6 Macro Views That Matter Now

Six key views: central bank cuts in 2026, Euro weakness, oil’s turning point, gold risks, and other trade ideas.

Dear readers,

It’s been a while since my last article - life and work have kept me busy - but I’m back with a macro update.

Not much has changed in my trading portfolio: I’m up 6.6% YTD, with my only remaining position a long USD cash exposure in my EUR-denominated account.

I’m not fully satisfied with this performance, but I’ve managed risk well this year: a 2.85% maximum drawdown and 7.62% annualised volatility. In this headline-driven, difficult trading environment, I’ll be content if I can catch one or two strong trades before year-end.

Looking ahead, here are the macro views I’m tracking into year-end - each explained in bullet points with supporting charts below:

Europe needs interest rate cuts. Dec’25-Dec’26 Euribor futures look mispriced.

The Canadian economy is screwed. Dec’25-Dec’26 Corra futures look mispriced.

The strong Euro is hurting European exports. The Euro needs to depreciate.

Large shorts in crude oil will eventually unwind. Get ready to buy crude oil.

Gold is a secular long, but poised for a short-term pullback. De-risk gold.

Equities are still a long. Is this one of the most hated bull markets ever?

Let’s dive in…

1. Dec’25-Dec’26 Euribor futures look mispriced.

3-month Euribor futures (Dec’25 - Dec’26) are currently pricing 0.5bps of hikes. I think the bar for the European Central Bank to hike interest rates is high. The bar for cuts is much lower. I can easily imagine one or two interest rate cuts if the European economy slows down next year.

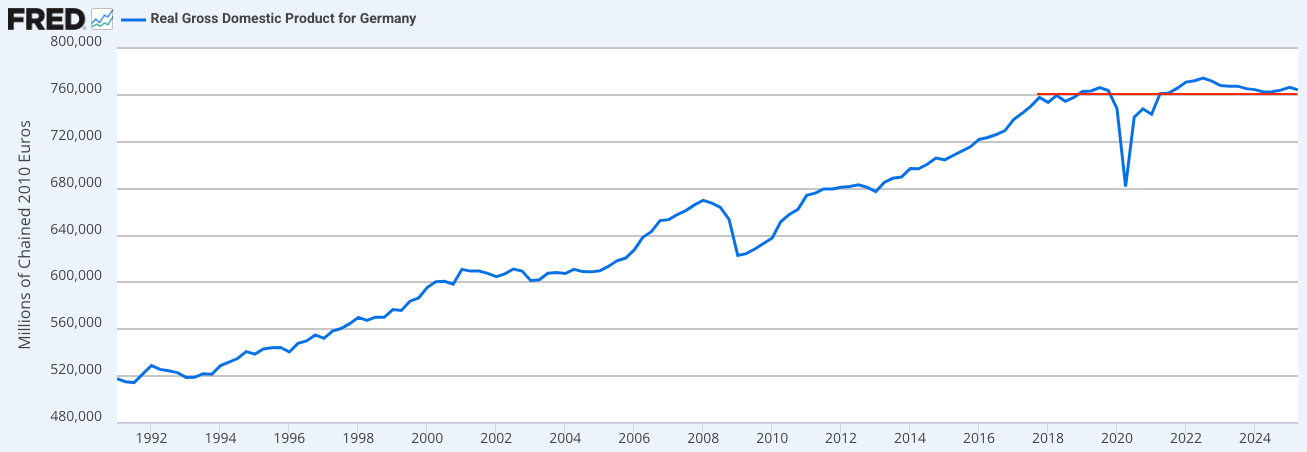

Germany - for a long time Europe’s economic engine - has stagnated since Q4-2017. Germany’s business model, i.e., import cheap energy from Russia, manufacture in Germany, and export to China, is outdated. Structural reforms are needed. But with Social Democrats (SPD) in the government, I doubt Merz (CDU) will be able to pass necessary reforms.

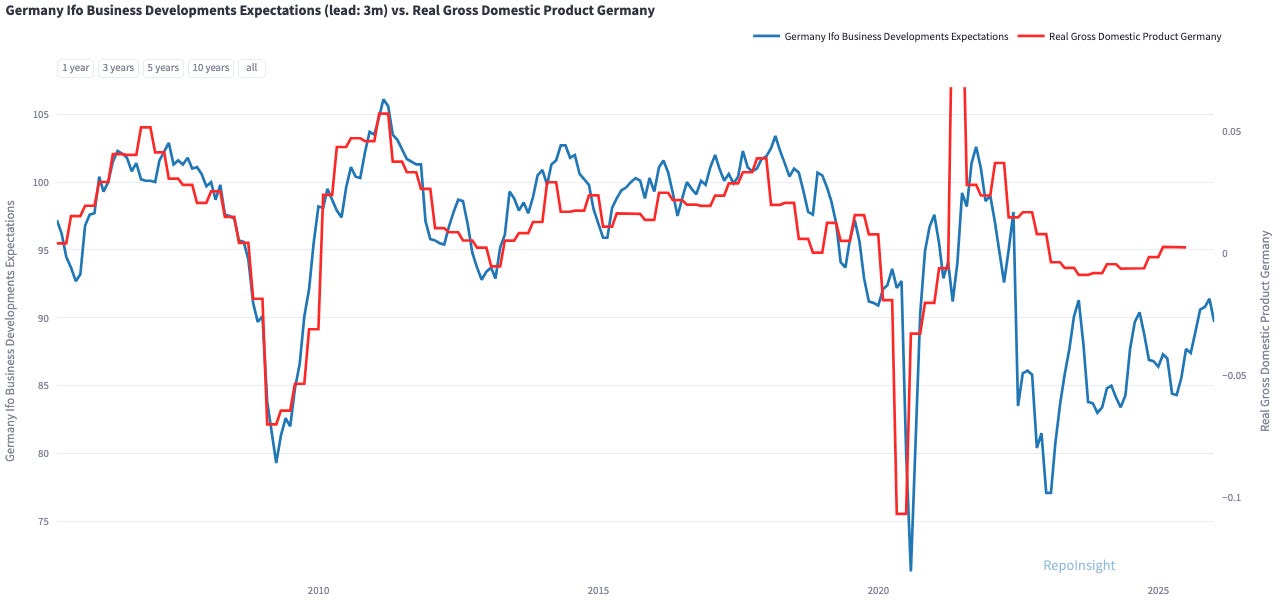

Today’s ifo data - one of Germany’s most closely watched leading economic indicators - came in below expectations. The ifo indices are based on a survey of around 9,000 German firms, and a good predictor of German GDP growth. Does the last print look like a re-acceleration to you? I think “Europe euphoria” is fading.

