Bearish News, Bullish Price Action

Why Trump’s tariff announcements didn’t rattle markets - plus a quick take on earnings, inflation expectations, and US dollar strength.

Hey,

Just a quick update this week - work has me swamped, so this one will be a bit shorter than usual.

As always, if you find these write-ups helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these out regularly. Let’s jump in!

Tariff Update: Trump Goes Big

Trump announced sweeping new tariffs: 30% on the EU and Mexico, 35% on Canada, 25% on Japan, 50% on Brazil, and 50% on copper.

Brazil is a particularly interesting case - back on Liberation Day, it was facing just a 10% tariff, and the U.S. actually runs a trade surplus with them. Three months later, Trump has ramped that up fivefold to 50%. His trade policy remains highly impulsive.

What’s more surprising is the market’s reaction. In April, this kind of announcement would have sparked a sharp equity selloff. Last week, the S&P500 barely moved (-0.3%).

I think the market realised that tariffs will hit corporate earnings by “only” 0.5-1%. That is very likely already baked in. Bearish headlines, bullish price action.

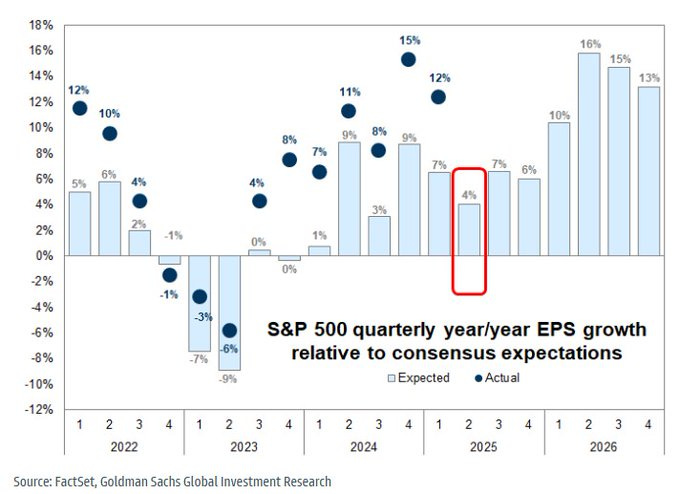

For Q2 2025, analysts are expecting just 4% EPS growth. Q3 and Q4 estimates stand at 7% and 6%, respectively. That’s a low bar - and in my view, one that many companies should have no trouble clearing.

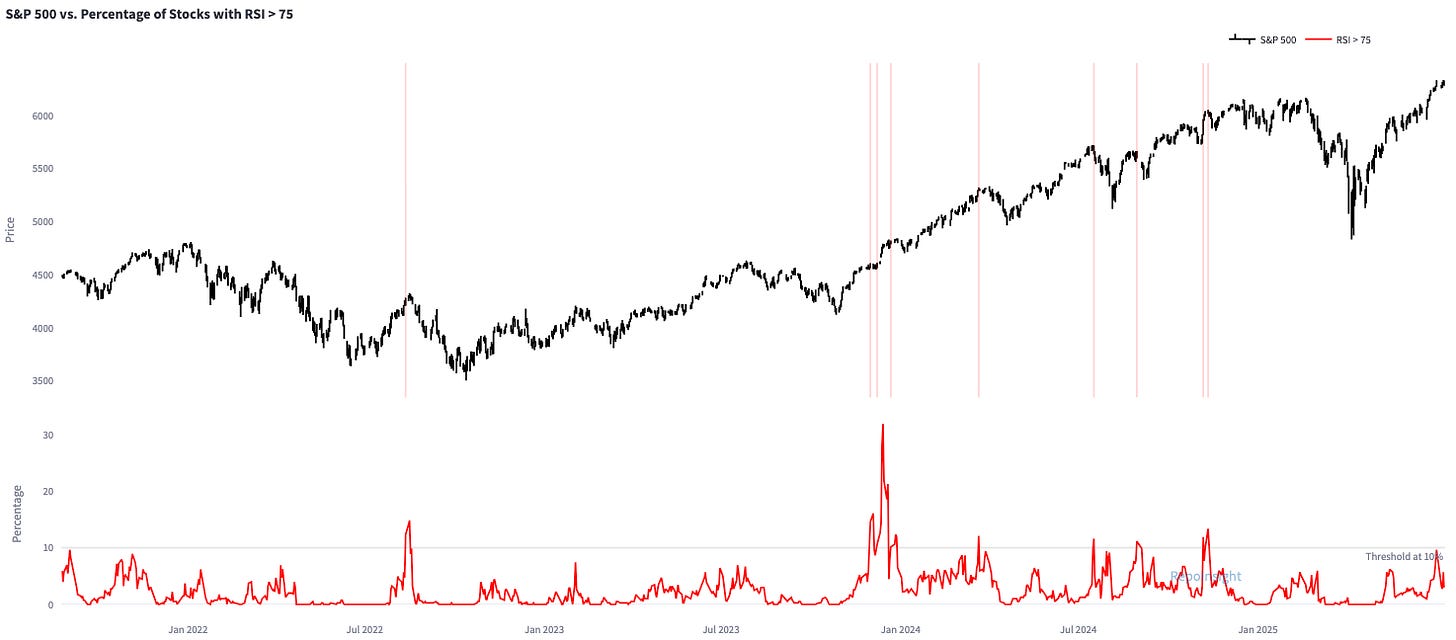

The S&P 500 was approaching overbought territory, but last week’s sideways price action helped cool things off. The number of S&P 500 stocks with an RSI above 75 has pulled back, which is a healthy sign for the market.

