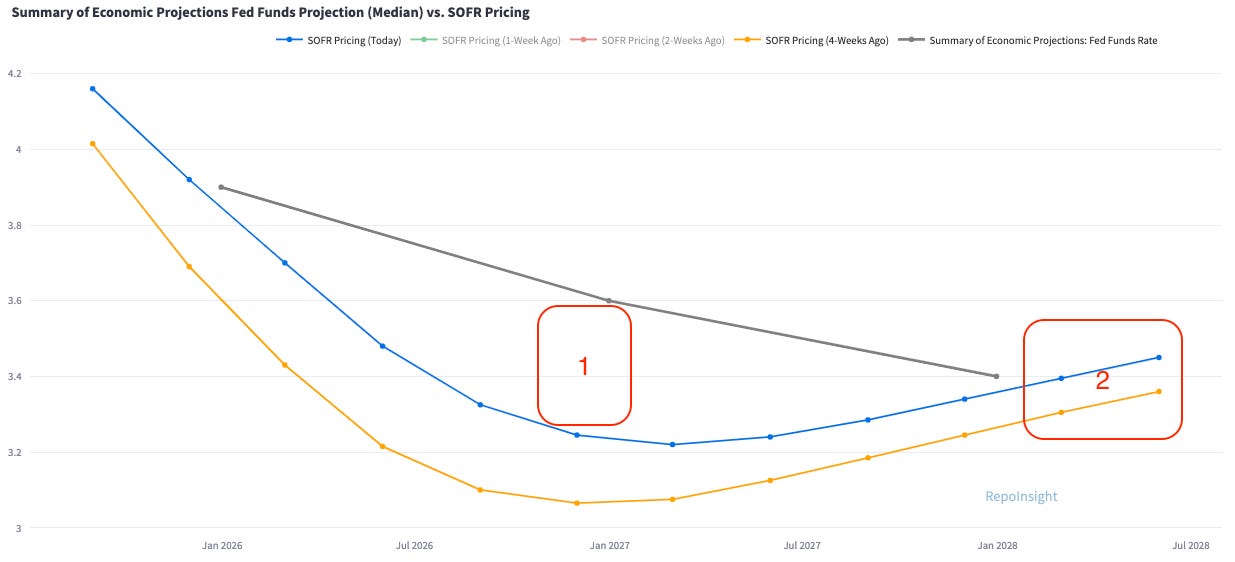

My STIR view from early July is playing out. On July 6th, I wrote:

“If growth surprises to the upside in H2 (thanks to easier FCIs), short-term rates (STIR) could reprice higher. For example, SOFR June 2026 is pricing in 4 of 6 total cuts during Powell’s remaining term (3.36%). If Powell simply stays on hold for a bit longer, those contracts need to reprice lower. On the other hand, SOFR December 2028 still implies a terminal rate of 3.53%, well above the Fed’s long-run estimate of 3.0%.”

Since then, the curve has moved in line with that view. The SOFR Dec 2028 minus Jun 2026 spread has repriced from -16.5bps (on July 6th) to -7bps today. Most of that move came from the June 2026 contract pricing out cuts - exactly the scenario I outlined.

While the belly of the SOFR curve continues to price in more rate cuts than the Fed’s own projections (1), the long end is doing the opposite - pricing in fewer cuts than the Fed’s long-run estimate (2). That disconnect suggests there’s still room for further repricing in the Dec 2028 vs. Jun 2026 spread.

Ethereum - Wall Street’s Blockchain?

My Ethereum view played out well - we’re now approaching the $4,000 level, which likely marks significant resistance (see chart below). Still, I don’t think the story is over. Dips are probably long-term buying opportunities. Here’s why.

Wall Street is quietly building crypto infrastructure - and Ethereum is becoming the preferred blockchain. For TradFi firms, Ethereum makes sense: it has the largest developer community, extensive tooling, and the broadest ecosystem beyond Bitcoin.

With the GENIUS Act now signed into law, I expect more firms to launch stablecoins. The stablecoin market is already >$260bn - and particularly useful for non-US residents seeking dollar exposure.

In many emerging markets, where currencies are unstable or banking access is limited, holding USD via stablecoins makes sense - even without earning interest.

For issuers like Circle, stablecoins are a high-margin business. They collateralise user deposits with US Treasuries but don’t pass on the interest - in fact, the GENIUS Act prohibits it. That yield (~3.5%) becomes revenue.

If USDC grows to $100bn in market cap (from ~$64bn today) and yields remain at ~3.5%, Circle earns $3.5bn in yield annually. Much of this is shared with platforms like Coinbase and Binance to incentivise adoption. For example, Coinbase receives 50% of the residual revenue from USDC reserves.

Stablecoins are likely a winner-takes-most (or all) market. Two or three could dominate. There's little reason for 50 USD stablecoins to coexist. We’re in the middle of a land grab to secure market share - and distribution matters.

But Ethereum’s role goes beyond stablecoins. Take JP Morgan, which is launching its own deposit token, JPMD, on Coinbase’s Base, a Layer 2 built on Ethereum. JPMD is tailored for institutional clients - enabling cheaper cross-border transactions — and integrates with existing banking infrastructure. It will also pay interest.

If the largest bank in the world is building on Ethereum, will others follow? Probably. I’m not a crypto expert, but the investment case makes sense. A sharp pullback could offer a good opportunity.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!