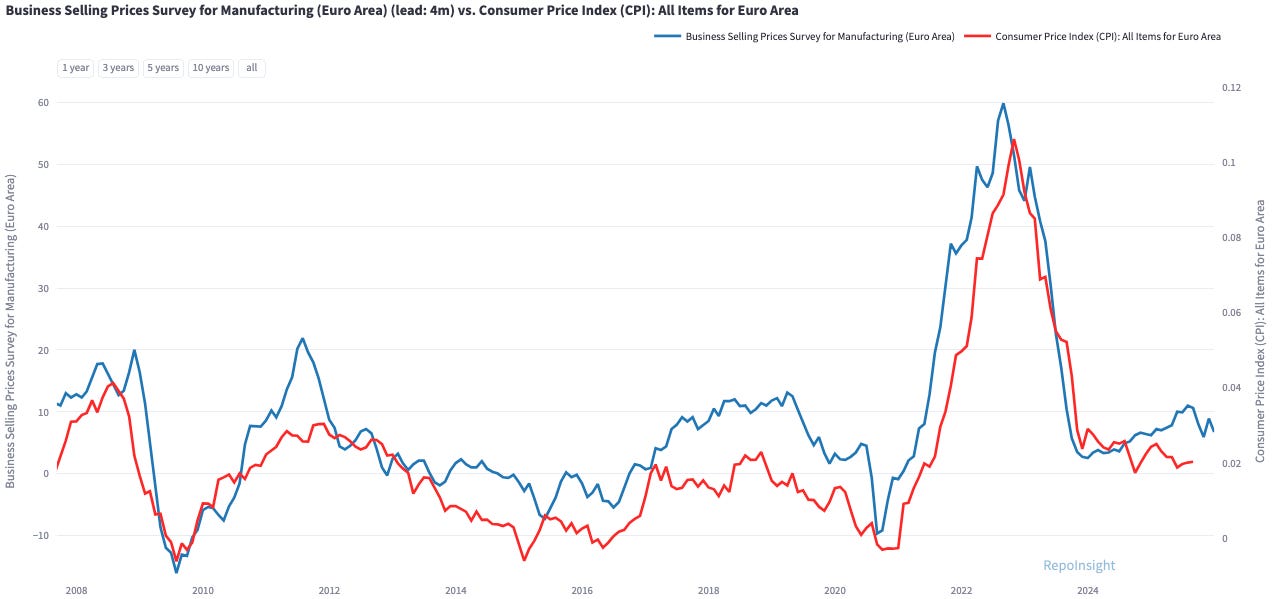

Headline inflation in the Eurozone has remained stable at 2.00% in the past three months. The business selling prices survey for manufacturing is not pointing to any near-term price pressures either. Euro Area core CPI has been stable at 2.3%. The ECB is not constrained by above target inflation. It has room to cut more.

I think Euribors should be pricing cuts in 2026, not 0.5bps of hikes. My idea is to sell Euribor Dec’25 and buy Euribor Dec’26.

2. Dec’25-Dec’26 Corra futures look mispriced.

Corra futures are currently pricing 2bps of cuts between Dec’25 and Dec’26. I think the Bank of Canada will have to cut interest rates more aggressively next year.

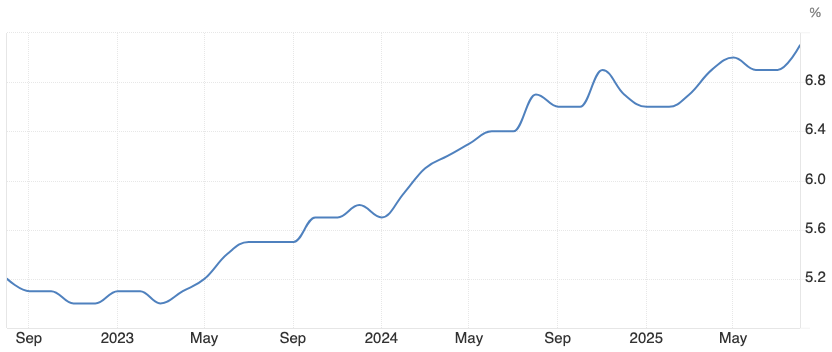

Canada’s economy is not doing well. It’s unemployment rate increased from 4.8% in July 2022 to 7.1% today.

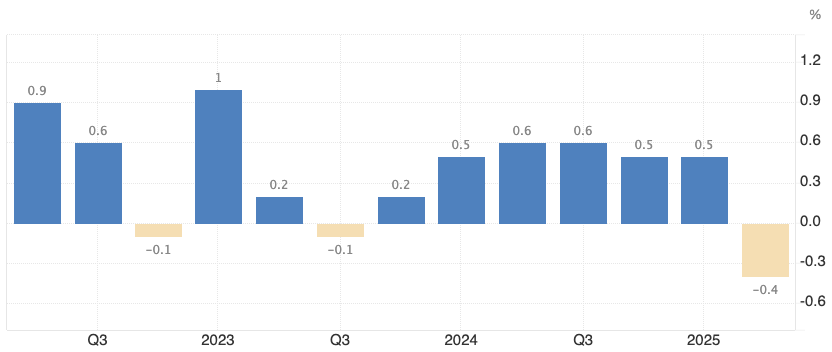

GDP growth has been weak in the past few quarters. On Friday, September 26th, Canada’s m/m GDP numbers will be released (expected: 0.1%).