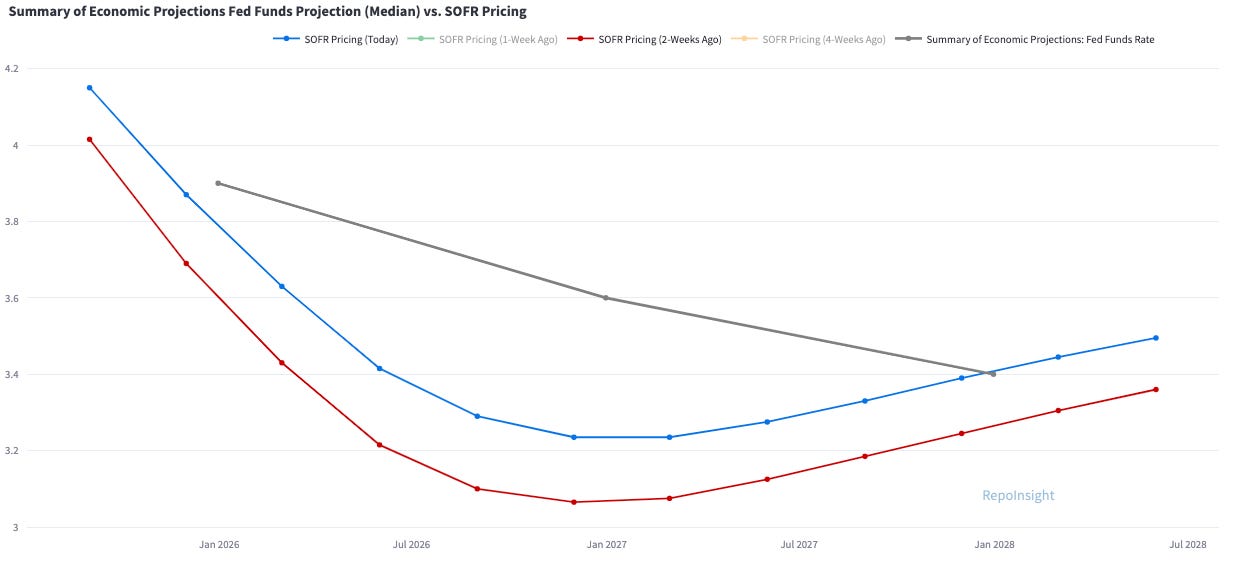

Markets are now pricing in a scenario where inflation re-accelerates and the Federal Reserve resists cutting rates as aggressively as Trump would prefer. The SOFR curve sold off in the last two weeks, with December 2026 futures moving from 3.07% to 3.24% - a 17bps repricing.

U.S. 5-year yields are beginning to price in a re-acceleration of inflation over the coming months. All eyes are now on Tuesday’s CPI report, where the consensus expects a 0.3% month-over-month print for both the headline and core readings.

The U.S. dollar’s price action last week was telling. Back in April, when Trump first announced tariffs, the dollar sold off sharply. This time, despite another round of tariff headlines, the dollar strengthened against most major currencies. Once again: bearish news, bullish price action?

The secular U.S. dollar bear case has become almost consensus among macro investors. But I think H2 2025 could offer a compelling opportunity to get long the dollar. The Euro, British pound, and Swiss franc are all showing signs of fatigue - and the Japanese Yen is breaking lower as well.

The crypto market is heating up. Bitcoin just hit a new all-time high at $118k, and Ethereum is starting to show strength as well. I continue to believe that stablecoin regulation could be a powerful catalyst for the Ethereum ecosystem - driving both on-chain activity and gas fees higher.

Trading thoughts:

I remain long S&P500 futures - that is still my only position in the trading account. The trading account is up 7.8% YTD.

I am looking to get long US dollars, either vs EUR, CHF or GBP. Tuesday’s CPI release could be the catalyst to initiate a position.

Palladium positioning is getting very stretched and the market is overbought. This market is worth monitoring as a potential short.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Thanks for the summary.

Thank you Mr. Repo!

Regarding the USD, it seems to be, as you stated, that a weaker dollar is pretty much everyone's consensus trade.

One could agree with the structural changes behind the scenes that are incentivizing huge stocks of unhedged USD owned by Euro/Asian (and others) players to start effectively hedging those positions.

Now, if that was the case, wouldn't this hedgers be a slow moving actor? I'm thinking they make the decission to hedge, and then they start doing so partially, not all of a sudden. Am I wrong?

My point being, if this huge wales continue hedging their 15+ years of USD accumulation, wouldn't any pop up in the DXY be short lived?

Would they ramp up the hedging flows if the dollar goes up, to get a better entry?

Thank you in advance for your work and for sharing your knowledge.

Best,

Valentino