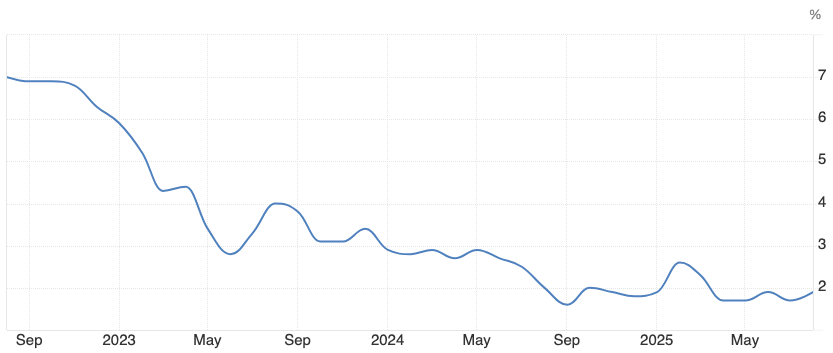

Canada’s headline inflation is back at target. The latest print came in at 1.9%. Canada’s core inflation currently sits at 2.6%, slightly above target. However, core CPI has not increased in the past three months.

Tariffs are deflationary for Canada and inflationary for the United States. They are also growth-negative for both countries.

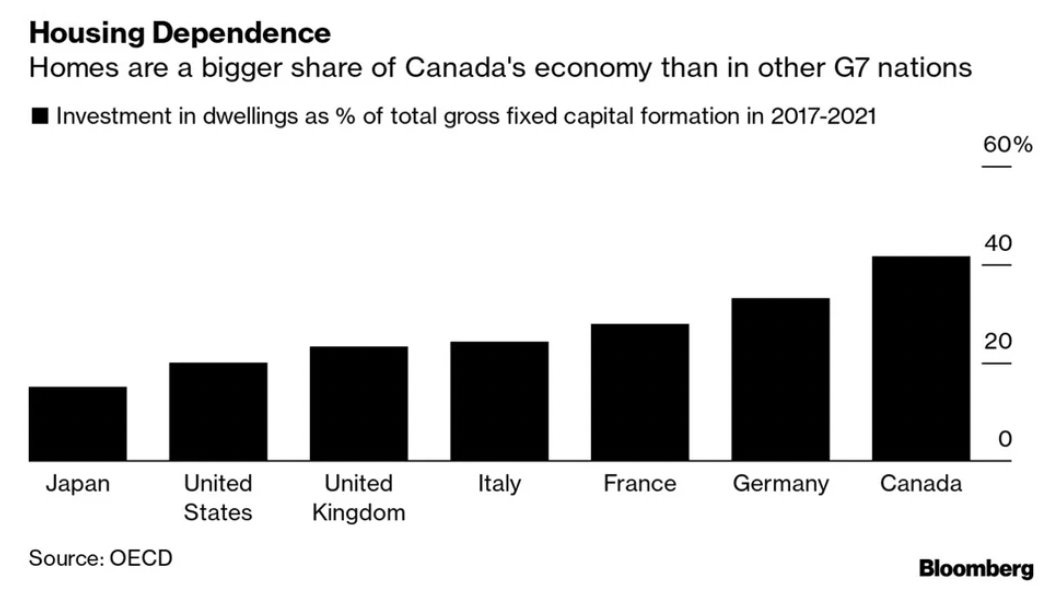

Canada’s real estate market is 13% of GDP - larger than manufacturing (10.4%) or mining/oil/gas (8.2%). From 2017 to 2021, the investment in dwellings as a percentage of total gross fixed capital formation was north of 40 per cent, larger than in other G7 nations.

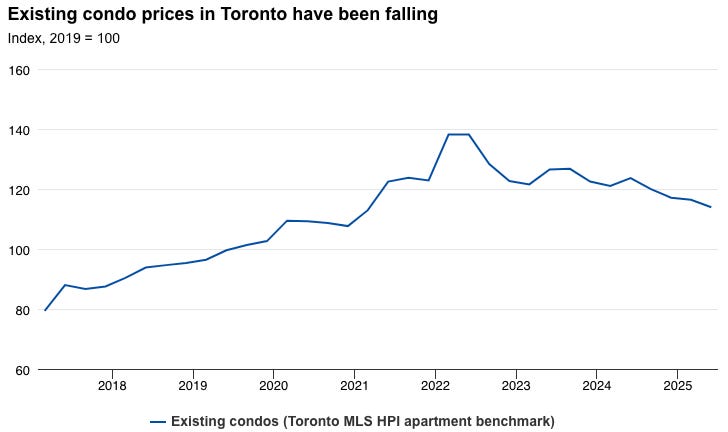

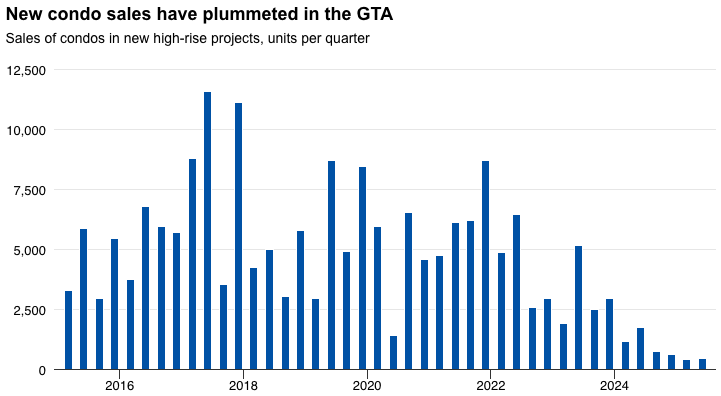

But Canada’s real estate market is struggling. Especially the condo market in Toronto is under pressure. Condo prices have been falling since 2022.

New condo sales have fallen in the Greater Toronto Area (GTA).

Tariffs and AI are the perfect storm to bring the labor market to a halt. Meanwhile, Canada’s private debt to GDP ratio stands at >160%. If Canadians start to lose their jobs, they will not be able to pay their mortgage anymore. And the value of their homes decline. All this calls for more interest rate cuts.

I think Corra futures should be pricing more cuts next year. My idea is to buy Dec’26 Corra futures and sell Dec’25 Corra futures.

3. The Euro needs to depreciate.

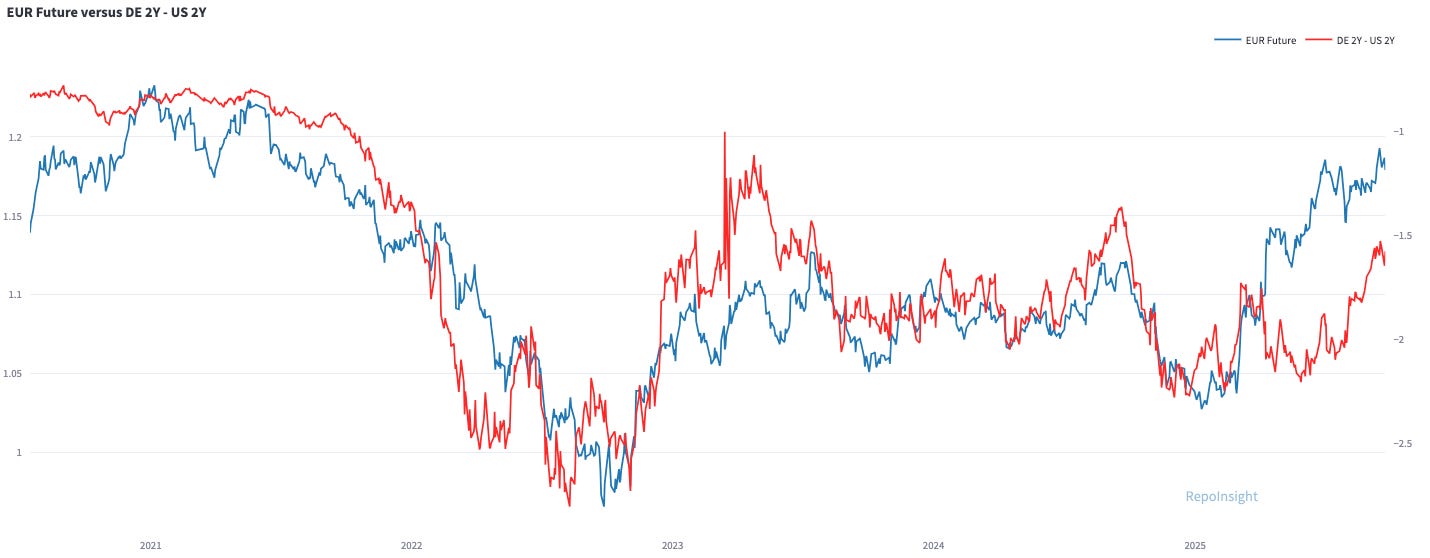

My view is that the Euro needs to depreciate. This thesis aligns with my view on interest rates. If the ECB cuts interest rates more than currently priced in, the Euro should come under pressure. Meanwhile, US equity markets are back at all-time highs, which means US consumption could re-accelerate (wealth effect). If the US economy re-accelerates and one or two Fed cuts get priced out, yield differentials should support a stronger US dollar (and weaker Euro).

European politicians are also pointing out that the Euro strength is hurting exports. Last week, Italy’s Economy Minister said “(the) strong Euro is a burden on EU exports”. What about the German car industry? Or luxury goods from France?

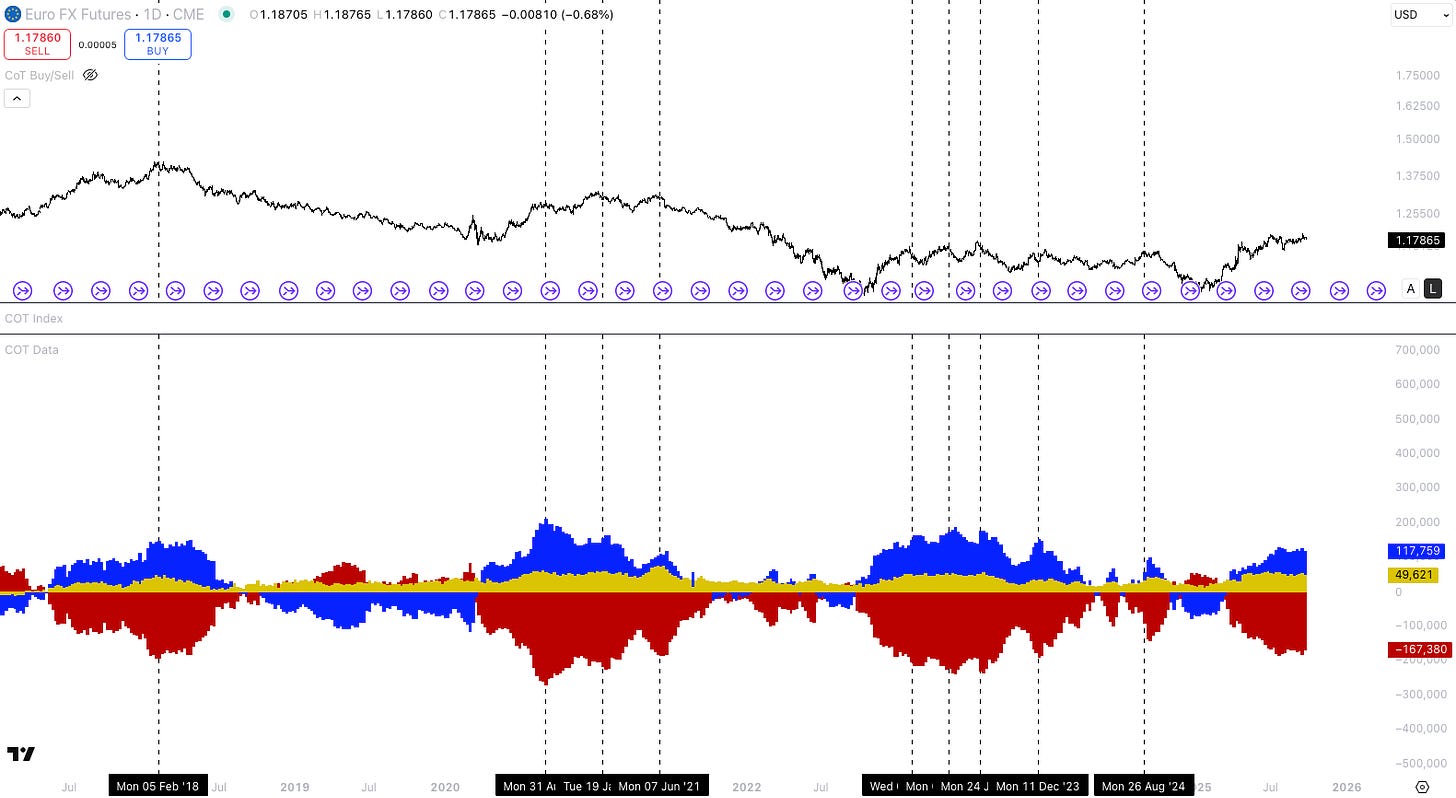

Based on COT data, large speculators (blue) and small speculators (yellow) are very long the Euro. I would not look at positioning data as a buy/sell signal, but as a buy/sell condition. The risk-to-reward to go long Euro is not great anymore. The trade is crowded. If positions need to unwind, we could see a larger drop.

In the short-term, I am watching for the Euro to break below the trend line. Last Wednesday, J. Pow. signalled the Federal Reserve will cut interest rates multiple times in the coming months. The meeting was dovish. But the Euro reversed and could not break to new highs. That day - which now looks likely to turn into a double-top - I converted my EUR cash into USD cash.

4. Get ready to buy crude oil.

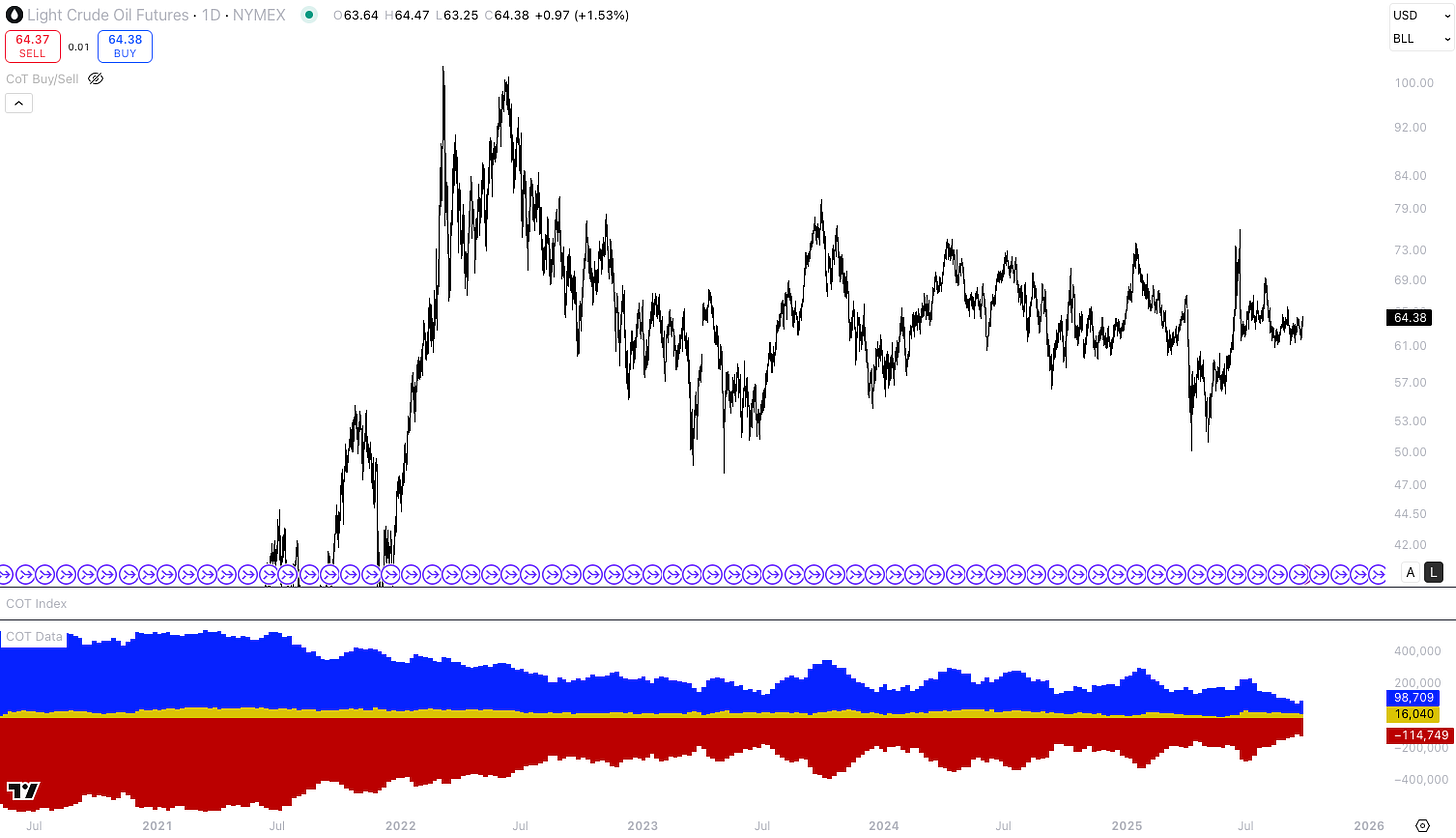

I only monitor positioning data in crude oil and wait for very crowded long/short positions. I do not analyse the physical market, OPEC trends, or other factors. At some point in the future, I will add those factors to my framework. Currently, large speculators (blue) are the least long they have been in years.

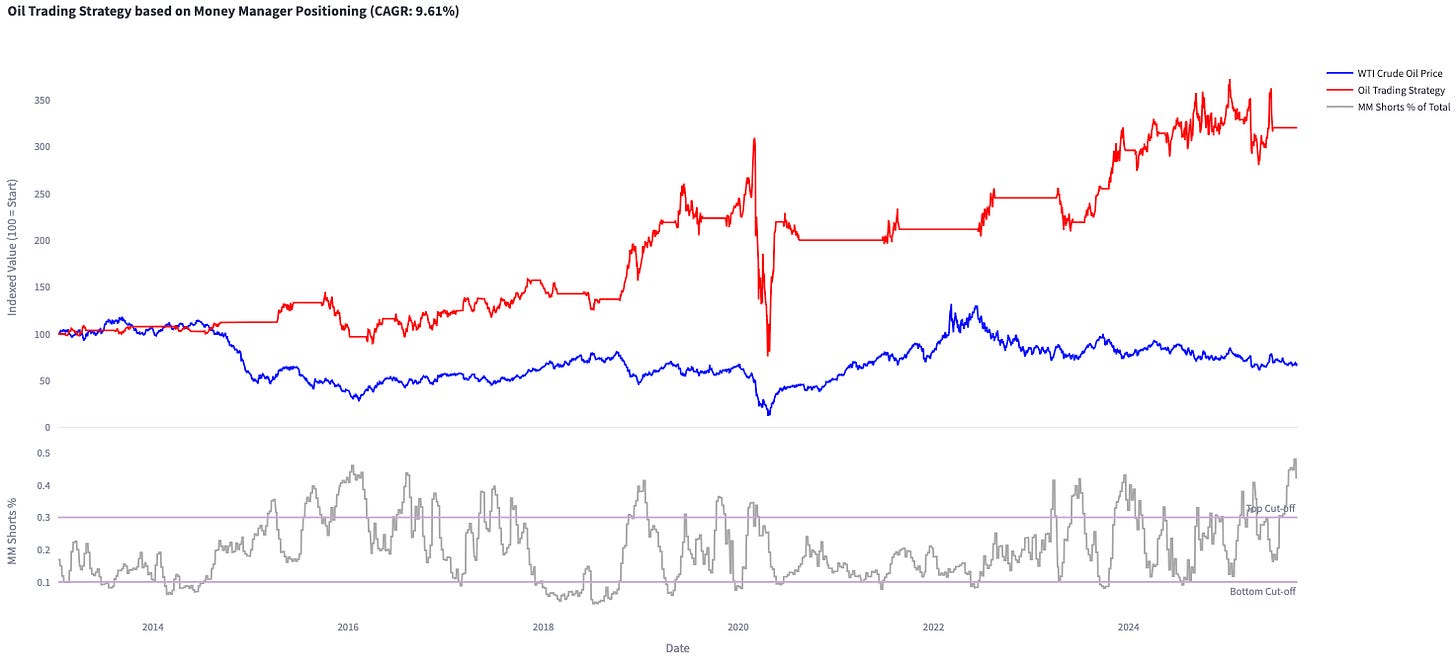

If we take a look at the disaggregated COT data, money managers are very short crude oil futures. In fact, money managers’ short positions are >40% of the total money manager position. Historically, if you would have gone long crude oil once money manager shorts fall below 30% of total money manager positions, i.e., shorts are unwinding their position, and you would have stayed long for two months, you would have traded crude oil profitably.

I do not have a position in crude oil futures. But I am monitoring the market. My ideal scenario would be that oil futures sell off from here, and short positions continue to build and get even more extreme. Then, I would be looking to take the opposite position.

5. De-risk gold.

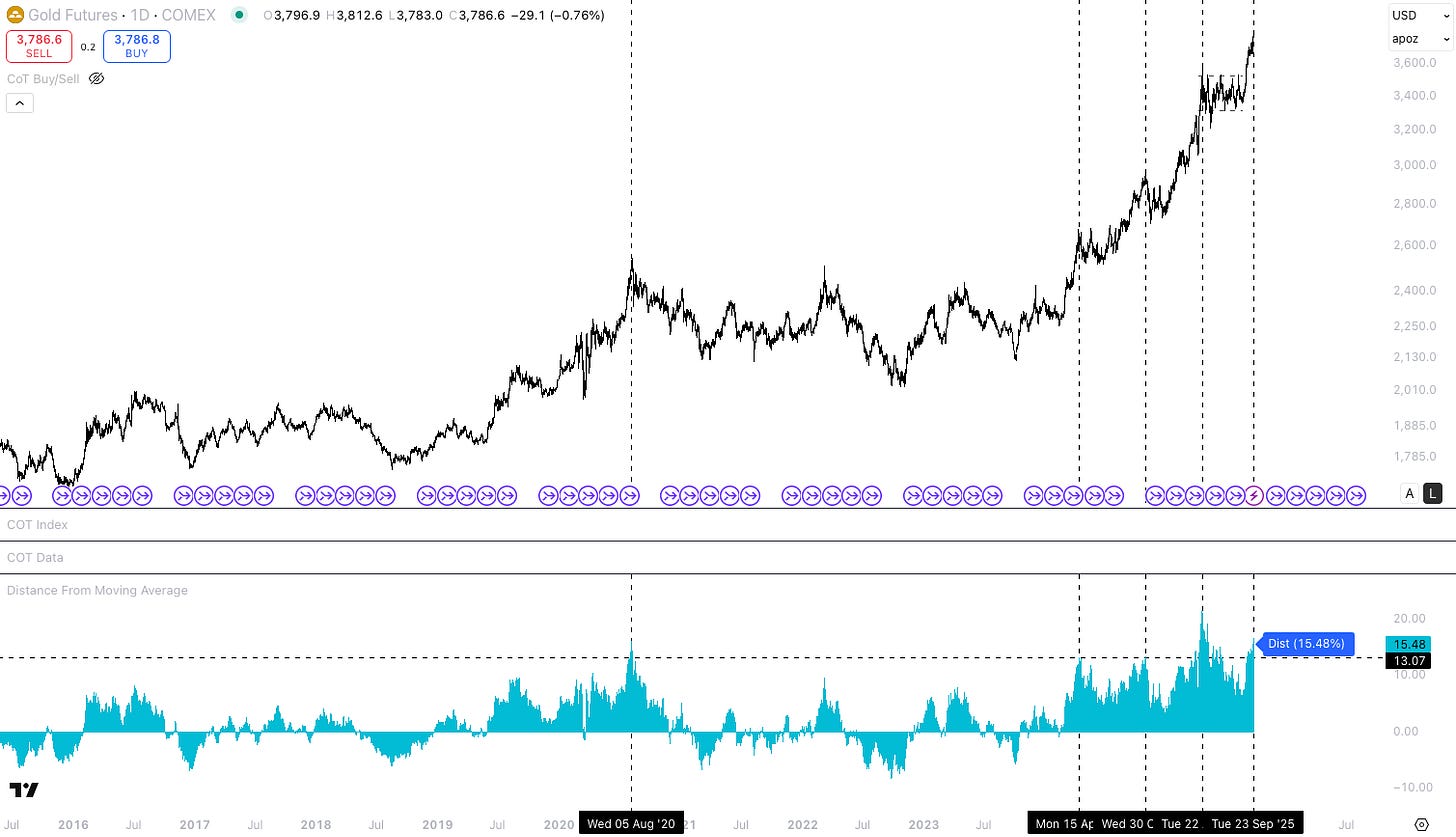

In the long-term, I am bullish gold. But in the short-term, I think it is time to de-risk / expect a pullback. There are a few signs that positioning is getting stretched. Last Friday, on September 19th, we saw the largest Gold ETFs inflow in the last three years.

Gold is currently trading 15.5% above its 200-day exponential moving average. Historically, these kinds of run-ups have often been followed by pullbacks or consolidations.

6. Equities: Is this one of the most hated bull markets?

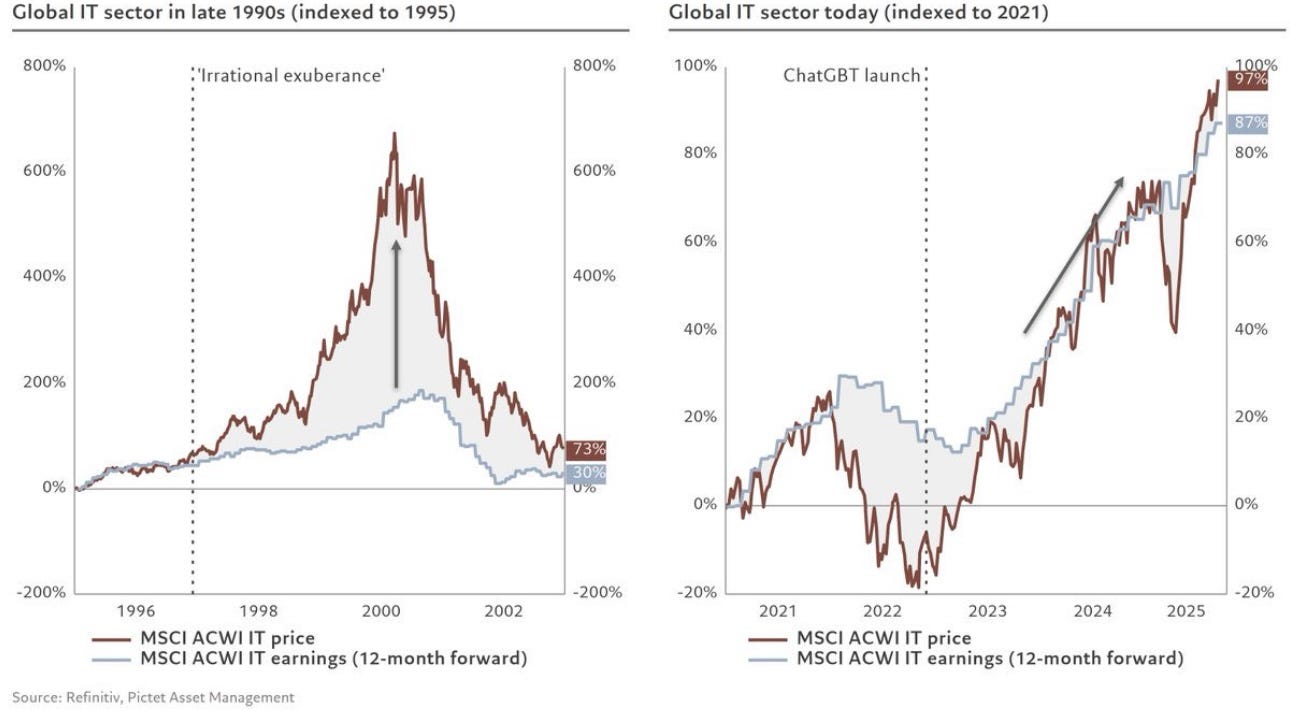

I know valuations are high. I also know the US economy is slowing. But I still believe you need to be long US equities. Tech stocks currently perform like it’s 1999 all over again. But that’s because the US tech sector is making so much money. As long as US tech companies - and in particular Mag-7 - continue to grow, there is no bubble. If you want to short US equities, you need a very strong fundamental thesis why US earnings will disappoint. Take a look at the chart below.

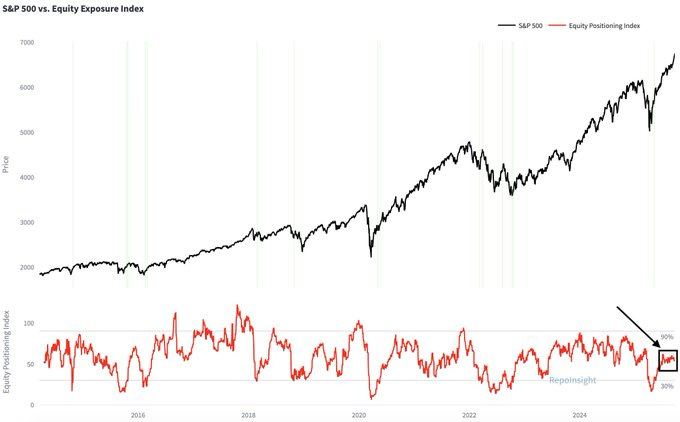

Macro investors continue to be underweight US equities. Hedge funds run their equity books almost fully hedged. My Equity Positioning Index, which combines COT futures positioning data, the NAAIM Exposure Index, and vol-targeting allocations, points to neutral equities positioning.

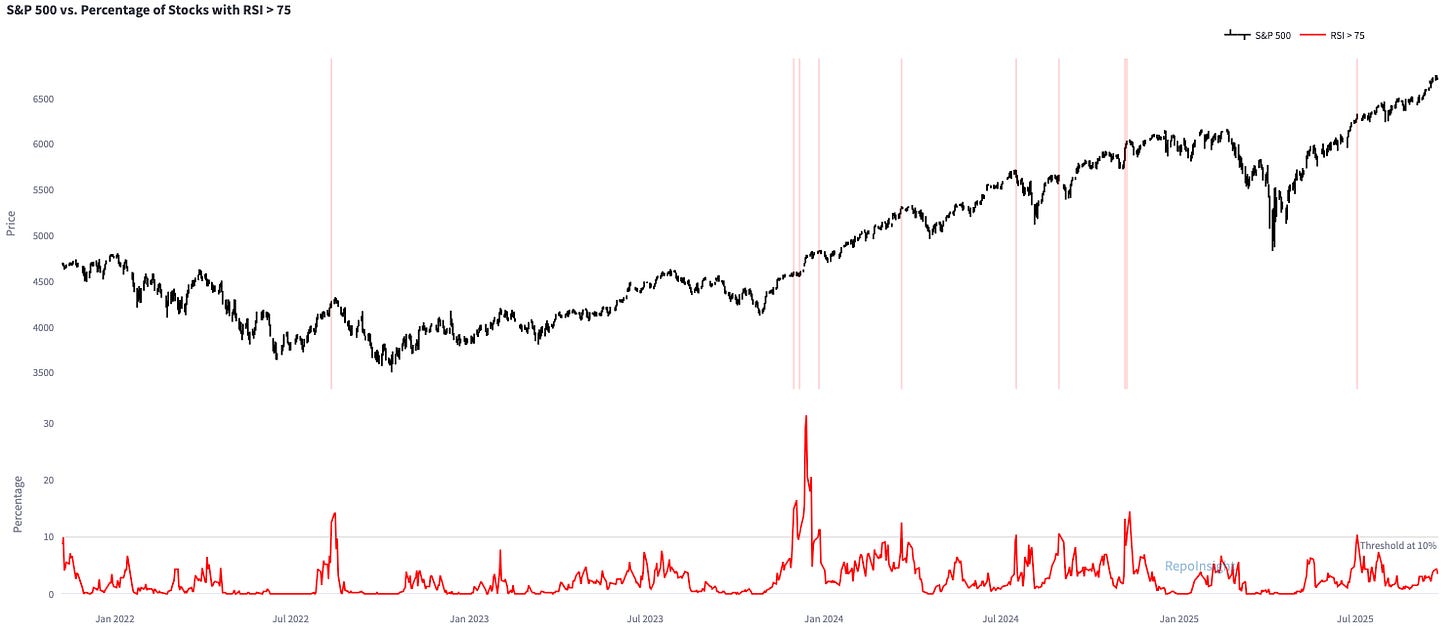

If many stocks get to an overbought condition, e.g., RSI above 75, I would get cautious. But that is not the case yet. Only 4% of the stocks in the S&P500 currently have a RSI above 75.

The Nasdaq-100 peaked at 55% above its 40-week moving average in 2000. It is currently trading 13.7% above its 40-week moving average. If you are looking for a melt-up, we are probably not even close.

I am flat equities in my contrarian (active) trading account. But I remain long S&P500 and Nasdaq-100 in my long-term investment accounts.

Dear Mr. Repo,

It's great to have you and your insights back!

A great read honestly.

A few questions regarding expressions.

Why are you suggesting, for both EUR and CAD rates futures, to sell december 2025 and buy december 2026? why not just buy december 2026?

For instance, for Corra futures, z2025 is at 2.3% vs 2.28% for z2026, as you noted, but do you think z2025 will sell off a bit, pricing in more cuts, or are you just trying to do a relative value and trade for more cuts december to december?

Curious here, for implementation purposes, what's your timing view for the repricing? If the repricing where to happen after z2025 expires, would that complicate one leg of your RV trade?

Related, I'm short CADUSD and if possible, would love your thoughts. Macro view is the same, but I just saw what I think was a more compelling expression on the FX side. Summary of the trade below.

Thanks again for your amazing pieces, I truly do learn a lot.

Best,

Valentino

******************************************************

We express bearish CAD via a CADUSD Jan-26 put spread on CME futures:

• Long UCDF6P 72.5 (CADUSD 0.725 put), IV of 4.65% (BBG last)

• Short UCDF6P 70 (CADUSD 0.700 put), IV of 7.48% (BBG last)

This structure keeps premium tight with a max payout of close to 4x. Current CADUSD

trades ~0.726. Our target is 0.700, where we would exit and crystallize gains. Stop is a daily

close above 0.736. The expression also benefits from historically cheap vol; we’re paying

very little optionality premium for directional exposure. Main risk is a broad USD sell-off,

but base case is CAD underperformance as weak Canadian fundamentals get repriced.

Our take-profit at 0.700 CADUSD lines up with the upper bound of the range reached during

the “peak US exceptionalism” trade earlier this year. We’re not betting on a retest of the full

0.69–0.70 zone, just a drift back to the upper range seen in late 2024 and early 2025, so

we’re willing to cap gains there by selling the 0.70 put. On the other side, a stop on a daily

close above 0.736 marks the upper end of the multi-month consolidation range; a breakout

there would invalidate the timing of our bearish CAD view.

A secondary risk is that the US SOFR curve could price even deeper Fed cuts than today. In our view, that would only materialize in a true US recession scenario, but even then, safe-haven demand should keep the USD bid. Net-net, we still expect CAD to underperform in that left-tail outcome, so the trade holds.

This was an excellent read. clear, insightful, and to the point.